When starting to use an Excel expense tracker, you might think that this is a rather simple concept. But, in actual fact, it can be a bit more complex than that. One thing that many people overlook is the importance of the step-by-step process in tracking your expenses. Without the…

Tag: Daily Expense Tracker Excel

Business Expense Tracker Excel

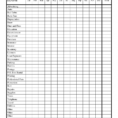

Daily Expenses Tracker

The Debate Over Daily Expenses Tracker If you’re on the lookout for a simpler method of tracking your costs, you may use the Expense Tracking Log to track every cent of merely the surplus money after all your taxes, debts, and other necessaries are paid that you need to spend….

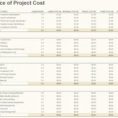

Business Expense Tracker Excel

Excel is the business expense tracker that every business must have in their arsenal. This software can help you make your money go further by helping you with your expense and finance records, reports, and the like. Business expense tracker excel has all the tools you need to be successful…