Bookkeeping Spreadsheet – A Powerful Tool to Keep Time and Organize Your Tasks A good bookkeeping spreadsheet is not only needed to run a small business but even for a larger business, as it helps in making record keeping easy. The purpose of the bookkeeping spreadsheet is to get things…

Category: Excel

Accounting Spreadsheet Templates Excel

Accounting Spreadsheets Excel

Accounts Receivable Excel Spreadsheet Template

What You Can Do About Balance Sheet Format in Excel with Formulas Beginning in the Next Seven Minutes Balance sheets are among the main financial statements for any business, big or little, startup or old. A Balance sheet is a snapshot of the firm’s fiscal position at a predetermined time….

Monthly Financial Planning

For many people, monthly financial planning is a vital tool for managing and maintaining their finances. Here are a few tips for starting the process and for making sure you have everything you need. Monthly financial planning can start with your budget. It will be based on your income and…

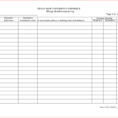

Reimbursement Sheet Template

A reimbursement sheet template is a detailed list of different types of business expense codes, and an overview of what they include. Once you get your accounting information down on paper, you can start compiling your own reimbursement sheets for each of your expenses. These are used to identify expenses…

Business Expense Tracking Software

The Low Down on Business Expense Tracking Software Exposed The Basics of Business Expense Tracking Software A time management system enables you to keep a tab on all the tasks which need to be completed immediately that lets you deliver on time which then enhances customer satisfaction level. It is…