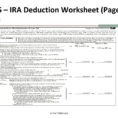

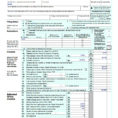

The Fundamentals of Ira Deduction Worksheet 2018 Revealed If this is the case, you can still itemize deductions instead of claim the standard deduction. The following year, it’s smart to take the normal deduction. Since the normal deduction nearly doubles in 2018, it is going to be the very best…

db-excel.com

Excel Spreadsheet Template