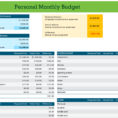

Unusual Article Uncovers the Deceptive Practices of Budget Spreadsheet Uk New Questions About Budget Spreadsheet Uk If you’re not acquainted with creating a budget, simply complete the pre-formatted templates with your earnings and expense info, and the template is going to do the calculations for you. If a budget is…

Tag: budget planning spreadsheet uk

Budget Planning Spreadsheet

Ways to Budgeting With a Budgeting Spreadsheet Budget planning can be accomplished with a spreadsheet and the proper computer programs. This is a great way to keep track of all of your financial goals. It is important to identify what your income, your expenses, and your debt-to-income ratio should be,…