Getting Help With Your Debt Elimination Plan

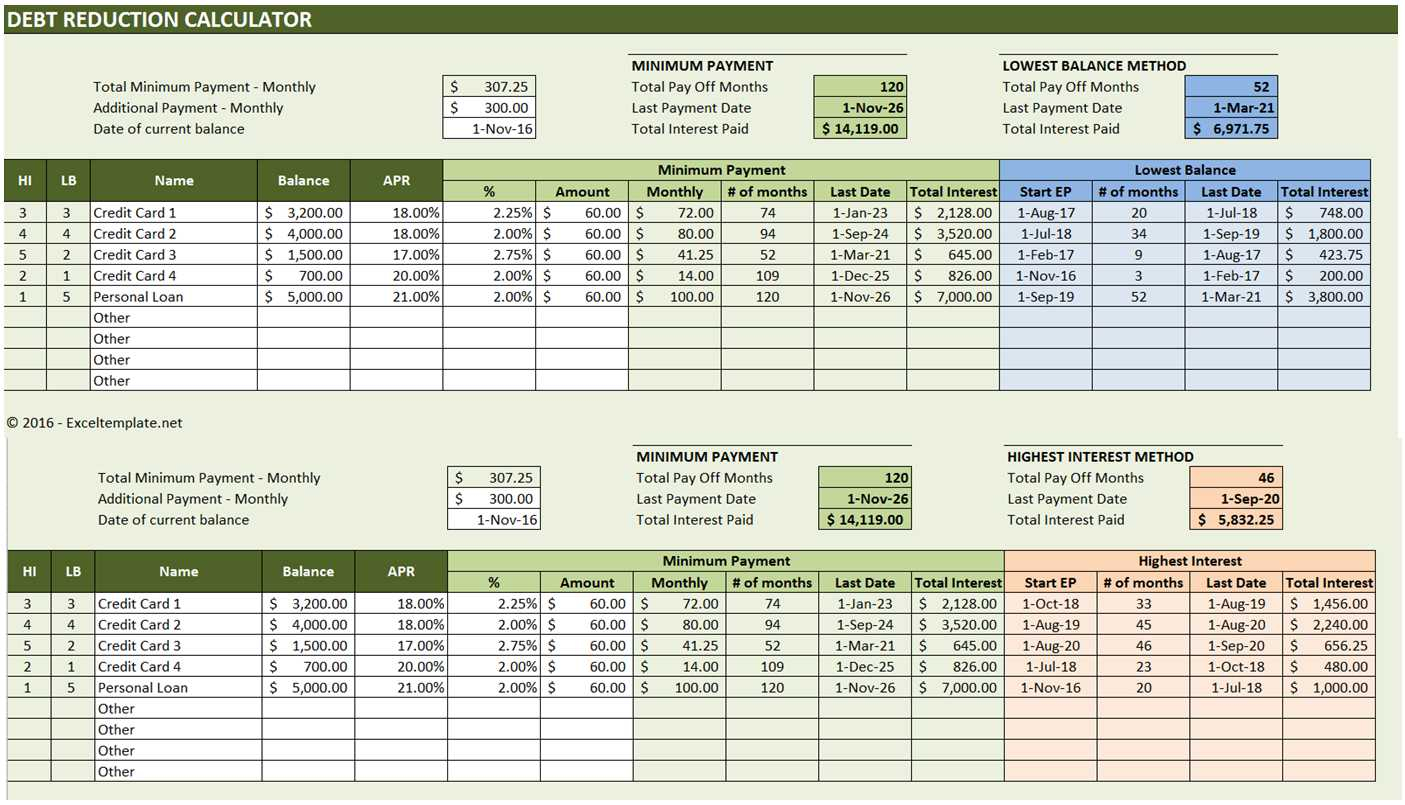

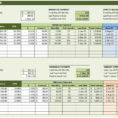

A debt elimination spreadsheet can be a useful tool to use when you are trying to eliminate your debt. However, like anything else, it can be used to help you create or maximize your success.

First and foremost, the debt elimination spreadsheet is not an answer to all your financial problems. It should not be considered as a magic pill that will suddenly fix your situation. The spreadsheet simply tells you how much money you have left over after paying your bills, then tells you what you should do with that money.

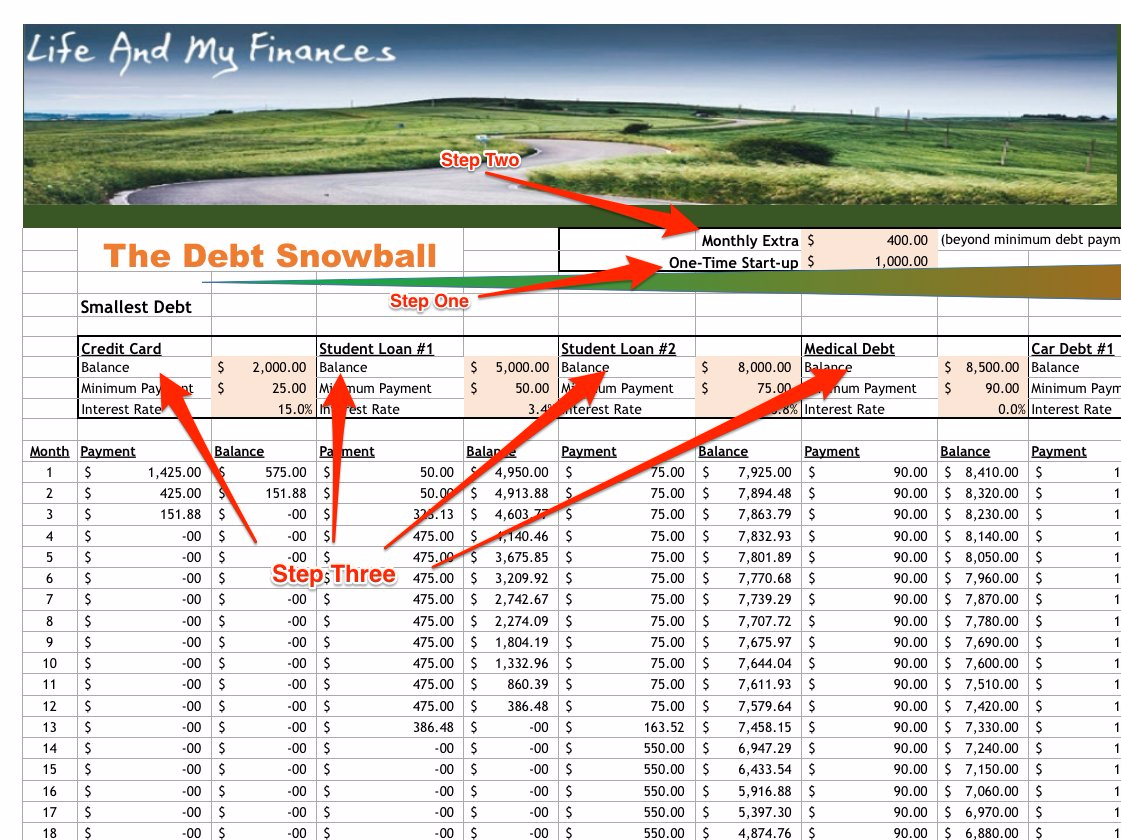

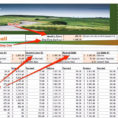

If you have a spreadsheet, however, but are not sure how to use it, the best place to start is at the end of the elimination spreadsheet. It will tell you exactly what to do to get your debt paid off.

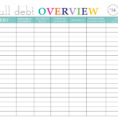

For example, if you have a debt elimination spreadsheet and you have debt that you are not currently paying back, you need to consider the tips on the next section. If you’ve never had any debt, you might just be willing to stick it out and try to figure out how to pay it off.

If you have gone months without paying a dime, and your financial goals are much more important than your interest rate, you are probably ready to start working on paying off your debt. Either way, there are some strategies you can follow to get started.

There are two ways to get started with a spreadsheet. One is to download it and use it in the same way that you would use an accounting program or look for one that will help you create a spreadsheet from scratch.

The other option is to find a spreadsheet that can be used with one of the free options that are available on the internet. Many of these programs will allow you to make a monthly budget, print out your bills, and see your monthly cash flow, but they won’t help you manage your finances in any other way.

If you want to use a debt elimination spreadsheet, you should probably use a program that allows you to customize your own budget for the month. There are other programs that can be used for that purpose, too, but a customized budget is better for any serious debt reduction efforts.

You can create a spreadsheet in any of the online programs that let you create your own budget and share it with others. You may want to do this as soon as possible, because creating a budget can be a powerful tool to use.

Creating a budget helps you see where your money goes, which can be very helpful when trying to decide how you will handle your bills. It can also save you a lot of time and help you be more organized when you are trying to make more money.

It’s important to have a spreadsheet, but if you aren’t sure how to use it, don’t let it hold you back. The right program is one that will help you better organize your finances and help you get out of debt. YOU MUST LOOK : debt consolidation spreadsheet