A good type of spreadsheet to use for your petty cash transfers is a petty cash spreadsheet. This type of spreadsheet is also known as a sales tax calculator. This type of spreadsheet can be used to calculate the amount of taxes you need to pay on your sales to figure out if you need to apply for an extension.

A petty cash spreadsheet is easy to use it does. You simply enter your transactions for your sales. The spreadsheet will automatically determine what kind of tax to apply to your sales. In addition, you can figure out whether you are paying your taxes early or late based on the date your receipt was received.

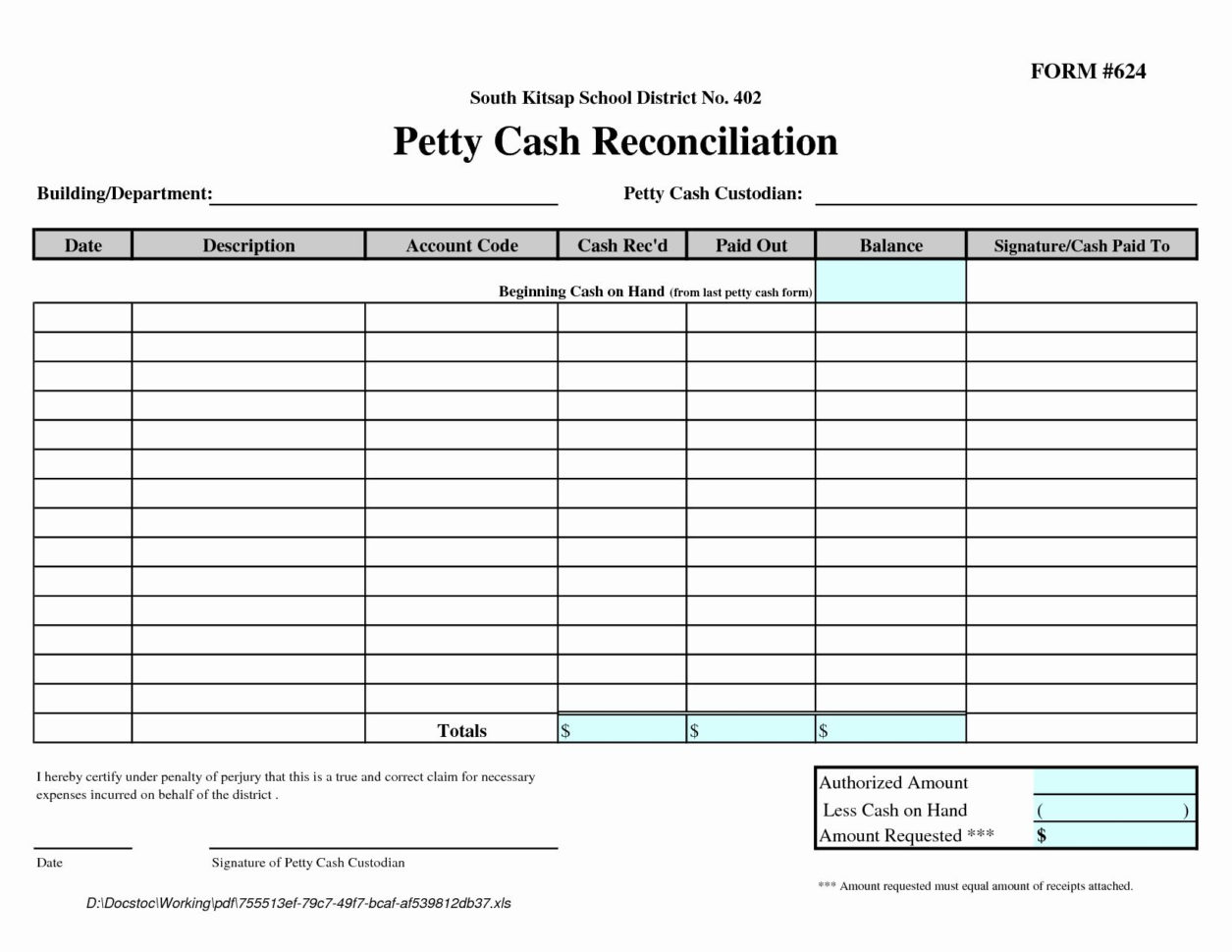

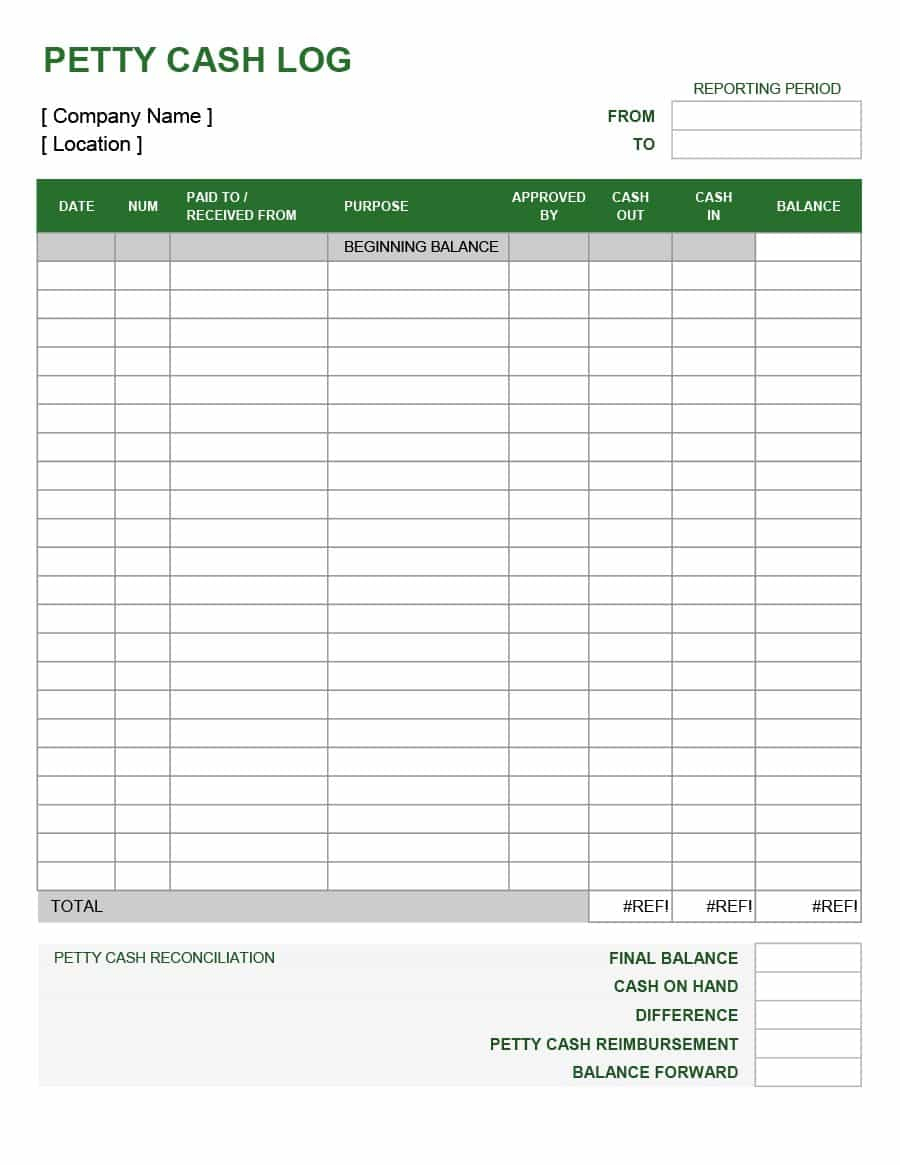

Petty Cash Sheets Example

A petty cash spreadsheet can also calculate your profit based on the date and amount of your sales. In addition, you can determine whether or not you are earning a profit. This feature is very handy because many small businesses fail and the owner must sell the business to make up for the tax debt. This can be frustrating and quite stressful.

The petty cash spreadsheet can be found online and a quick search for it will find a good number of companies that offer this type of service. However, not all of these companies are reliable. Some of them simply offer their service as a free download. You can also find websites that charge a fee for their services but do not actually offer any service.

Anytime you pay a fee for any type of service, the quality of the service you receive may not be of the same caliber as the service you would receive for a free petty cash spreadsheet. When you are asked to pay, you are making a commitment to the person or company offering the service. It is in their best interest to make sure their service is of the highest quality.

If you decide to go with a website that offers a free petty cash spreadsheet, be sure to read the terms and conditions of the service you are using. Many websites will have a money back guarantee in case you find their service to be of poor quality. They are also not going to claim that you get a service for free, because that would be false advertising.

If you decide to use a free petty cash spreadsheet, be sure to always double check its accuracy and completeness. The last thing you want is to find out that you have made a mistake on your spreadsheet. If it has errors, then you need to remove it and start from scratch.

Another area where you can save time and money by using a petty cash spreadsheet is to see how much money you need to spend on income taxes. The next time you file your taxes, you can use this service to determine if you need to file a late. For example, if you have a good number of sales but only a few dollars in profit, then you probably do not need to file a late. This is because your profit is small enough that you can easily pay the taxes without having to worry about the penalties.

A petty cash spreadsheet can also be used to see what kind of additional taxes you will be charged. This can be used to see what kind of tax forms you need to file and which ones you should skip. It is also helpful to determine whether or not you should file an extension for your tax return. Often times, people who are unsure of their state tax payments will skip certain forms.

A petty cash spreadsheet can also be used to get the best deal when it comes to filing your taxes. Do you have more than one office address? Then you can get the best deals when filing taxes when you have two addresses. You can use the spreadsheet to see which types of items you need to purchase at two different locations and then compare prices.

Another great use for a petty cash spreadsheet is when you need to see which tax types are applied in your area. You can do a search for each type of tax and then use the amount of taxes you need to pay as your input criteria. When you have your results, you can determine which type of tax you owe and then purchase the most appropriate form to apply. to your account. PLEASE READ : personal training excel spreadsheet

Sample for Petty Cash Spreadsheet Example

![Petty Cash Spreadsheet Example With 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab Petty Cash Spreadsheet Example With 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab](https://db-excel.com/wp-content/uploads/2019/01/petty-cash-spreadsheet-example-with-40-petty-cash-log-templates-forms-excel-pdf-word-template-lab-749x970.jpg)

![Petty Cash Spreadsheet Example Regarding 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab Petty Cash Spreadsheet Example Regarding 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab](https://db-excel.com/wp-content/uploads/2019/01/petty-cash-spreadsheet-example-regarding-40-petty-cash-log-templates-forms-excel-pdf-word-template-lab-749x970.jpg)

![Petty Cash Spreadsheet Example Regarding 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab Petty Cash Spreadsheet Example Regarding 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab]( https://db-excel.com/wp-content/uploads/2019/01/petty-cash-spreadsheet-example-regarding-40-petty-cash-log-templates-forms-excel-pdf-word-template-lab-118x118.jpg)

![Petty Cash Spreadsheet Example With 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab Petty Cash Spreadsheet Example With 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab]( https://db-excel.com/wp-content/uploads/2019/01/petty-cash-spreadsheet-example-with-40-petty-cash-log-templates-forms-excel-pdf-word-template-lab-118x118.jpg)

![Petty Cash Spreadsheet Example Regarding 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab Petty Cash Spreadsheet Example Regarding 40 Petty Cash Log Templates Forms [Excel, Pdf, Word] Template Lab]( https://db-excel.com/wp-content/uploads/2019/01/petty-cash-spreadsheet-example-regarding-40-petty-cash-log-templates-forms-excel-pdf-word-template-lab-1-118x118.jpg)