The Untold Story on Capital Gains Tax Spreadsheet Shares You Must Read

At the close of the calendar year, you opt to sell your shares. It’s well worth weighing before you lock shares into the typical cost system. No issue here as you are able to determine the shares you’re selling from the 10,000 you bought in your very first trade in 2007. So will the variety of lot IDs to pick from when you finally begin selling shares. If however, whoever passed away acquired the shares before 20 September 1985 then the man inheriting them is thought to have acquired the asset at the right time of death, or so the cost base is going to be the industry value of the shares then. In the event the shares are held for three or more years they’re CGT-free on disposal. The shares you get in the acquirer might actually become QSBS shares in your hands to the area of the gain at the right time of the transaction.

Using Capital Gains Tax Spreadsheet Shares

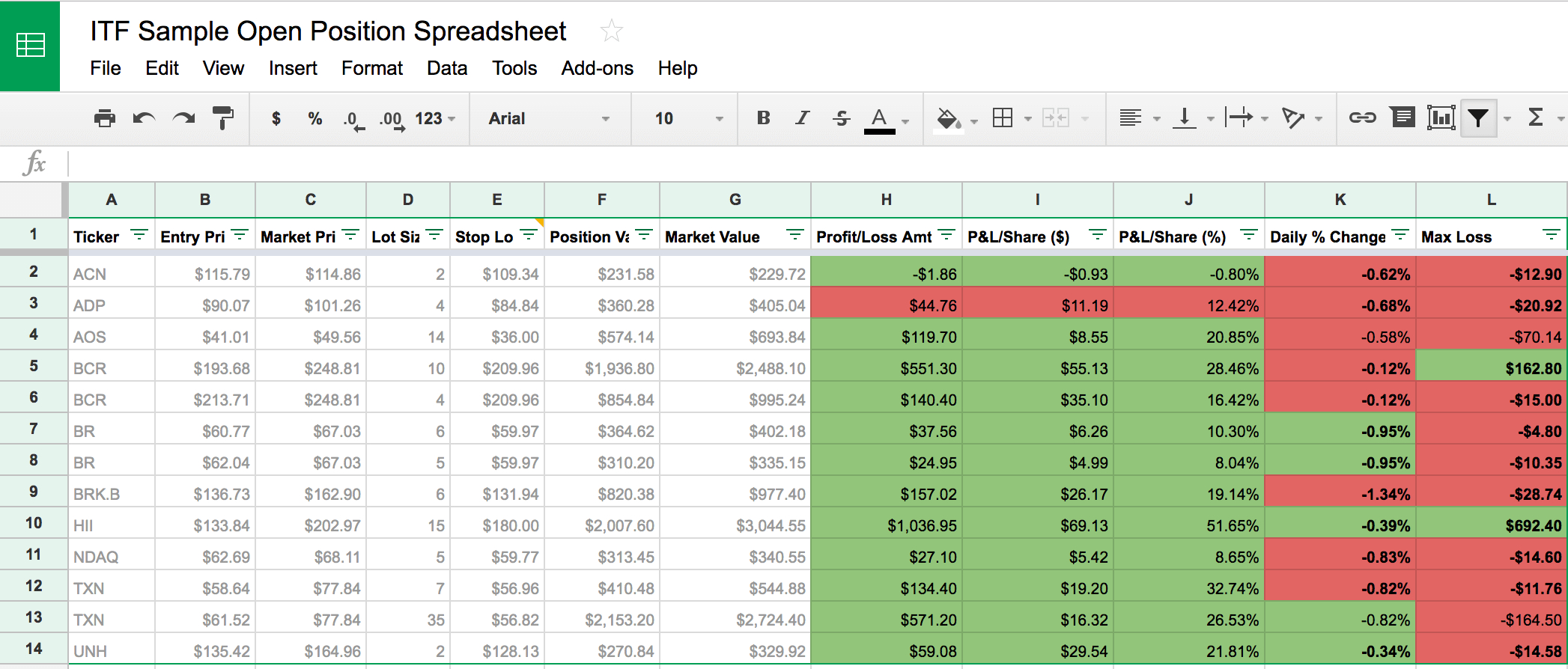

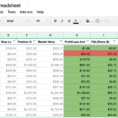

Tax calculation is a complex company and lots of serious investors leave this up to high-paid accountants. It’s possible that you name your spreadsheet all you desire. Should you want to use the spreadsheet, then you’ll want to click enable content. Oh, and be sure that you keep the spreadsheet updated! Whenever you’ve published your spreadsheet,… Should you would love to use the spreadsheet, then you should click empower content. Open the spreadsheet you’d like to publish.

The Unexpected Truth About Capital Gains Tax Spreadsheet Shares

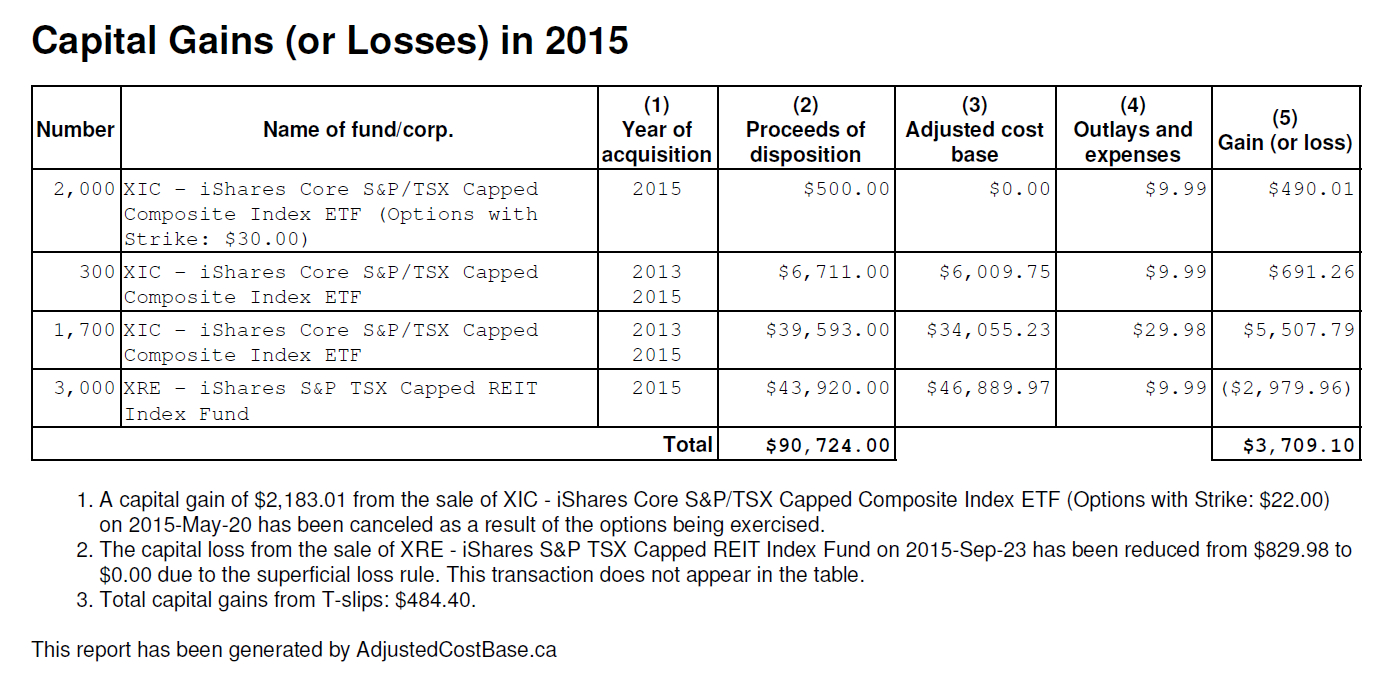

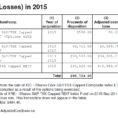

The gains are taxed twice cutting down the person’s after-tax proceeds. If you make a capital gain, it’s added to your assessable income and could significantly boost the tax you have to pay. Before claiming the reserve, make sure your capital gains are not eligible for an exemption. In order to know the worth of the reserve period, you should understand how the CRA calculates capital gains. Subtract that from the selling price and you have the capital gains. In the event you’re unable to invest total capital gains as above, you’ll get tax exemption only on invested amount. Long-term capital gains may also be gotten on both equity mutual funds in addition to debt mutual funds.

The Definitive Approach for Capital Gains Tax Spreadsheet Shares

Now you need to find out how much tax you owe. At that point you need to start considering taxes. Understanding ESPP income tax can be somewhat confusing occasionally. The sum you pay is dependent upon your earnings and the asset. Rather, the income from the selling of its assets passes through the shareholder, who’s accountable for paying taxes.

In the majority of instances, you don’t need to pay tax on any profit you made from selling your principal home. Capital Gains Tax (CGT) can find just a little complex occasionally, but using a small planning it’s possible to avoid paying it a lot of the moment. Sooner or later you ought to be paying tax on $5,000. Capital gains tax may often be complicated to estimate. Our capital gains tax is known as Vermogensrendementsheffing.

When an asset is held for at least 1 year, then any profit from the selling of the asset is regarded as a long-term capital gain. If it was held for greater than one year, it’s a long-term capital gain. The assets can subsequently be sold, tax free. When it has to do with assets such as shares or a home, it will get a bit more complicated.