Why a Format For Small Business Needs to Be Created Many small businesses don’t think about writing an accounting format for small business because they feel that they are not experienced enough to do it. This is not true. There are many people who are good at writing, but can’t…

Tag: accounting template for small business

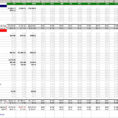

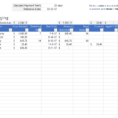

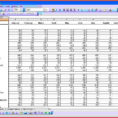

Accounting Template For Small Business

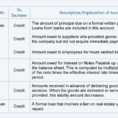

What Is An Accounting Template For Small Business? Why, you ask, would you want to use an accounting template for small business? Well, you probably have some concerns about using any form of software that has no code, but the truth is that a lot of businesses do run under…