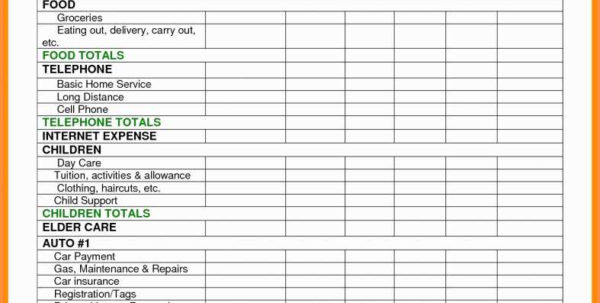

For those who deal with the daily operations of a large corporation, getting a loan tracking spreadsheet can help them keep track of which loans they have advanced. With these free software programs, they can make sure that they are not wasting their money.

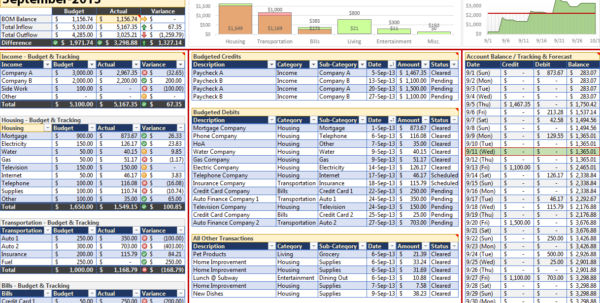

A loan tracking spreadsheet is a type of spreadsheet used by businesses to keep track of the various loans that a company’s entire business is built around. This spreadsheet is usually created with one or more business loan applications on it. It will record every loan that a company has advanced and what each line means.

Loan applications can be for many different types of loans. It may be for a car loan, a credit card bill, a lease payment, a home mortgage payment, etc. Every loan that a company has is recorded on the spreadsheet.

How A Loan Tracking Spreadsheet Can Help Your Business

One of the benefits of using these basic spreadsheet applications is that the owners do not have to devote their time to figuring out how to import data into the program. The user just enters data into the form fields, and the program does the rest.

Another benefit of having this type of application in a company’s finances is that there is no need to keep track of when the loan is due. If there is no way to estimate when the loan will be paid off, there is no way to plan for the company’s future finances. This is because if the loan is not paid back, there is no money to pay for other loans.

This can have serious consequences for a company, especially when certain dates come and go. The only way to plan for this would be to do the calculations manually. This could lead to a loss of thousands of dollars, as companies cannot afford to make such calculations by hand.

This program will keep track of when the loan was approved, how much additional money was paid, and the terms of the loan. A company that uses a spreadsheet to keep track of all of their loans will find that there is always a track record of their company’s finances.

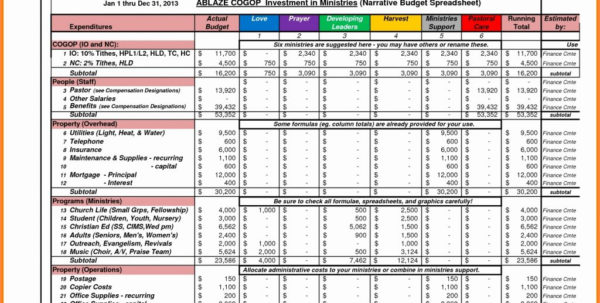

When this application is used for the first time, it is important to remember that it is a business and the company needs to make money in order to keep running. A lot of money will be spent on the application, so it is important to ensure that the company’s budget is carefully maintained.

Many companies give out money as grants for the general good of the company. For example, some companies give money to help people pay off their credit card debt, or to help a woman who has recently had a baby.

Companies that give out money for these types of purposes have been found to have a higher success rate than other companies. So a loan tracking spreadsheet is a perfect way to use the free software to keep track of all the money that the company has received.

The free software can also be used for tracking the money that the company has spent, as this can be easier to compare to the money that was given away. The company owner can compare the money received to the money spent and see how well the company is performing financially.

This type of loan tracking spreadsheet can help a company make sure that they do not lose money by misusing the money that they have been given. This type of application is a great asset to a company, as it can help them stay on top of their finances. SEE ALSO : loan spreadsheet