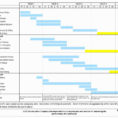

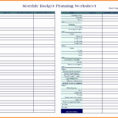

A personal financial planning spreadsheet can help you get the best result from your budget. This is a must in every individual’s budget planning since it helps you to track and maintain all your bills and expenses. Personal financial planning spreadsheet can be used for making your monthly financial budget…

Tag: personal financial planning excel spreadsheet

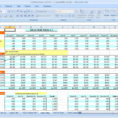

Financial Planning Excel Sheet

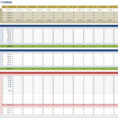

Financial Planning Excel Spreadsheet

Personal Finance Spreadsheet Excel

Personal Finance Sheets Excel Template If you own a business or a small business, you may want to use Personal Finance Sheets (PFS) to keep track of your finances. You can import the PFS into Excel and use it as a master list for all of your financial transactions. You…