In the event you wish to earn your record more protected, you might also convert excel to PDF to prevent the misuse of the information in the dictionary. You might also import your present documents to Google Docs. Google Records has a Spreadsheet feature which also enables you to make…

Tag: debt snowball calculator spreadsheet

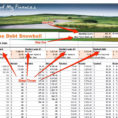

Debt Snowball Calculator Spreadsheet

A debt snowball calculator spreadsheet can make a lot of sense if you are having trouble keeping track of your debt and the payments that you are making. This can be a time consuming chore and can eventually add up to a mountain of debt. One option is to consult…