It’s time to create an Excel spreadsheet for loan repayments. You’ve been so busy paying your bills, keeping up with the mortgage and college loans that you haven’t had time to add all the extra expenses on your credit card bills. Although there are ways to add them to your spreadsheet, it is not something that should be done quickly because it is likely to be overlooked.

As with all other financial transactions, the exact process of entering the necessary figures into your spreadsheet depends on how you are going to use it. It’s okay to use it to track your expenses, but that is not the same as creating a spreadsheet to manage your payments. You should have some idea what is in your budget and how to calculate expenses when you’re looking to make any type of financial transaction, but creating a spreadsheet for loan repayments is different.

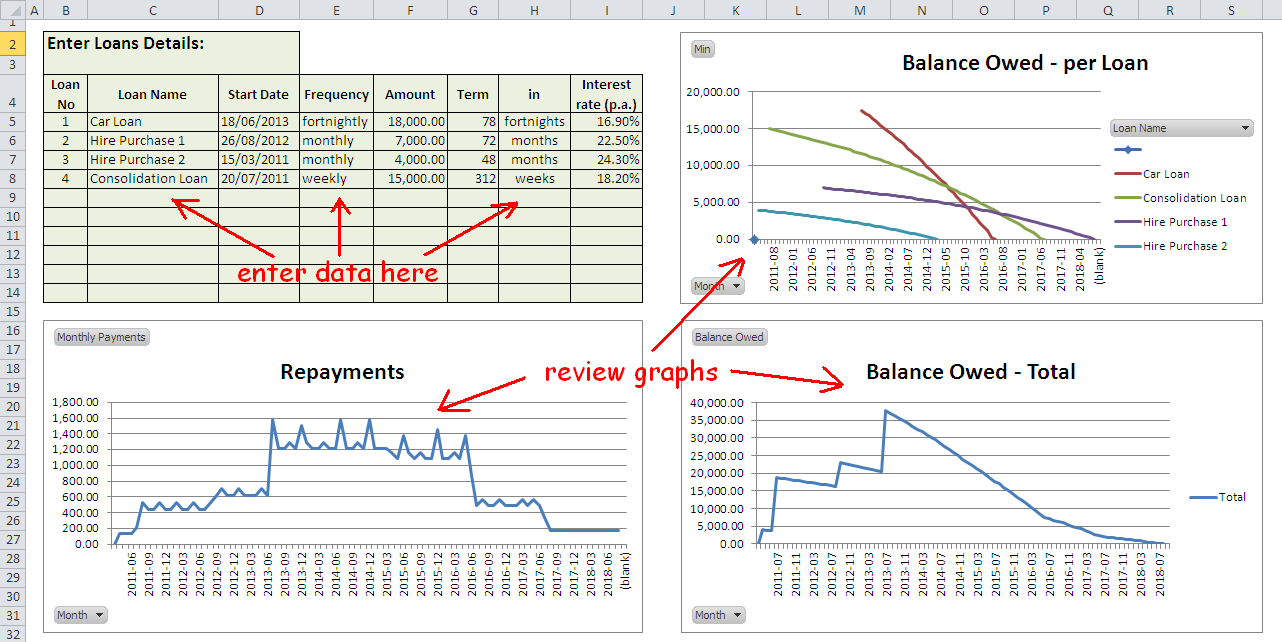

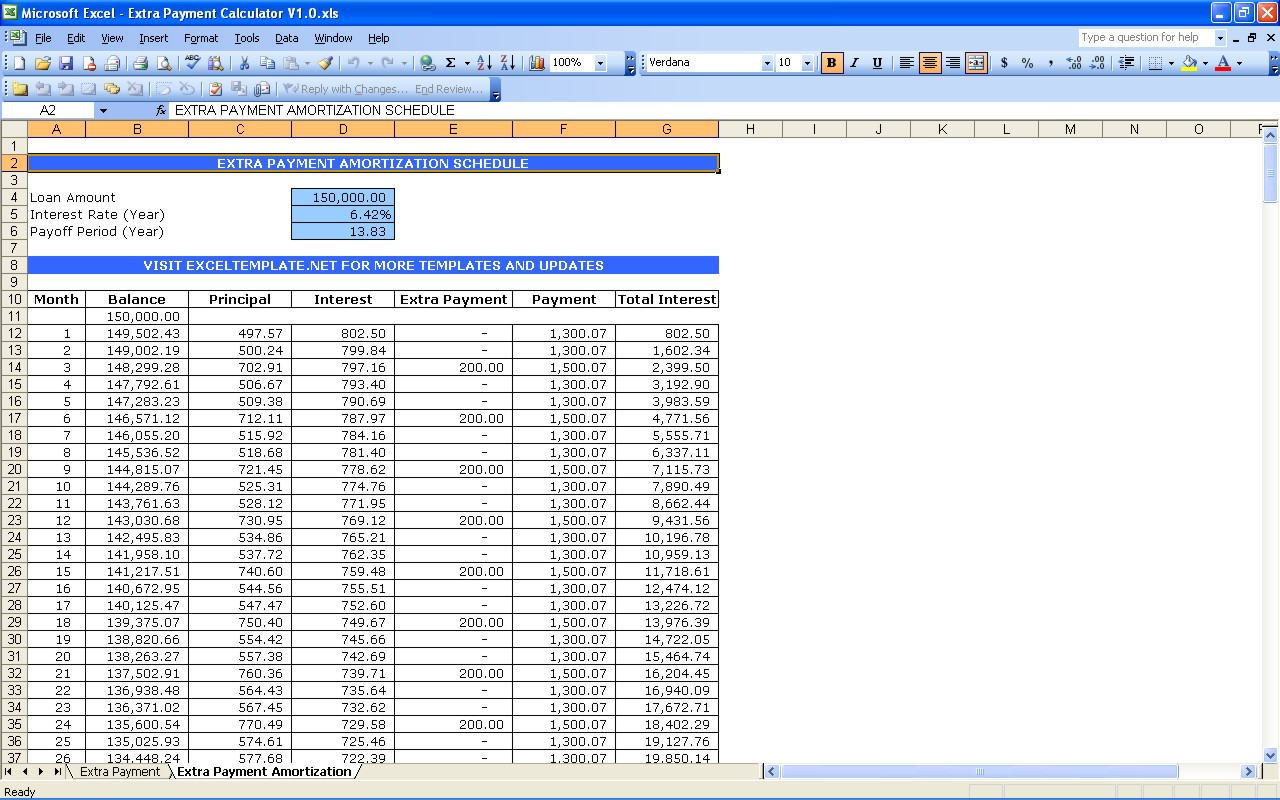

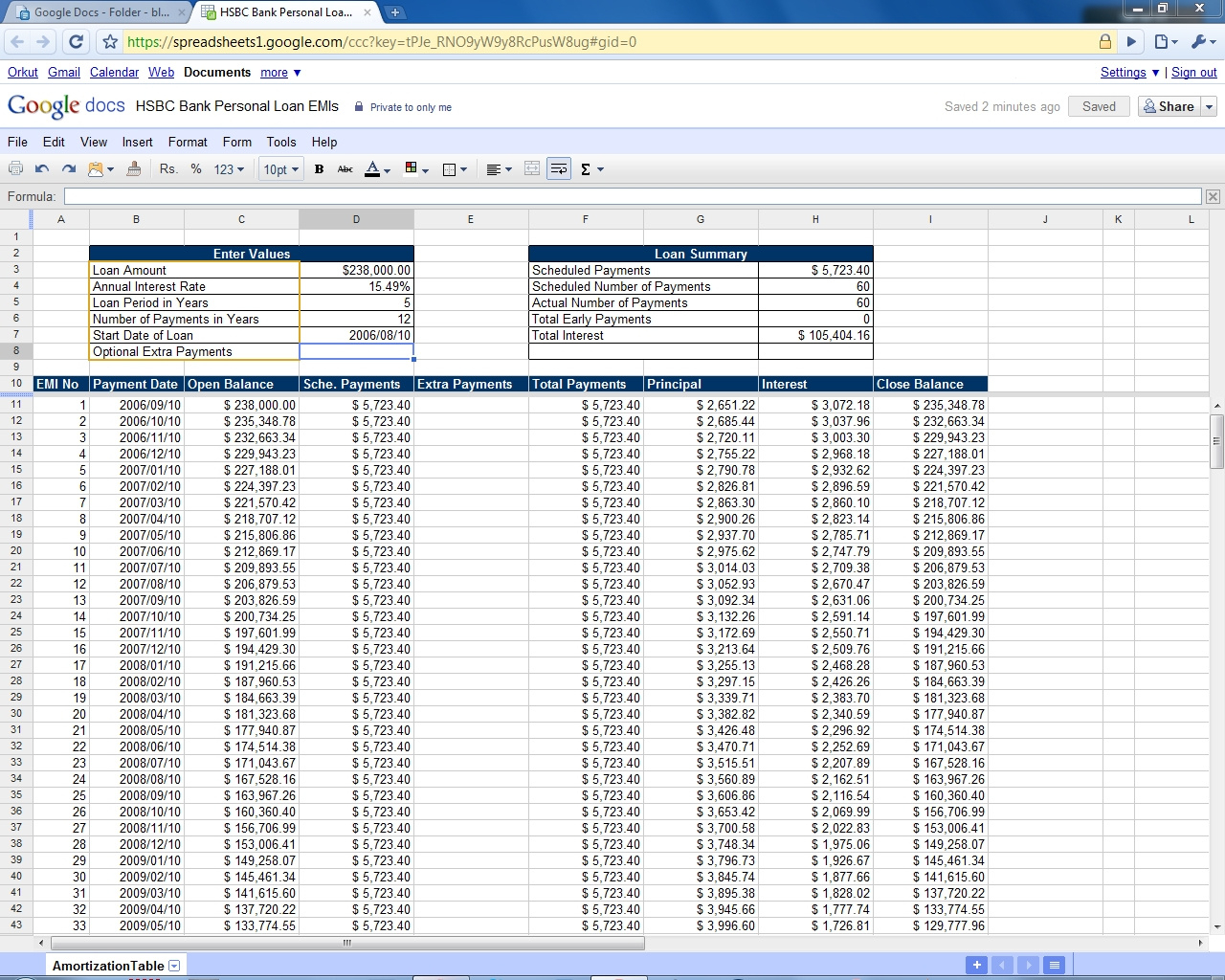

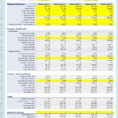

With loan repayments, your spreadsheet will be used to keep track of every single payment that you make on your house, car or other valuable assets. If you have a spreadsheet for car loans, you will be able to input your car expenses and calculate the amount you spend each month on your car. You can then input that information into your Excel spreadsheet to see how much you pay out each month on your car payments.

Excel Spreadsheet For Loan Repayments – How to Create a Spreadsheet for Loan Repayments

You might have several expenses on various income streams. It might take some effort, but when you’re working in Excel you are able to view them all at once and quickly assign an expense to a category. For example, if you have two types of expenses on your credit card balance, you can put the credit card spending on one line and the extra income you get from working.

After you’ve determined how much you have left after making payments on your credit cards, you can add up the amounts that are coming from this income. You can easily add that amount into your spreadsheet to see how much you spend monthly. When you’re looking to reduce your interest and save money on your car payments, this will help you figure out how much money you need to apply to your car payments.

When you’re looking to create a spreadsheet for loan repayments, you may be overwhelmed by the number of choices available. However, because it is your budget that will determine how your loan payments are calculated, you may want to change the formulas you are using. Look at several different formulas and select the one that will work best for you.

Most programs will require you to enter the necessary formulas. This may be another reason why you may find it easy to make mistakes and enter wrong information. On the other hand, if you are familiar with using Excel, you can simply copy and paste the formulas into your spreadsheet.

Once you have determined the formulas for your budget, you can start filling in the necessary information into your spreadsheet. Just as you would in your budget, make sure that you have the correct income and expense information before you begin. Keep tabs on your monthly income and expenditures in Excel and double check everything as you go.

As you make adjustments to your spreadsheet, make sure that you do it in a way that isn’t too drastic. A good method is to make only small changes and then leave the rest of the changes alone. If you don’t have the patience to make large adjustments, you can simply delete the rows and columns that need to be eliminated.

Remember that when you are working with financial transactions, it’s important to stay organized. Make a note of all the important dates for your budget and enter the necessary information into the spreadsheet. You’ll be able to keep track of everything that is happening with your finances and even use your spreadsheet to help you stay organized.

You might find that a financial transaction is causing you to gain more money than you need to. In that case, simply subtract the amount that you lost from your budget and enter the rest as your profit. You can do this for the expense of every expense and create a spreadsheet for loan repayments to look at again.

Creating a spreadsheet for loan repayments is not the most difficult task you will ever face. once you get used to the spreadsheet and charting your income and expenses. expenses, you’ll find that you can easily make the required adjustments to keep track of your finances. LOOK ALSO : excel spreadsheet for expenses

Sample for Excel Spreadsheet For Loan Repayments