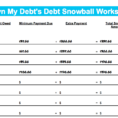

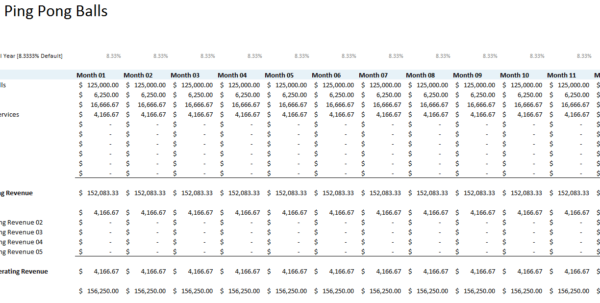

A debt snowball calculator spreadsheet can make a lot of sense if you are having trouble keeping track of your debt and the payments that you are making. This can be a time consuming chore and can eventually add up to a mountain of debt. One option is to consult with an expert.

There are free online resources that can help you out. These resources also offer many useful tips and advice on how to handle your debt problems. The first tip is to cut down on your expenses.

You have a huge temptation to splurge on your little luxuries. So if you have to make some sacrifices, do so. Your debts will ease up over time.

How to Use a Debt Snowball Calculator to Manage Your Unsecured Debt

Take advantage of getting low interest rate credit cards. These cards are easily available and do not come with any fees. They help in giving you lower monthly payments. You will get to keep more of your money at all times.

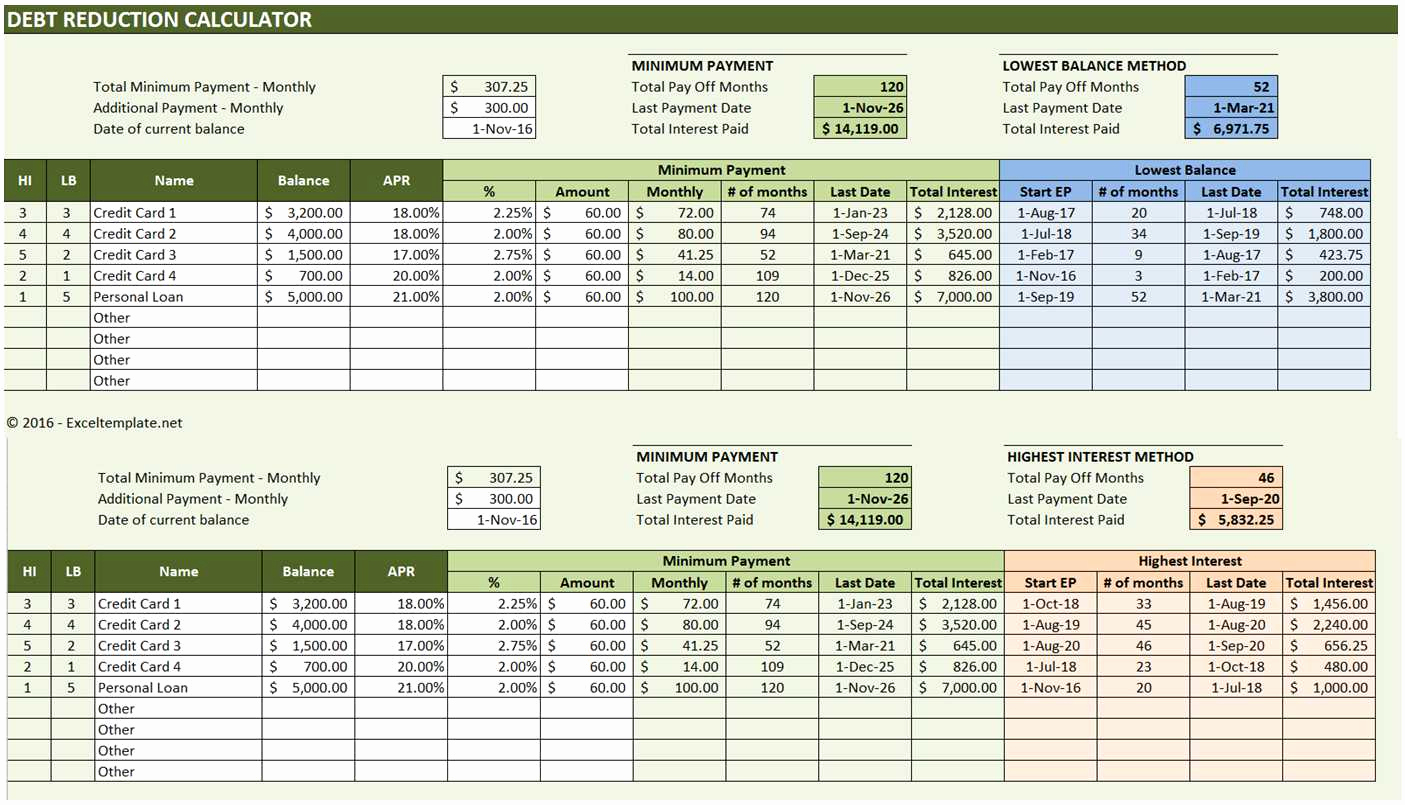

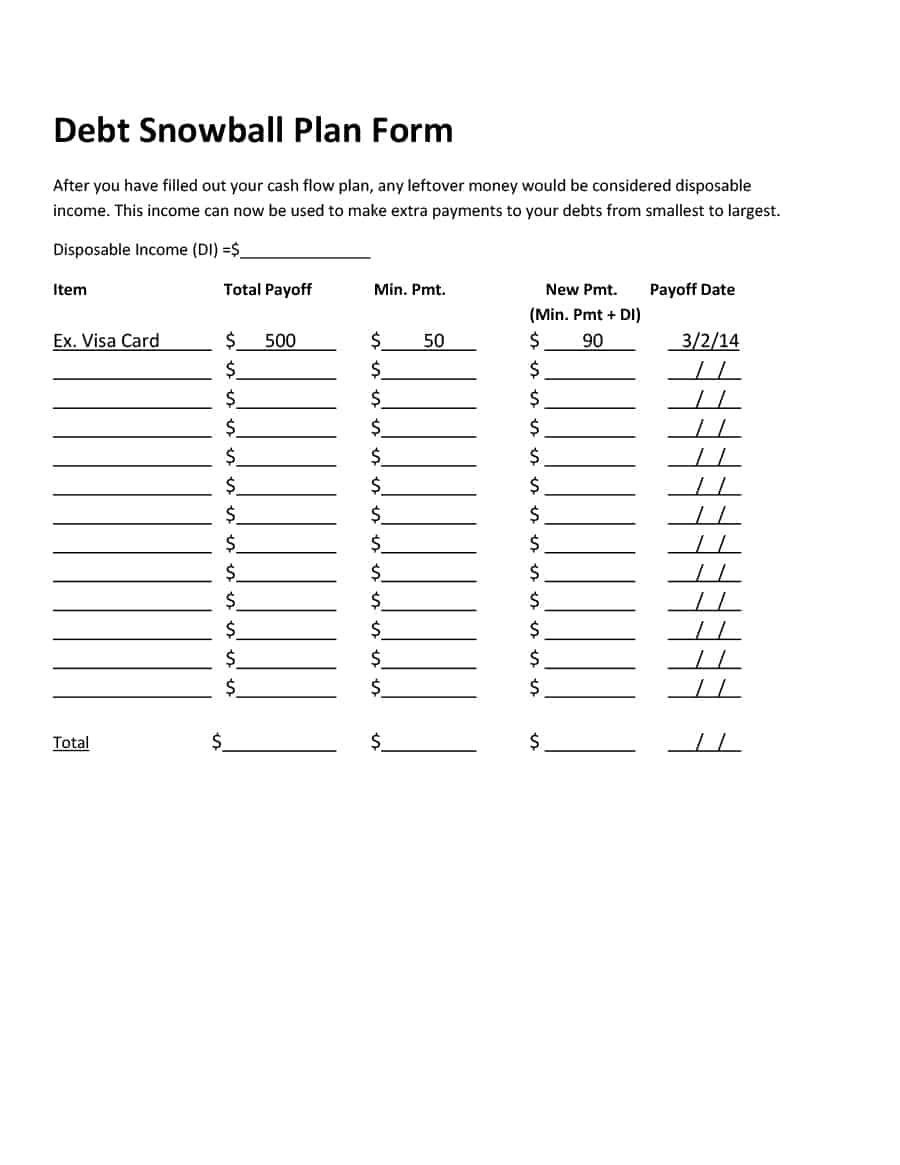

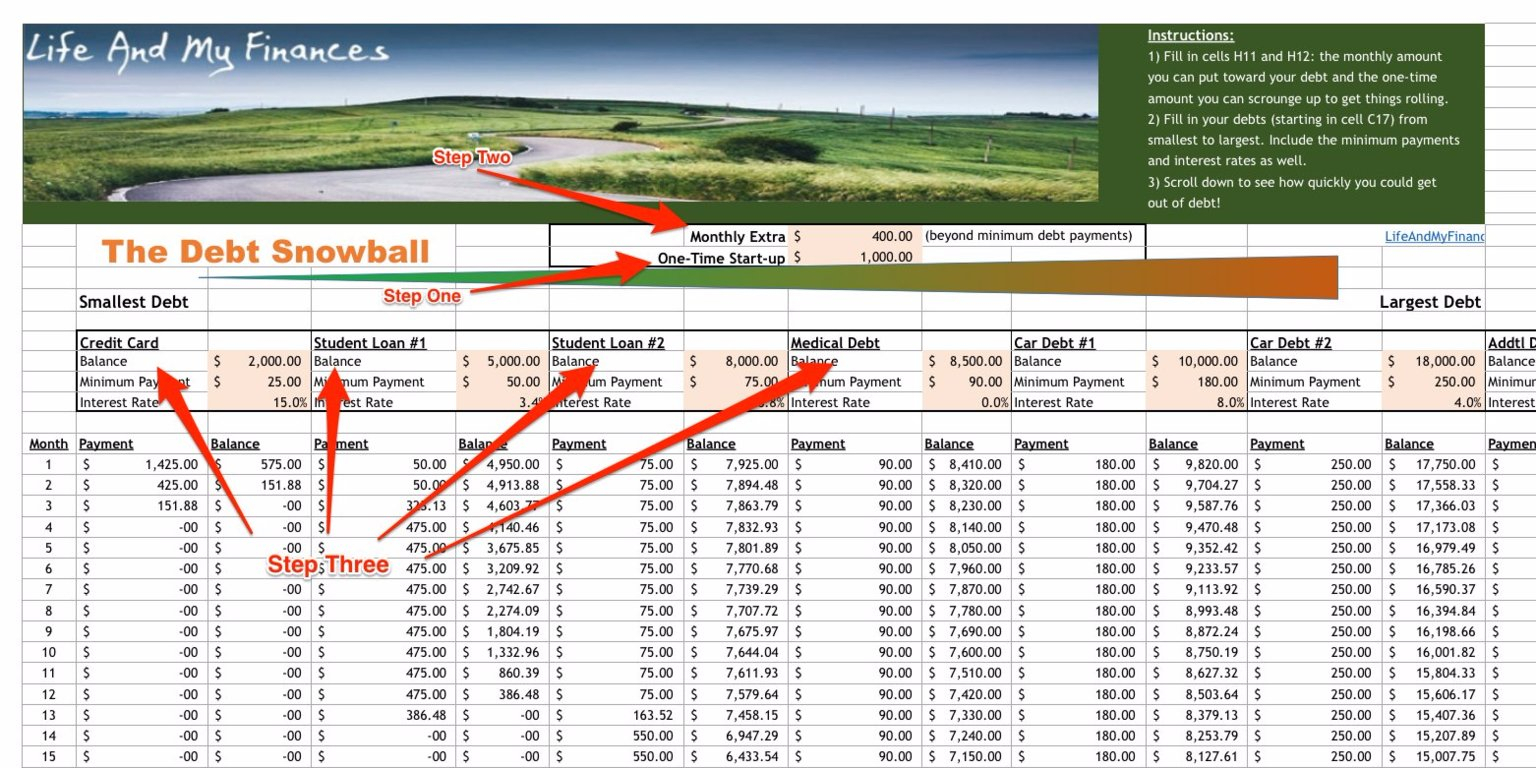

Debt snowball can help you with reducing your debts. You can reach your goal by setting a financial plan with your creditors. Start by getting a consolidation loan that can save you a lot of money.

The debt consolidation company will help you reduce your debts. You can still go ahead and pay your creditors but by consolidating your debts into one small debt, you will be able to make the monthly payments. Then you can look forward to a brighter future.

Debt snowball can help you with reducing your debts. Once you find a good debt consolidation company to work with, it will eliminate your debts. This is a good option if you have multiple debts.

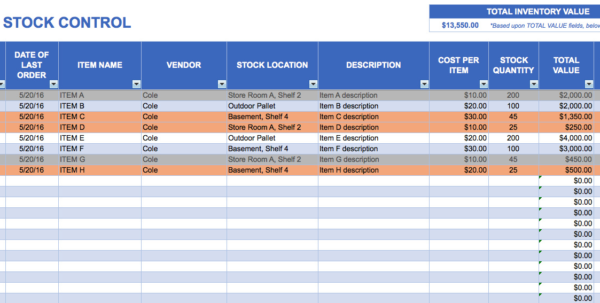

Debt consolidations can help you with reducing your debts. You can consolidate all your unsecured debts into one loan. This will help you to make the monthly payments easier.

Make sure that you avoid borrowing the money from friends and family as you need to repay the debt you have borrowed. This will ensure that you only use the money for your needs. Do not try to save money.

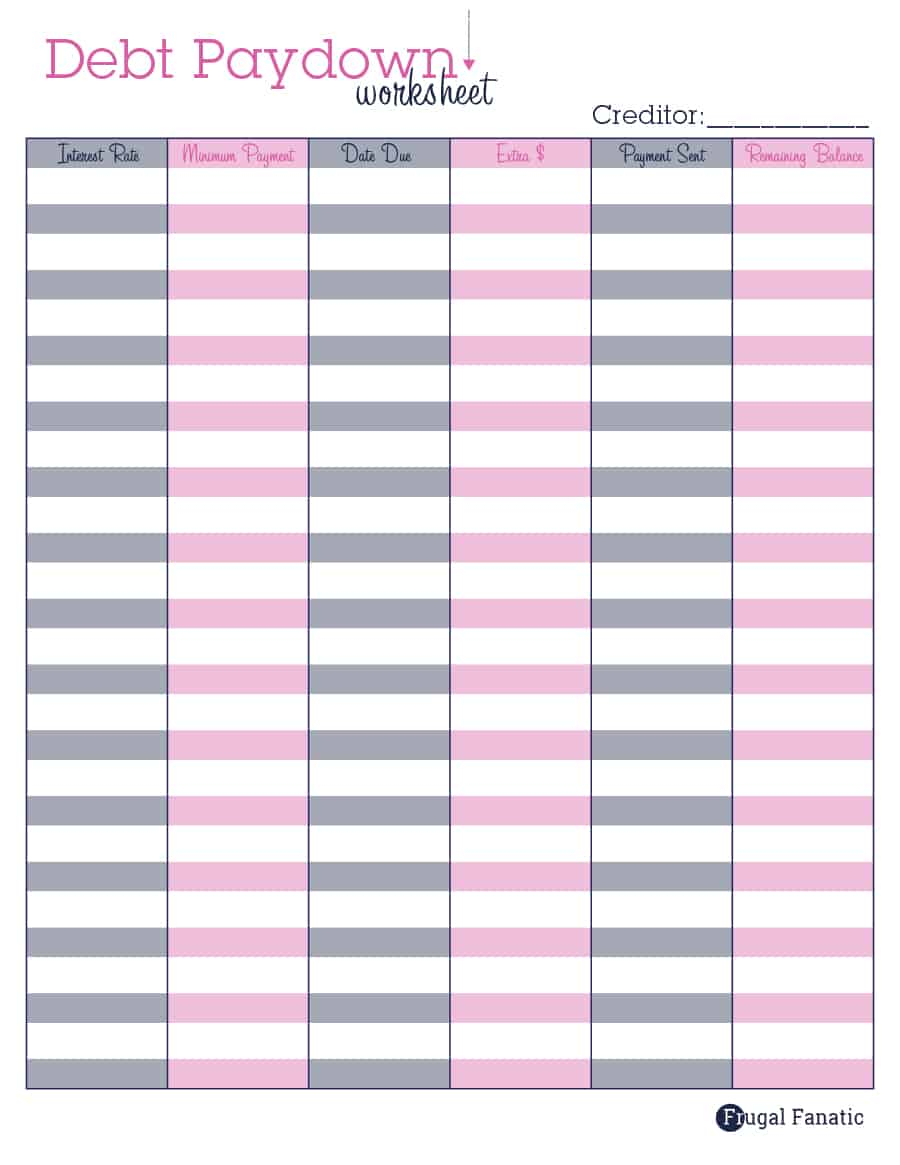

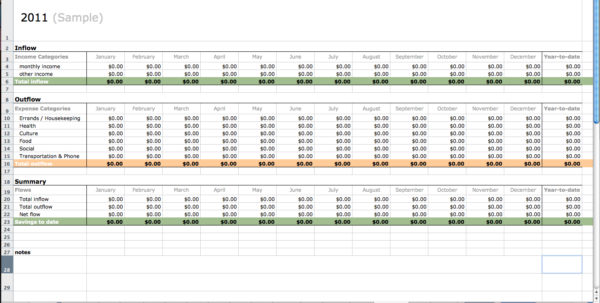

It is important that you monitor your credit card balances. You must set aside a set amount each month and keep track of your spending. When you are managing your debt, you must be careful with your spending.

It is a wise decision to get an expert to help you manage your debt. An expert will guide you about how to reduce your debt and the best way to make your monthly payments. It will also help you plan your finances so that you will never fall into a financial crisis again.

The best way to start managing your debt is by using a personal budget planner. This planner will help you develop a budget so that you will always know where your money is going. YOU MUST SEE : debt repayment calculator spreadsheet