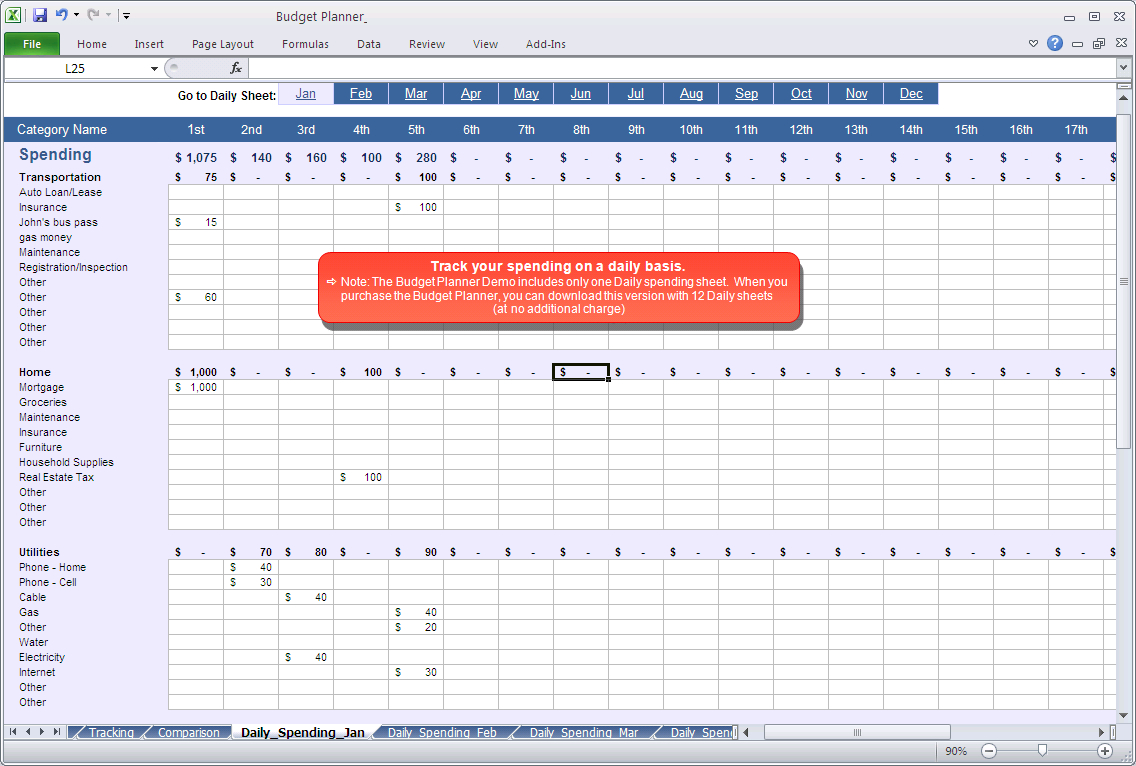

Ways to Budgeting With a Budgeting Spreadsheet

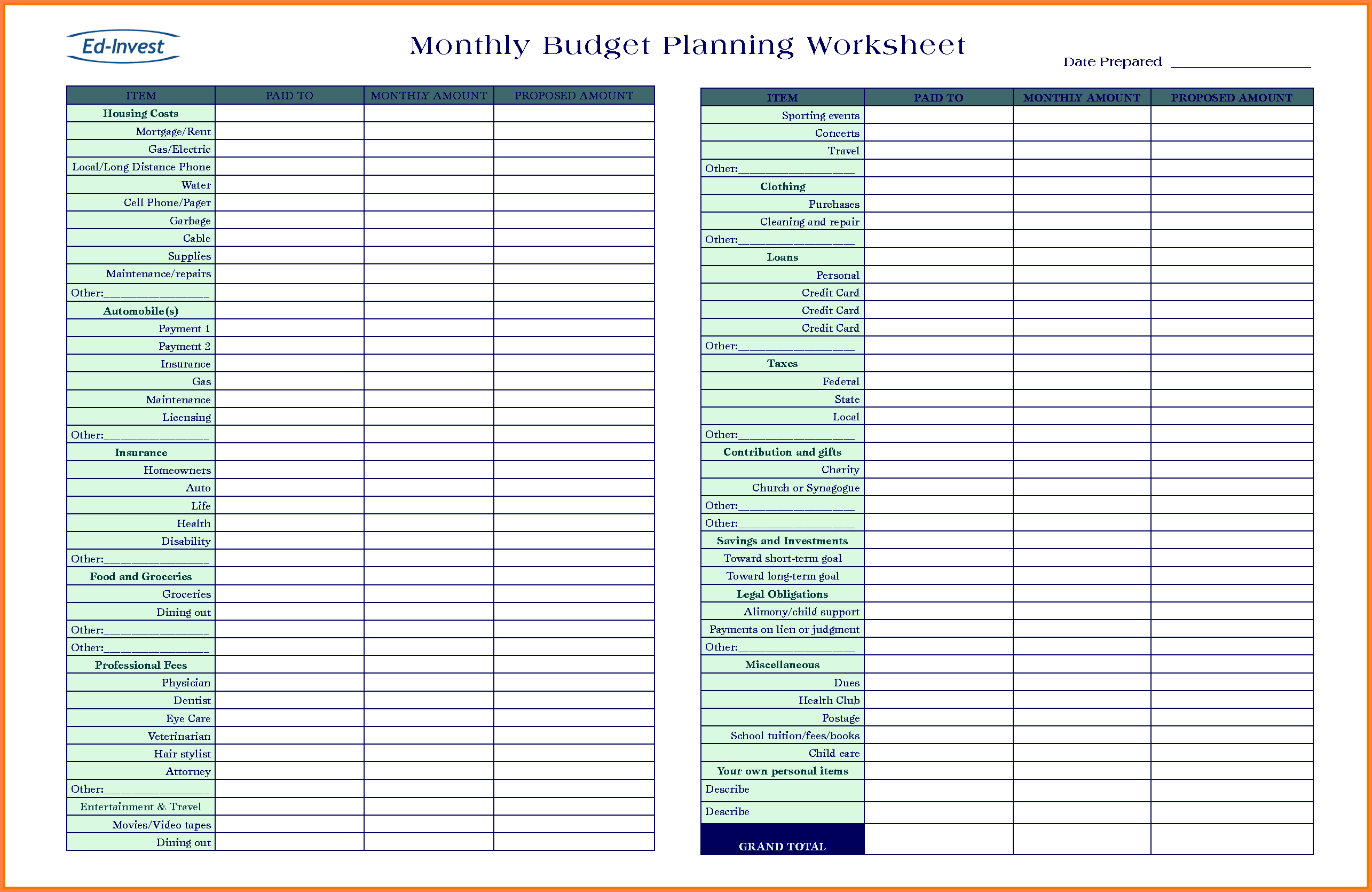

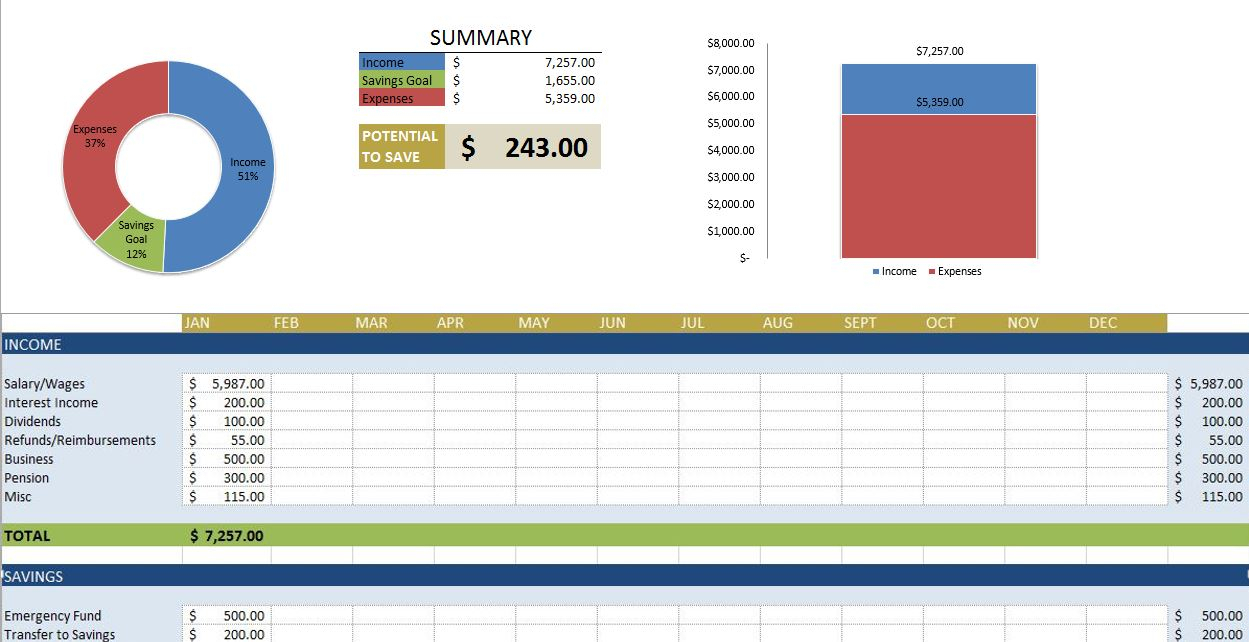

Budget planning can be accomplished with a spreadsheet and the proper computer programs. This is a great way to keep track of all of your financial goals. It is important to identify what your income, your expenses, and your debt-to-income ratio should be, before you actually begin to plan a budget.

Planning is a great way to eliminate unnecessary expenses. It is also a tool to teach people how to live within their means.

First, you should write down your annual income statement and subtract the gross income from your gross monthly income. In this manner, you will determine if you are “rich” or not.

If your gross monthly income is less than the amount on your income tax return, you should still stay on track. By following these guidelines, you will make sure that your assets will not be lost and that you will not become “poor”.

Some people receive a large amount of extra income in a given month. These people should learn how to manage their cash flow and adjust their spending accordingly. Otherwise, they will end up in a debt situation that they cannot afford.

Some people also receive extra income from outside sources. With this type of extra income, it is important to do a comparison to determine if you are getting a fair deal. Additionally, if you receive extra income from outside sources, you should always keep a running total of how much you have received.

If your gross monthly income is above the amount on your income tax return, you should check with your employer to determine if you have taxable income. You should also learn how to make sure that your personal deductions are accurate.

You should check your taxes to determine if you have any other income that is included in your gross monthly income. Additionally, you should learn how to control the tax deductions that you have received.

While you are in your accounting class, you should learn about how to use the calendar year to understand your taxes. This will help you determine how many deductions you have to make and how many years you need to wait before you have paid them off.

Each individual has their own tax code and they have to adhere to this tax code. However, each person has to abide by certain rules as well.

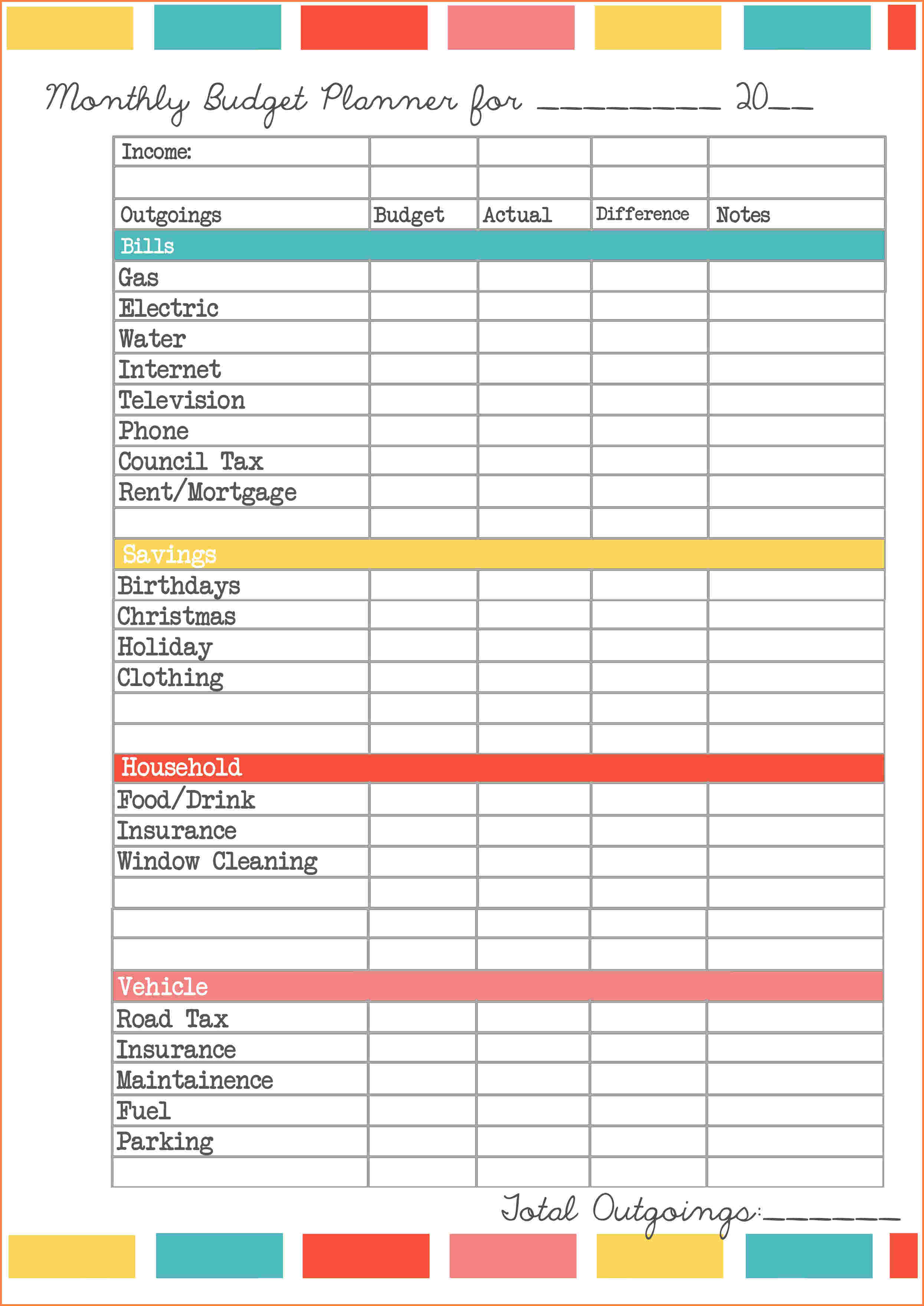

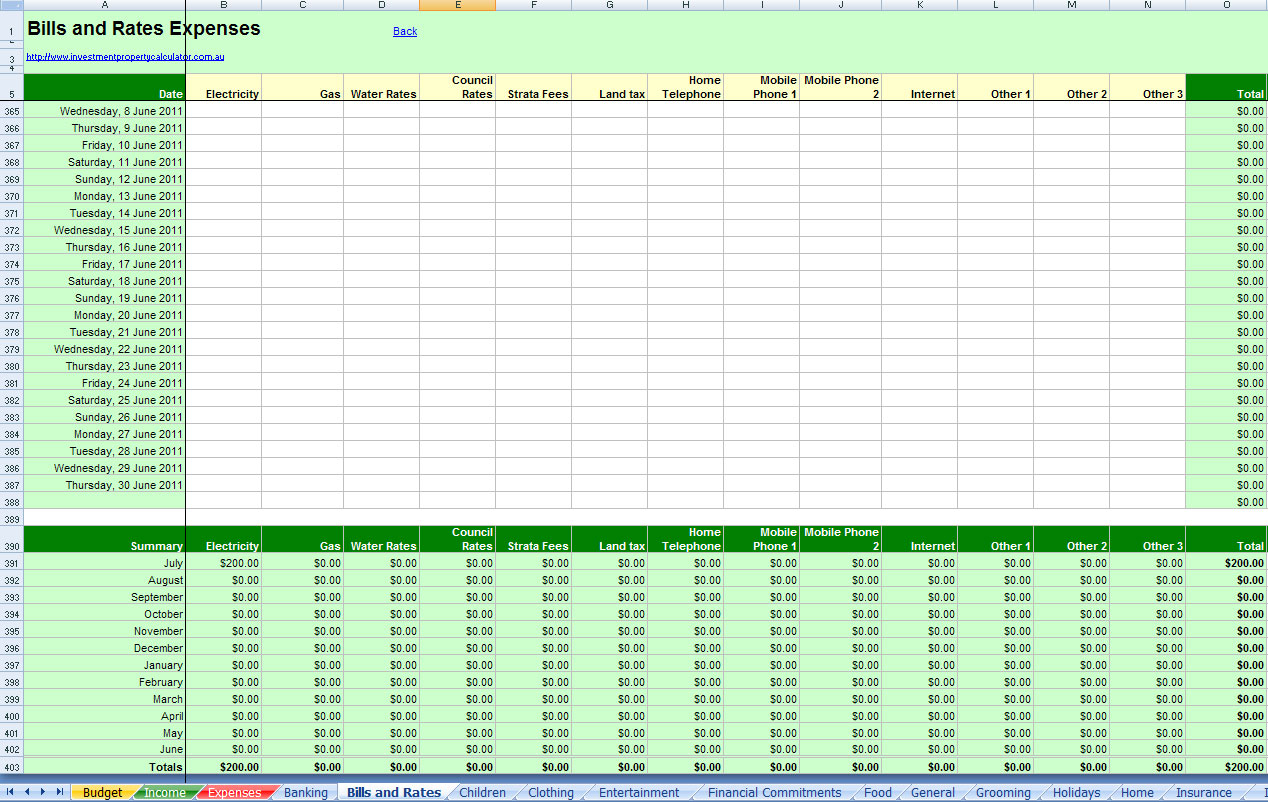

Budget planning is a great way to educate yourself about finances. By properly keeping track of your income, expenses, debts, and assets, you will learn how to live within your means and how to plan for future finances. PLEASE SEE : budget planner spreadsheet