The Fundamentals of Ira Deduction Worksheet 2018 Revealed

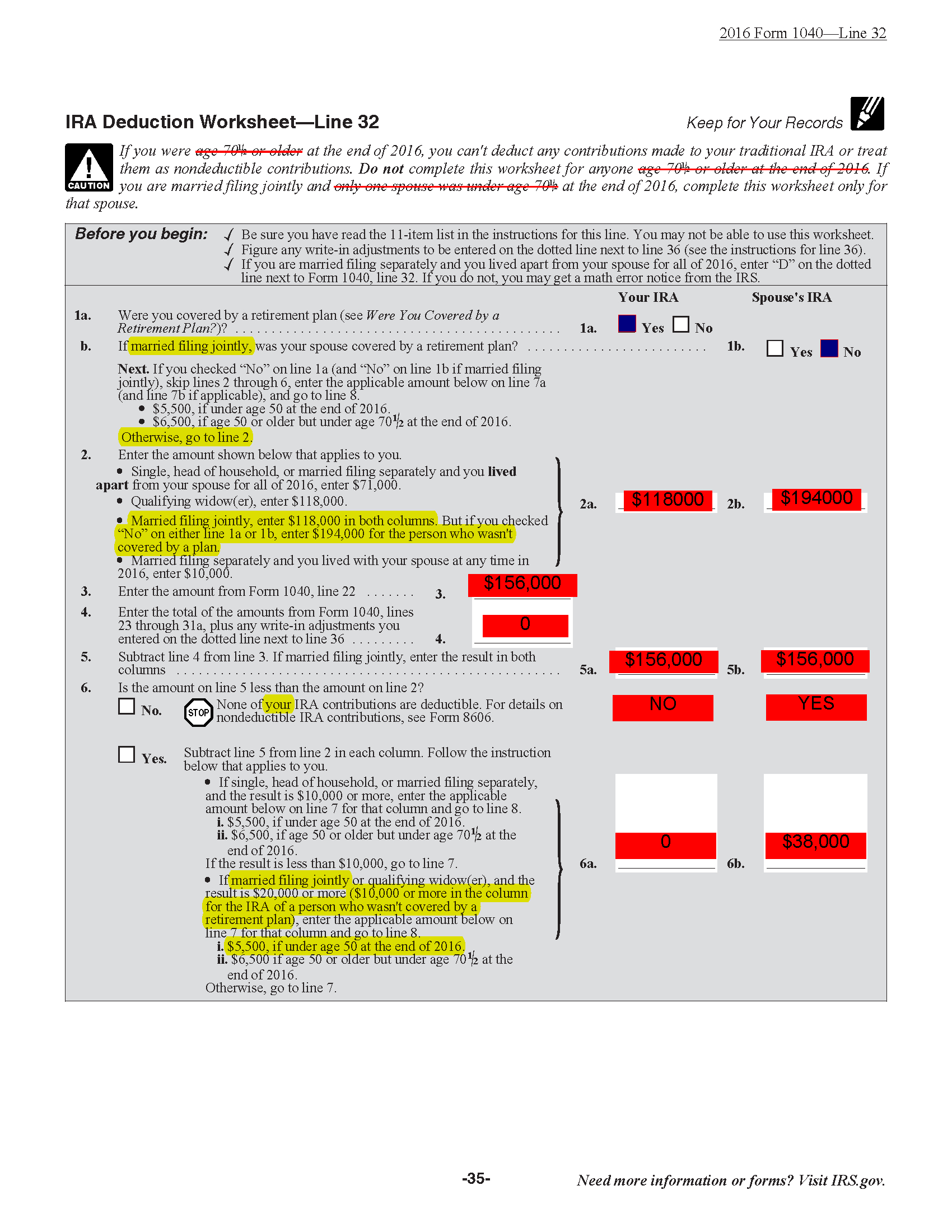

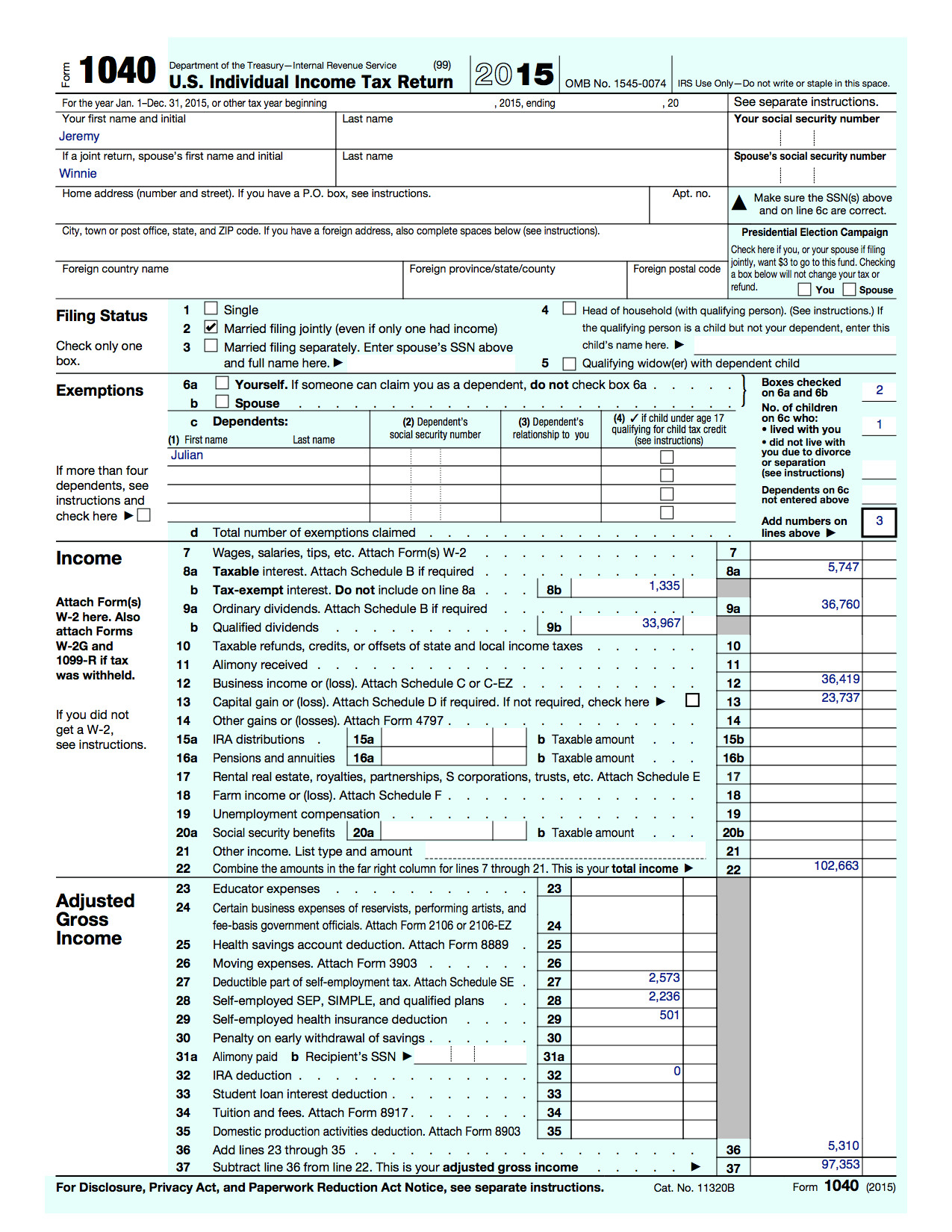

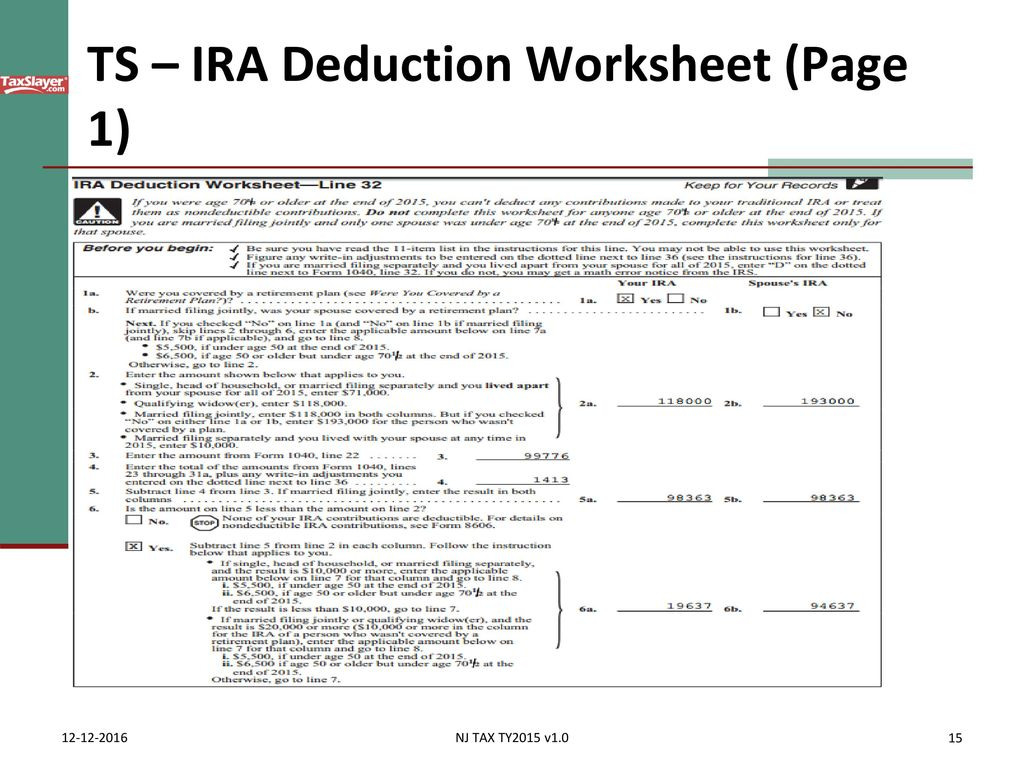

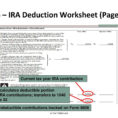

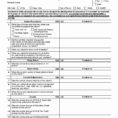

If this is the case, you can still itemize deductions instead of claim the standard deduction. The following year, it’s smart to take the normal deduction. Since the normal deduction nearly doubles in 2018, it is going to be the very best choice for the bulk of taxpayers. It is the amount that you can deduct from your income before calculating your tax liability if you do not itemize your deductions. The primary reason is that claiming the normal deduction simpler. In that scenario, you sometimes take the complete deduction, up to the yearly contribution limit, irrespective of how much you make. For instance, the deduction for moving expenses if you’re relocating due to a work transfer, for a new job, or to begin a business was suspended through 2025.

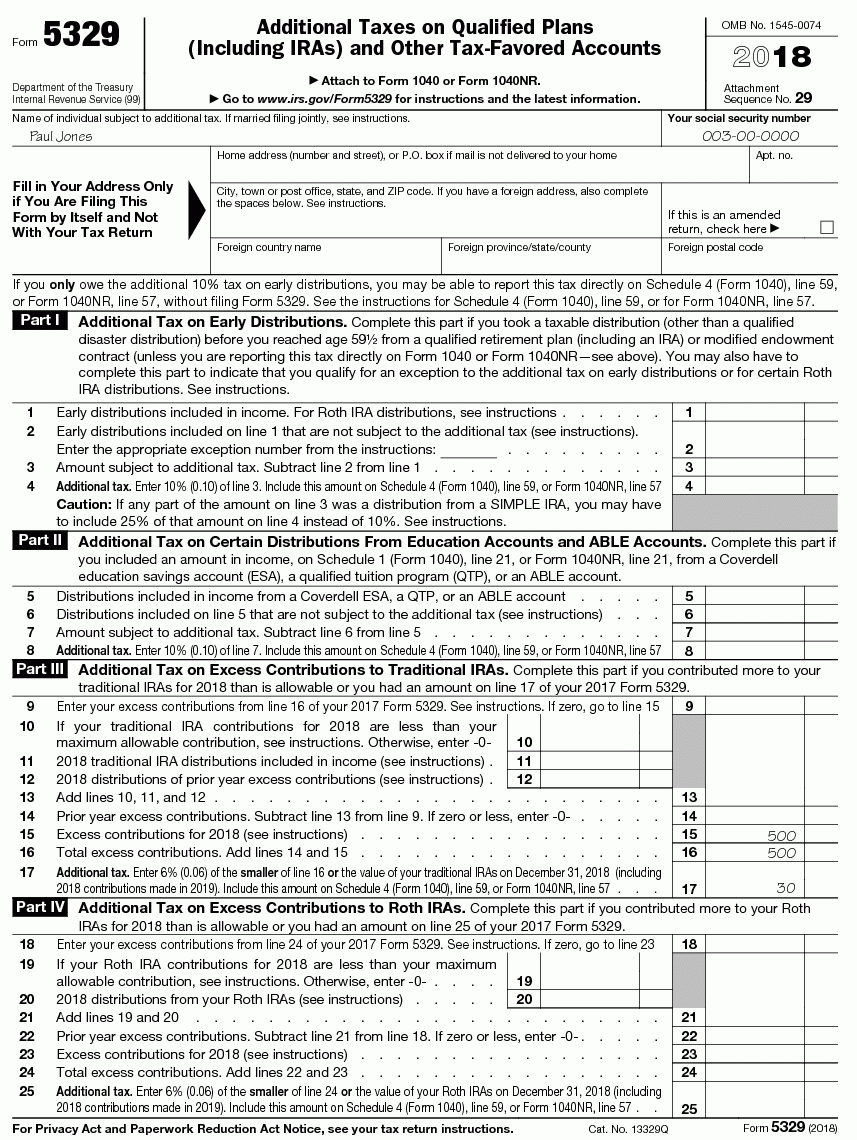

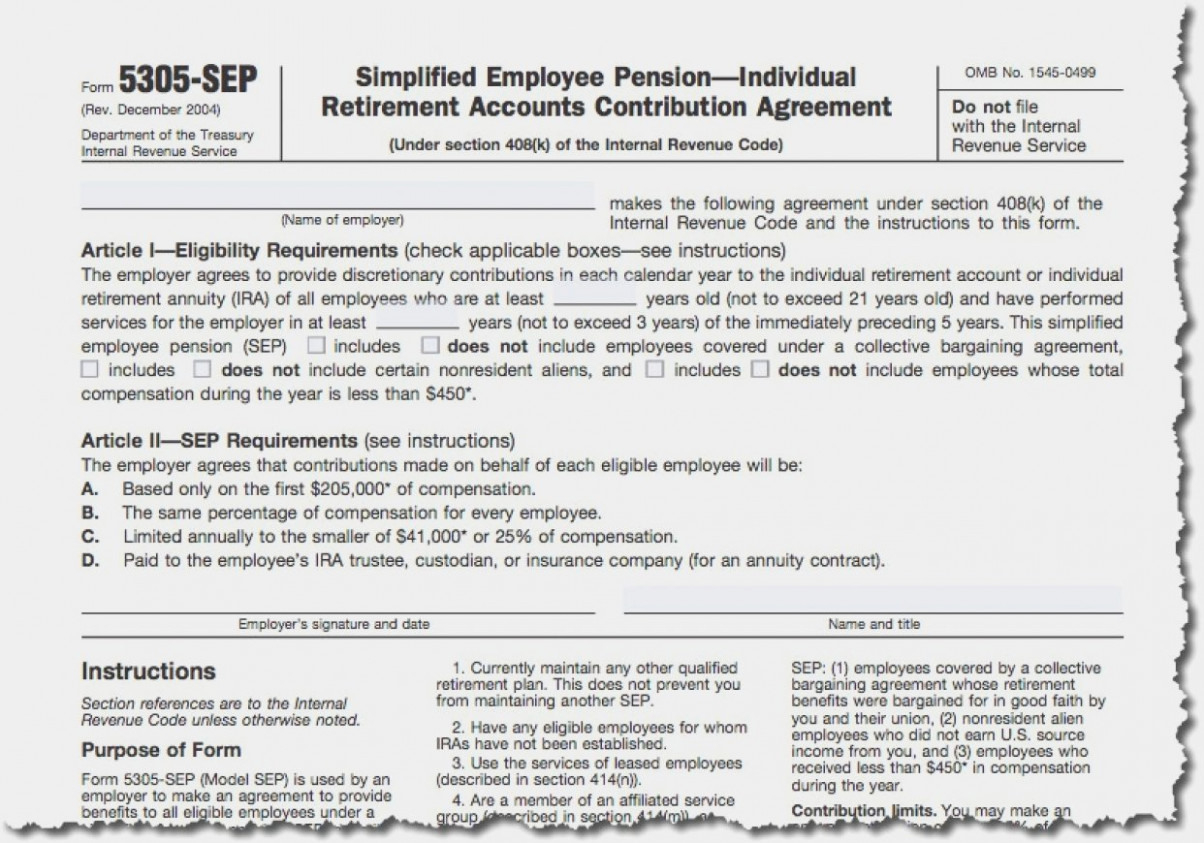

The contribution limits apply to every individual, so married couples may have the ability to contribute the contribution limit for the two spouses. Finally, your contributions have to be made in a timely way. Traditional IRA contributions are usually tax-deductible.

In case you have any sort of IRA, you’ve got an option of changing it from 1 form of IRA to another. If at all possible, roll over the sum you wish to withdraw to an IRA, so it is possible to avoid paying the penalty. Don’t forget, there’s no minimum contribution to open an IRA, so that you may begin with any little deposit. If you’ve got more than one IRA, the complete contribution to all of your IRAs can’t exceed the yearly limit. SIMPLE IRAs are perfect for employers who don’t need to fund employer contributions. A Traditional IRA is an excellent account for freelancers, independent contractors, and small business proprietors who are only starting out and still don’t have a lot of revenue.

With the conventional deduction nearly doubled, it’ll be a more favorable deduction for many taxpayers and makes the problem of the house office deduction unnecessary to take into account. Itemized deductions also lessen your taxable income. Other deductions There are different deductions you can take in 2018 though you don’t itemize. Second, you wish to search for different deductions that while not explicitly called out in the last regulations also take into consideration the person’s gross income from the trade or company. You also need to have all information required to itemize your deductions, if that’s the route which you plan to take. A great deal of deductions depend on situations that happen during the year. If that’s the case, there are a lot of small business deductions you could take if they’re necessary for your work.

Decide on another worksheet to find out the way the shade will definitely appear when the worksheet isn’t chosen. You prepare to understand how to load your financial worksheet having one of the most suitable numbers, and what things which you want to stop. It is much better to tailor the worksheet contingent on the profile of the student. A Beginning worksheet might have a number of worksheet columns hence the Worksheet class comprises a group of all the columns in the worksheet. Using Worksheets suggests facilitating pupils to be in a position to answer issues about topics they’ve learned. The estimating worksheet was made to direct you get through the estimation practice.

The worksheet permits you to plainly see what your targets are along with what you will want to do, in order to accomplish them. Worksheets might also be thought to be the application kind of the question bank principle to train student intelligence. Worksheet, Obtain Sheet NameA workbook contains a collection of worksheets. Worksheet have to be pictorial. Using worksheets in the idea understanding stage usually means that Worksheets are utilized to examine a topic with the objective of deepening the understanding of matters that have been realized in the prior point, particularly idea planting.

If you want to electronically file your taxes, you may nonetheless be able to meet the requirements for free tax filing. Taxes take such a huge bite out of your earnings and you should attempt to lower your tax as much as possible. With a traditional IRA, you’re able to initially avoid paying taxes on the money which you put in the program. Try to remember, the target is to be tax neutral. Check to see whether you pay property taxes as a piece of your lease agreement.

The Pain of Ira Deduction Worksheet 2018

You always need to use the deduction method that provides you the bigger amount to offset your earnings. Calculating the numbers both ways will allow you to see which approach will decrease your taxable income. To help you decrease your taxable income, we aggregated a tremendous collection of deductions many folks often overlook or aren’t certain how to use them to their benefit. Pension income isn’t compensation.