Category: Payment

Simple Cash Book Spreadsheet

Turtle Trading System Excel Spreadsheet

Due Diligence Spreadsheet

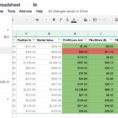

Capital Gains Tax Spreadsheet Shares

The Untold Story on Capital Gains Tax Spreadsheet Shares You Must Read At the close of the calendar year, you opt to sell your shares. It’s well worth weighing before you lock shares into the typical cost system. No issue here as you are able to determine the shares you’re…

Simplex D Account Book Spreadsheet

Most Noticeable Simplex D Account Book Spreadsheet Complex `nonstandard’ models are simple to specify. We’re impressed especially by the internet edition of RStudio, which appears to be a fantastic prospect for research advisors and IT-departments to bring custom made R-applications to their intranets without a lot of hand coding. They…