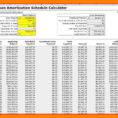

For those who deal with the daily operations of a large corporation, getting a loan tracking spreadsheet can help them keep track of which loans they have advanced. With these free software programs, they can make sure that they are not wasting their money. A loan tracking spreadsheet is a…

Tag: home loan tracking spreadsheet

Home Loan Spreadsheet

Home Loan Sheets – Are They Necessary? Home loan paperwork is something that is very much important. Whether you are applying for a conventional mortgage or an unsecured home loan, the information on the mortgage application and the information you will provide when you make a loan application must be…