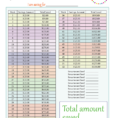

Using a debt tracker spreadsheet is the fastest way to get rid of your debts and get a better credit rating. The only problem is that most people will not find this information, because it is not the most interesting thing in the world. What they will find is a…

Tag: Debt Tracker Spreadsheet

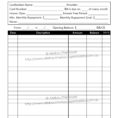

Debt Management Spreadsheet

Using a Debt Management Spreadsheet to Manage Your Finances Debt management is a service that is intended to manage one’s finances and is meant to prevent bankruptcy. A management plan will help the debtor to get back on track with finances and to gain financial control. If this sounds like…