This article looks at how to use an expense spreadsheet program to help you manage your household expenses. In fact, I will show you what to look for in one. You will discover how to use this type of program to help you control your household spending. To use an…

Tag: expenses spreadsheet example

Bill Spreadsheet Example

Why Bill Sheets? When is the last time you used a spreadsheet software program? If you have not, it’s time to find out. There is no greater gift than time and when it comes to financial planning there is no more important commodity than the money you earn or spend…

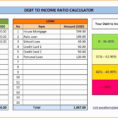

Financial Spreadsheet Example

Financial spreadsheet example will be useful to you if you’re already familiar with Excel. But if you’re a beginner, perhaps you are not interested in spending money on software that might be obsolete in a couple of months. Financial spreadsheets are not difficult to create, even for someone who’s never…

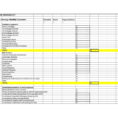

Expenses Spreadsheet Example

If you want to take your time and really make an effective expenses spreadsheet, then you may want to look at the Expenses spreadsheet example. This example allows you to get an idea of what it’s all about before you download the actual application and begin working with it. You…

Expenses Spreadsheet Template

Expenses spreadsheet template is a must-have tool in the accounting career. With it, your accounting and bookkeeping are done in the most effective manner and best. However, you have to understand some of the basic rules of the expenses spreadsheet and how it works so that you can easily get…