How to create a shared spreadsheet in Excel is pretty easy. You just need to be able to open it up. So how do you go about doing that? If you’ve used your computer in the past, it’s possible that you’ll be familiar with how this works. You’ll open up…

Category: Download

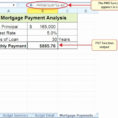

Mortgage Comparison Spreadsheet

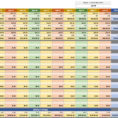

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available. Mortgage comparison sheets…

Create Database From Excel Spreadsheet

When starting your own internet business, you can create a database from an Excel spreadsheet. In this article, we’ll show you how. The first thing to do is download and install Excel. Make sure that you have enough money to buy an Excel programmer. You can find a lot of…

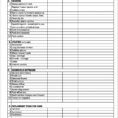

Living Expenses Spreadsheet

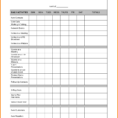

To get a good handle on how much money you are spending on your living expenses, you need to make a living expenses spreadsheet. You will need to be creative and easy to understand to make this work. What most people don’t realize is that they spend more on large…

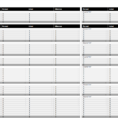

Monthly Income Expenditure Spreadsheet

Are you looking for a great income and expense spreadsheet? Then look no further. Read on for a look at how to use a monthly income and expense spreadsheet. More people are choosing to work from home with large spreadsheet software that can produce not only time-saving documents but also…

Forecast Spreadsheet

Forecast spreadsheet software is designed to provide financial, operational and human resources managers with information in the form of graphs, figures and charts. It is an in-depth report creation tool for the fast and accurate computation of business forecasts. If you are a manager looking for a cost-saving strategy that…

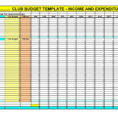

Project Budget Tracking Spreadsheet

When a business comes to use a project budget tracking spreadsheet, they are getting something that will greatly help them to make sure that they stay on budget. They will be able to manage their projects in a much more accurate way than they ever have before. The right system…