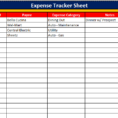

Business expense tracker template is usually created to look like an Excel spreadsheet. The template may use a menu bar, or add drag and drop functionality. The most important benefit is that it would help business owners make their budget, as well as manage business expenses. Once you are finished…

Category: Expense

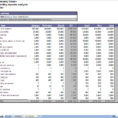

How To Track Expenses In Excel

The Hidden Secret of How To Track Expenses In Excel There are a number of different ways to keep an eye on your expenses and you ought to pick one which works for you. Contemplating the present economic environment, an individual may desire to better keep tabs on personal expenses….

Business Expense Tracker Excel

Simple Expense Form

When you buy a new home, you need to make a simple expense form for yourself. No matter how much you are getting into, it can still be very overwhelming. People seem to think that it is so easy when in reality, it is not as easy as you might…

Excel Expense Reports

Excel expense reports are designed to track expenses of business and personal individuals. It is the preferred accounting software for this purpose. However, with the advent of different forms of electronic expense report, Excel expense reports are replaced by other alternatives like PDFs, Excel spreadsheets and HTML spreadsheets. Though the…

Daily Expenses Tracker

The Debate Over Daily Expenses Tracker If you’re on the lookout for a simpler method of tracking your costs, you may use the Expense Tracking Log to track every cent of merely the surplus money after all your taxes, debts, and other necessaries are paid that you need to spend….