Personal finance spreadsheet is not a simple idea. Many think it should be one of the simplest things in the world to make, especially when you have your computer at hand. But they forget that personal finance sheet has two sides to it. The first side of this common personal…

Tag: personal finance spreadsheet excel

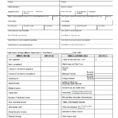

Personal Finance Spreadsheet Excel

Personal Finance Sheets Excel Template If you own a business or a small business, you may want to use Personal Finance Sheets (PFS) to keep track of your finances. You can import the PFS into Excel and use it as a master list for all of your financial transactions. You…