A Savings Goal Tracker can be a helpful tool to help you keep track of your progress. The spreadsheet does not require any additional software or special connection to the internet. Once it is loaded onto your computer, you can begin tracking your savings and other financial information in the spreadsheet.

There are many professional spreadsheet programs available on the internet for free download. If you can view these programs, they can offer you the best-looking and most detailed reports out there.

But, if you do not know how to use these programs, they can cost money and be difficult to get around to each month. An easier, less expensive alternative to professional spreadsheets is a personalized savings goal tracker spreadsheet that you can create and download for free.

Creating Savings Goal Tracker Spreadsheets

This will allow you to print off your spreadsheet and keep it on your computer for convenient access whenever you need it. Or, you can simply save it and then print it when you want to review it quickly for comparison.

This is the best way to keep track of your personal saving goal tracker spreadsheet. Not only will you be able to see your progress each month, but you will also be able to compare the progress of your income with your expenses each month. This will help you find out where you are making money and where you should cut back your spending.

You will be able to pinpoint any money that you may have been putting toward things that you did not even want to spend money on. You can either reduce your monthly budget by making changes in your lifestyle or by making drastic changes in your lifestyle or purchasing habits.

An important part of keeping a personal saving goal tracker spreadsheet is to never to put a dollar amount on your goals. No matter what kind of personal goal tracker spreadsheet you are using, no dollar amount can be written down.

The spreadsheet should be just that – a budget that you write on a piece of paper every month. The goal tracker spreadsheet will just be a way to compare your performance with the goal set forth by the monthly budget.

Even a standard spreadsheet can change from month to month, so be sure to only copy and paste the relevant columns into your new spreadsheet. Also, be sure to look over the month and year entries with your spreadsheet before you make any changes to them.

Keep track of your monthly goals on a spreadsheet that you can print out and refer to often. You can also convert your savings goal tracker spreadsheet into a standard spreadsheet and include a wide range of different purposes.

Many businesses like to keep track of their specific goals and budgets for each of their departments in the same spreadsheet. It’s a great way to keep track of all the activities, the budgets, and the amounts being used by each department in your business.

Remember, whether you are tracking your own savings goal tracker spreadsheet or whether you are using it to track another’s, you can always use it to keep track of your savings goals. The most important thing to remember is to have fun with it.

Setting Up Savings Goal Tracker Spreadsheets

Setting a savings goal tracker spreadsheet is the best way to keep track of your financial progress. If you have a lot of money and you don’t know where to put it, this is probably the only tool you need.

Saving money isn’t something that you should be doing without being aware of how much you are spending. That is why the best way to save money is to chart your progress over time. The idea is to track how much you spend each month and how much you are saving.

Using a good spreadsheet will help you keep track of the money you spend. In some cases, it can also help you see how much you are saving.

But, before you can use a goal tracker spreadsheet, you will need to make sure you understand the benefits of a financial record. And, before you get started on your goals, it will be helpful to get some ideas on how to set up the first one.

Setting up a spreadsheet can seem overwhelming because there are so many features that you need to take into account. But, once you get past the initial set-up of the spreadsheet, it will be easy to get going with your goals.

One of the first steps you will need to take when you set up a goal tracker spreadsheet is to decide how you want to work the spreadsheet. You can choose to have a column for each month of the year.

You can then use this column to create a month at a time schedule and column for how much you saved each month. The best thing about a goal tracker spreadsheet is that you can update these columns as you move towards your ultimate goal.

You may want to also look at how you plan to divide your income stream. You can use your gross income or your net income.

Once you have chosen how you will divide your income and how you want to keep track of your financial goals, you can now get to work on creating your first spreadsheet. There are many different companies that offer the ability to make your own financial goal tracker spreadsheet.

You can choose to use one of the free versions or pay a little bit of money to find a good spreadsheet. After you select a type of software, you can then download your first spreadsheet.

Once you have your first financial goals, you can continue to add goals and other tracking tools to your spreadsheet. Of course, it will take a little bit of work on your part to add these new features.

It’s important to remember that it is always good to set your financial goals first and to choose the spreadsheet that will allow you to create your goals. Once you set these goals, you can keep track of your progress and adjust your financial situation to better fit your goals. YOU MUST READ : savings goal spreadsheet

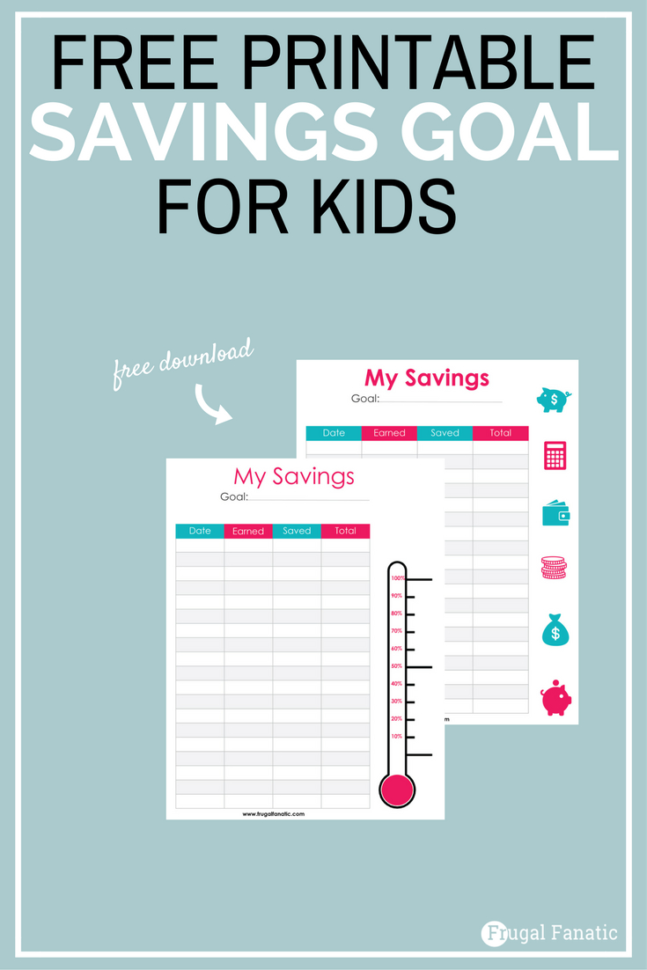

Sample for Savings Goal Tracker Spreadsheet