Why a Format For Small Business Needs to Be Created

Many small businesses don’t think about writing an accounting format for small business because they feel that they are not experienced enough to do it. This is not true. There are many people who are good at writing, but can’t write a format for small business.

The first thing you need to do when writing an accounting format for small business is to be sure you have the skills you need to be an accountant. How will you record your records? Do you want to use paper or electronic tools to create the records?

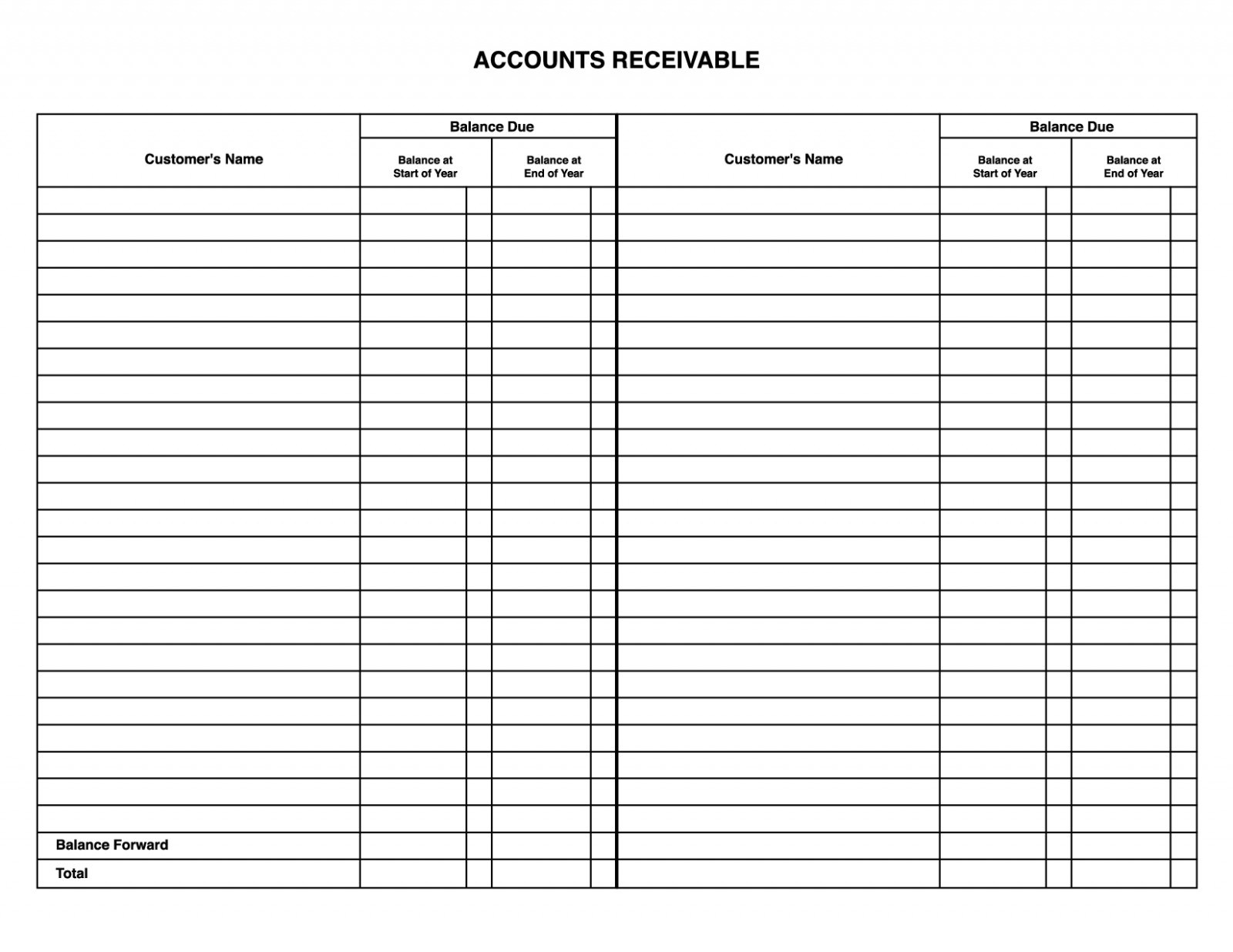

How will you handle invoices and payments? Will you mail them or will you keep them in a file? If you keep them in a file, then you can add these in when you plan for expenses and revenue.

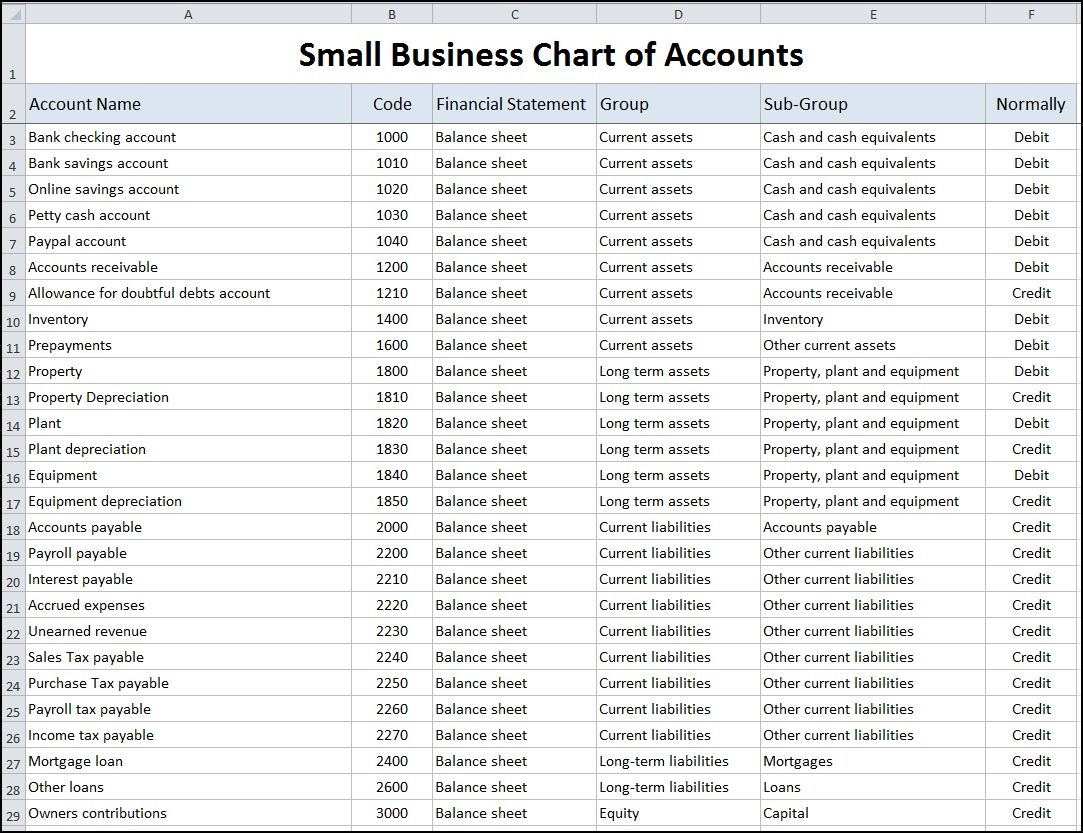

How will you manage your accounting for the business? Will you keep a separate book of accounts or do you need to have it on hand for everyday expenses? Having the accounting information on hand will help you do your daily accounting.

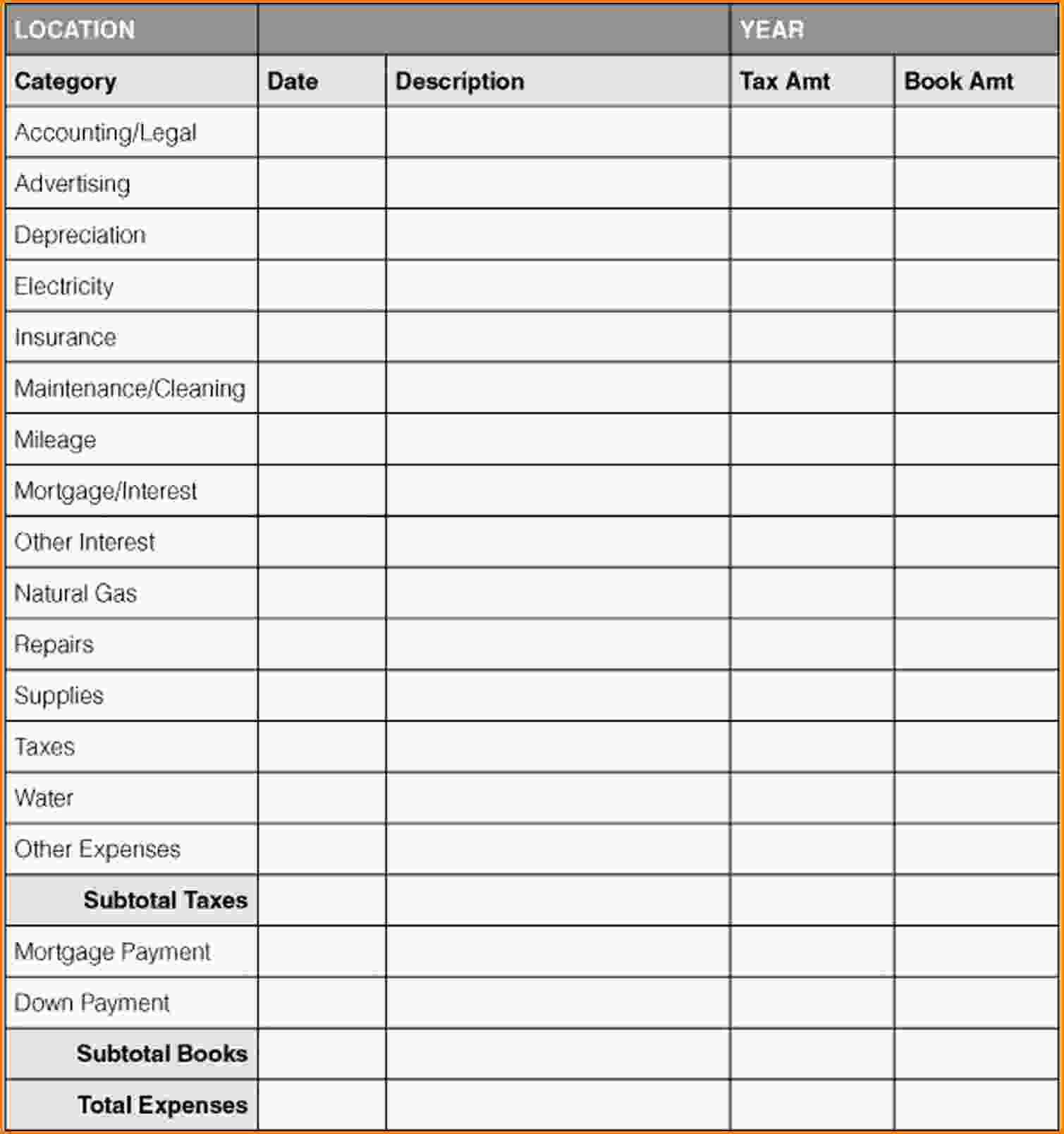

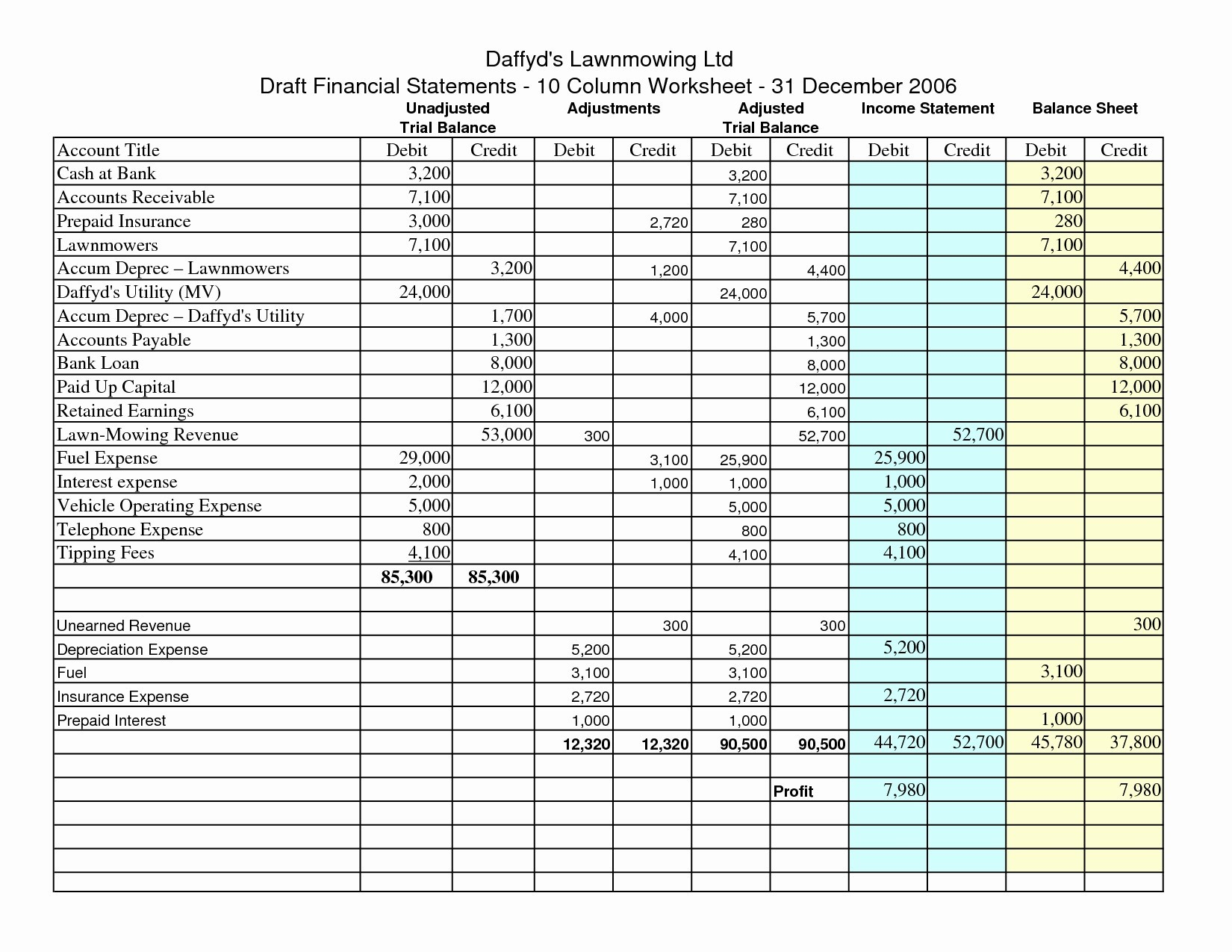

Budgeting is the next step. You will want to have a budget in place. The budget you create will be used to keep track of your business’ assets and income.

Profit and loss are the next steps. Profit should be used for expenses and loss should be used for income. You can also use this information to determine what you need to spend for the company. They need to come up with a profit and loss statement every quarter to help reduce your risk.

To complete your tax return, you will need to prepare a Federal Tax Return Form. Some companies offer a service to prepare your Federal Tax Return for you. If you need more than one form for your state, you can call the IRS and they will send you all forms for your state.

Once you have all of these items ready, you are now ready to call yourself an “independent contractor”. Most employers will ask you to fill out Form W-2 for payroll purposes.

Reporting must be done by individuals who are not an employee. You can use other accounting software, such as QuickBooks, to make this task easier. You may choose to do this by yourself or you can hire someone to do it for you.

Reporting needs to be done every year or every three years depending on the number of employees you have. Some businesses report their finances in annual or semi-annual reports, while others only keep audited financial statements.

Writing an accounting format for small business isn’t hard. All you need is a spreadsheet program to help you create your records. You can also consult with a professional accountant who can guide you through the process. READ ALSO : accounting excel templates free download