Using an Applicant Tracking Spreadsheet to Organize Your Business An applicant tracking spreadsheet is a useful and indispensable tool for any business, whether small or large. The benefits of using one will soon become obvious. For starters, it can help you decide which applicants have the most appeal and which…

Category: Software

Investment Property Analysis Spreadsheet

Investment Property Analysis Spreadsheet The investment property analysis spreadsheet can help you find out all of the details about a property that you are interested in buying. As soon as you have bought it, the next thing you need to do is ensure that it is in an area that…

Budget Planning Spreadsheet

Ways to Budgeting With a Budgeting Spreadsheet Budget planning can be accomplished with a spreadsheet and the proper computer programs. This is a great way to keep track of all of your financial goals. It is important to identify what your income, your expenses, and your debt-to-income ratio should be,…

Product Inventory Spreadsheet

Product inventory spreadsheet program is something that is popular in the business world these days. You can easily do your own inventory and even open up an online shop or sell your products from this inventory program. What you need to know is that this program will give you information…

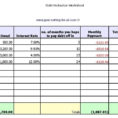

Debt Reduction Spreadsheet

Debt Reduction Spreadsheet – Student Loans, College Financial Aid and Debt Reduction Strategies There are two types of consumers that need a debt reduction spreadsheet and they are both college students. Let’s look at these two groups of consumers and what they need to know to be successful with their…

Household Inventory Spreadsheet

Household Inventory Spreadsheet A household inventory spreadsheet can be a great tool to see the volume of items you have. It can also be used as a guide to know how much you can spend in purchasing items from different retailers. This way, you can also keep track of your…

How To Convert Pdf File To Excel Spreadsheet

How to Convert PDF File to Excel Spreadsheet – Make Good Use of the Experts How to convert PDF file to Excel spreadsheet? This article will help you learn this step-by-step conversion process. The first thing you need to do is to prepare the PDF file and put it in…