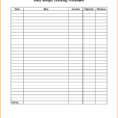

A daily expenses spreadsheet is an excellent tool to keep track of every single expense that you incur during the day. No matter how much or how little expenses you have, keeping track of them can help you be more effective and prevent spending money unnecessarily. The first step is…

Tag: daily expenses spreadsheet for small business

Spreadsheet For Small Business Expenses

What Are the Benefits of Using a Spreadsheet For Small Business Expenses? In the small business industry, there are many benefits of using a spreadsheet for small business expenses. These days, it is common practice to store your business information on a database. However, not all businesses use a database…

Financial Spreadsheet For Small Business

Financial Spreadsheet Software – Saving Money Financial spreadsheet software and applications to help small businesses manage their finances more efficiently. By using a financial spreadsheet software, you can easily keep track of your bank account transactions, tax documents, inventory data, receipts, and any other information that need to be managed….