For many people, monthly financial planning is a vital tool for managing and maintaining their finances. Here are a few tips for starting the process and for making sure you have everything you need.

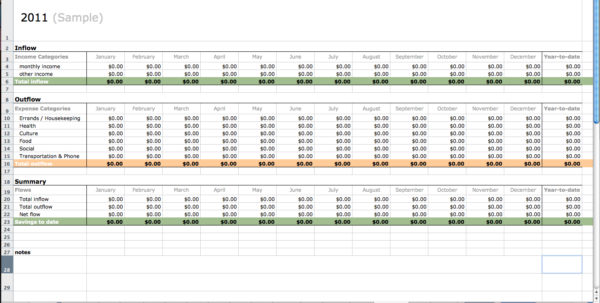

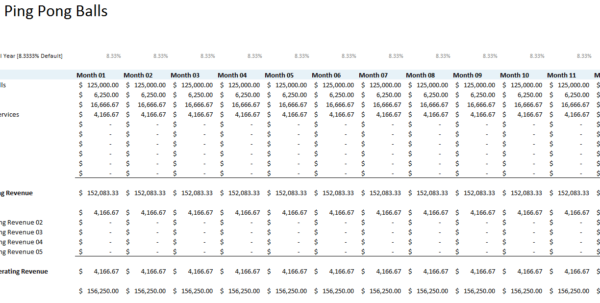

Monthly financial planning can start with your budget. It will be based on your income and expenses, as well as on your savings, credit card balances, investments, and your debts. There are several ways to figure out your budget. One is to use your income, and then subtract out all your expenses.

Another way to start your monthly financial planning is to set up a budget that fits into the ways you intend to pay your bills. There are many ways to do this. One is to use a spreadsheet or an online budgeting software program.

Things To Consider When Starting A Monthly Financial Planning Session

Monthly financial planning should include debt payments. You should consider your debt to equity ratio, the time that it will take you to pay off your debts, and your current debt to income ratio. If you have several loans, you might want to break them up and make one payment every month.

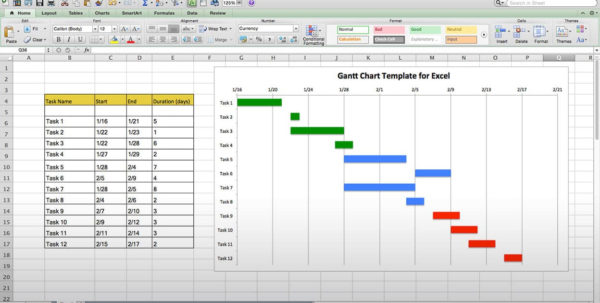

Monthly financial planning can be a very time consuming process. You should set aside a time each month for making your monthly budget. This should be a point in the day when you do not have to work to put food on the table, and your finances should not be another factor in your life. You should not have any conflicts about your finances and should not have to be worried about the future.

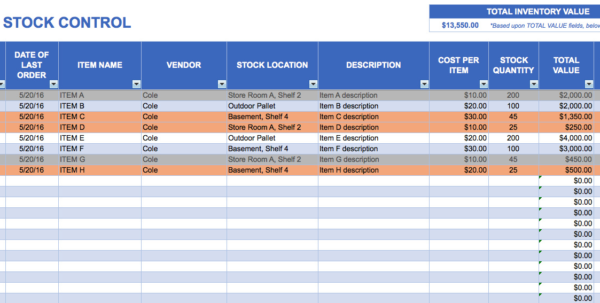

Monthly financial planning should also include stock ownership, bonds, mutual funds, and CDs. These are often used to manage retirement savings, but can also be used for your other financial goals.

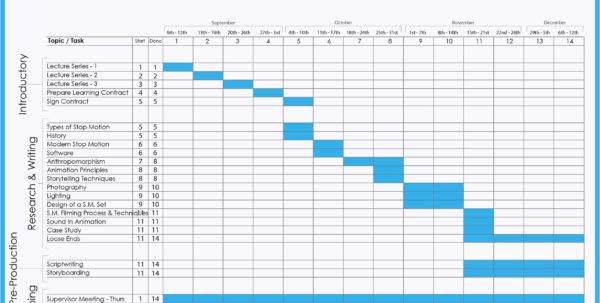

Financial planning can also include one more important step that is important for saving for the future: makingan annual report. This will give you an idea of where you are, and where you plan to go.

In this annual report, you should have something concrete to work towards your future goal. It can be small things like making your mortgage payment next month, or buying a vacation home. It can be large like working on lowering your monthly debt by paying off one of your credit cards.

Monthly financial planning can take some discipline. Many people start out with a dream, like owning a vacation home or a house. When it does not happen, they simply give up.

Financial planning should not be stressful. When starting out, it is very easy to get caught up in the details of how your budget works, and in all the details of your finances. However, this can be very time consuming and ultimately leads to serious stress.

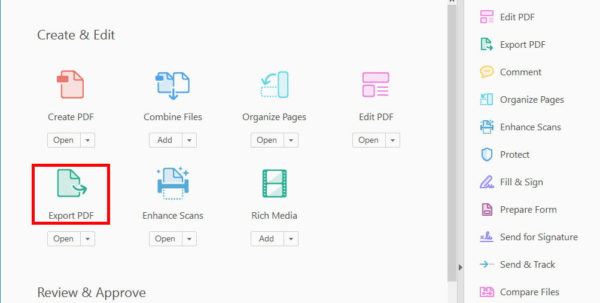

Learning about how to better manage your money through a monthly financial planning session will be the best investment for your finances. It is important to keep your budget balanced, have a large amount of savings, and look at investments to see if they are worth keeping. Learning how to use your time wisely and sticking to your financial goals can help you grow financially in the long run. YOU MUST SEE : microsoft invoice office templates