In case you’re in need of a spreadsheet to help you look up your credit card payoff balances, you might want to look into the credit card payoff spreadsheet. If you’re not familiar with these types of spreadsheets, they basically are a spreadsheet that lists down your balances in a…

Tag: Credit Card Payoff Spreadsheet

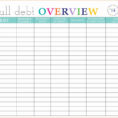

Debt Management Spreadsheet

Using a Debt Management Spreadsheet to Manage Your Finances Debt management is a service that is intended to manage one’s finances and is meant to prevent bankruptcy. A management plan will help the debtor to get back on track with finances and to gain financial control. If this sounds like…