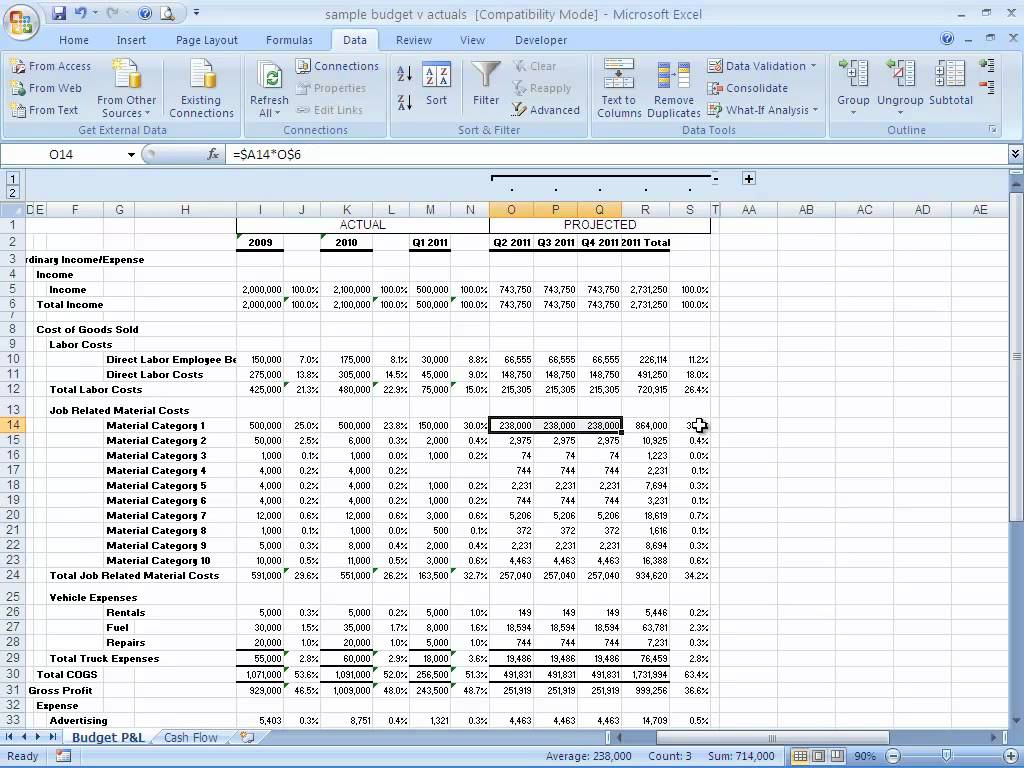

The spreadsheet comprises several worksheets. It may be seen on the FDIC website. It will also tell you just how much tax that you will pay on the property based on the budget tax changes, in particular Section 24 mortgage interest relief. There are lots of sorts of blank spreadsheet available online. Possessing a blank spreadsheet is currently simple with the help of template. The next downloadable spreadsheet has the template used to perform non-linear regression utilizing Microsoft Excel.

db-excel.com

Excel Spreadsheet Template