Savings Account Spreadsheet – Overview

The very best and fastest way to eliminate a mortgage is to produce more payments. Perhaps you only want to pay off your student loans and have a nice retirement! Make certain it’s available even in the event you’ve only 1 in it, and check how frequently you can withdraw your cash. You’re able to rest easy knowing you have the cash to cover future expenses. Now you are aware of how much money you wish to spend on various items, the purpose is to make it as easy as possible to understand how much cash you’ve got available. As opposed to starting with creating a whole budget, you might decide to keep track of your spending so that you have a better feeling of where your hard-earned money is going every month.

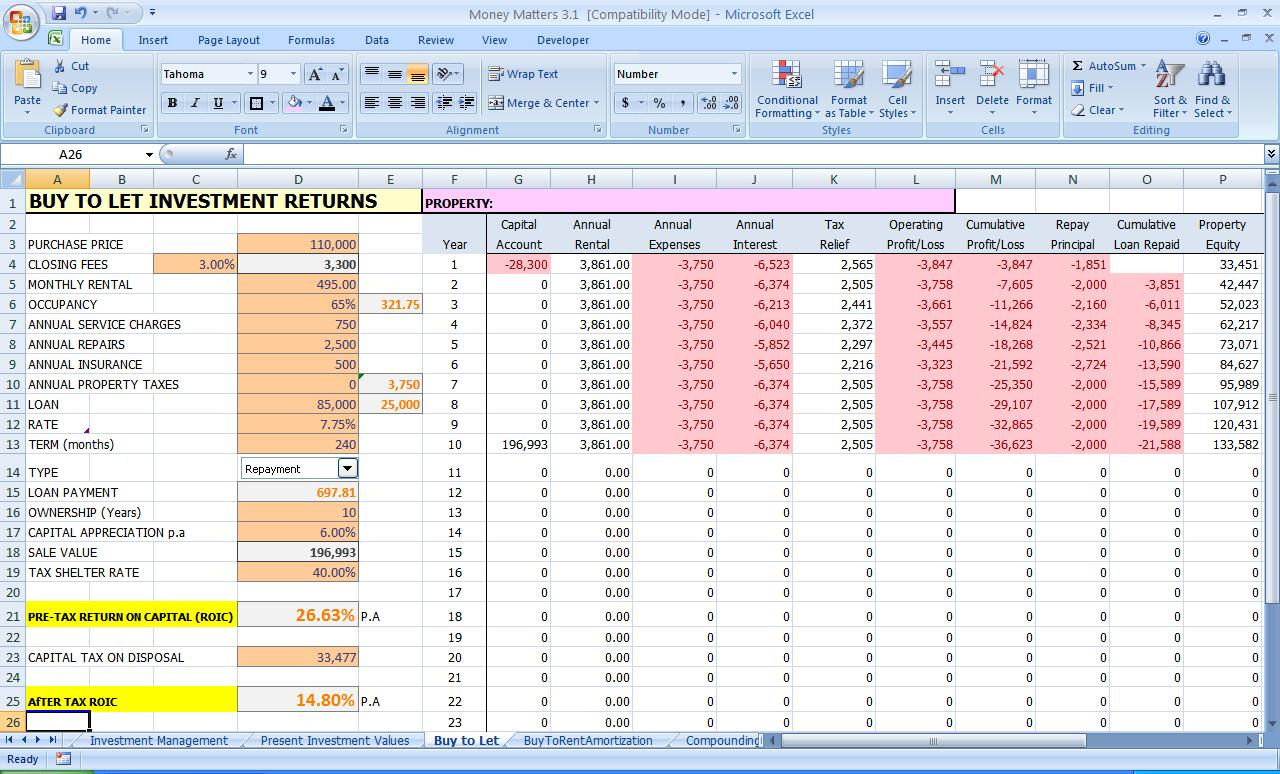

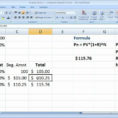

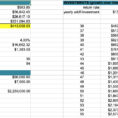

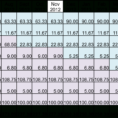

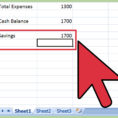

The Excel calculator makes it feasible that you simulate your saving at bank in various scenarios. The calculator is created in two scenarios. Our Savings Calculator is an absolutely free spreadsheet that’s easy to use and a lot more powerful than most online calculators you will find.

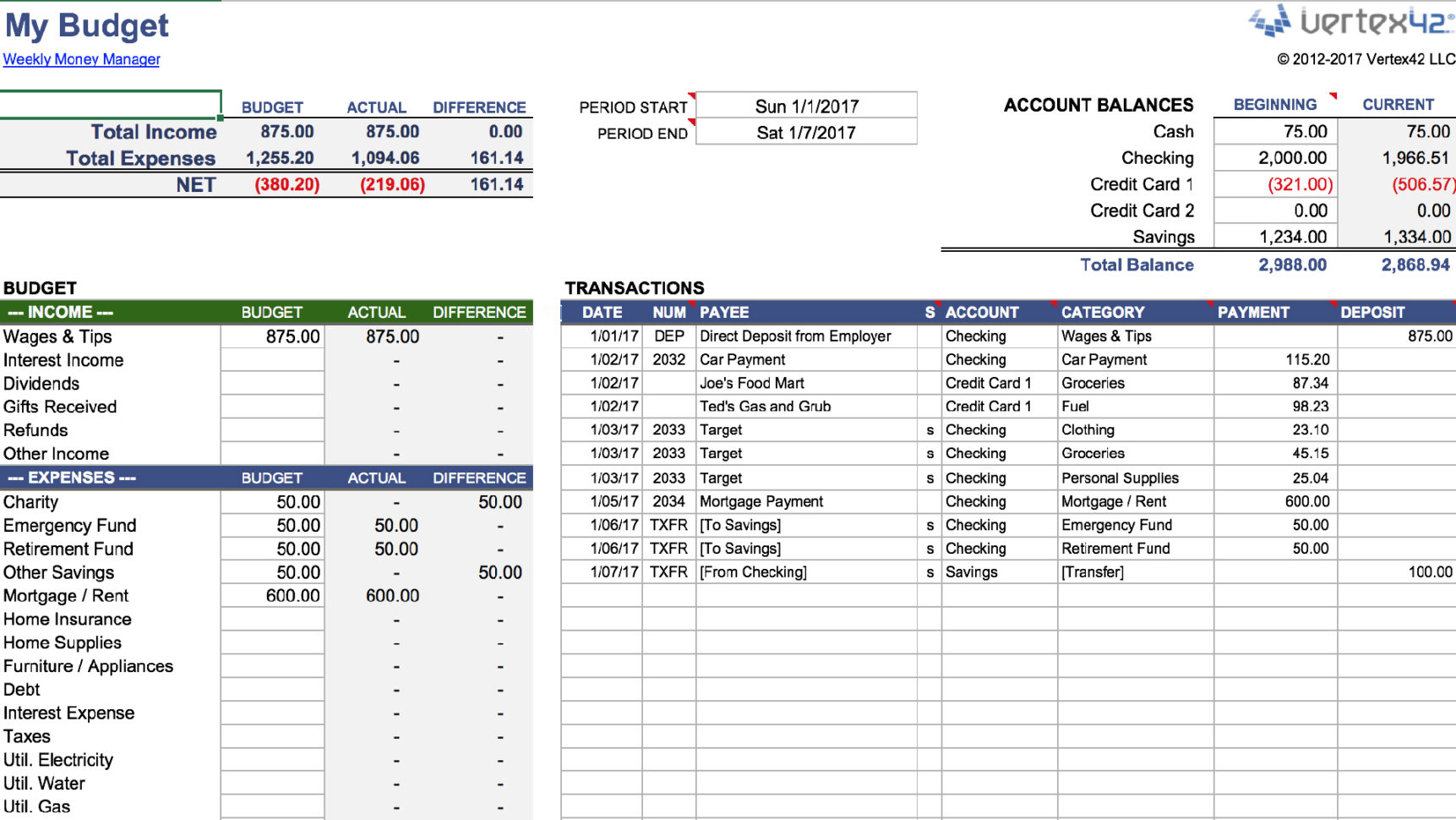

You can opt to have Calc save your spreadsheet automatically at fixed intervals. This spreadsheet is quite similar to one i used a couple of years ago. Spreadsheets can continue to keep a watch out for your favourite player stats or stats about the complete team. The spreadsheet consists of several worksheets. This spreadsheet is made for the little business proprietor, and permits you to thoroughly and meticulously take charge of your business’s finances. At this time you can produce a lot simpler spreadsheet if you want, or all you have to do is use an exercise book and pen, which is the way I tracked my savings for many years. If you’re comfortable with Excel, you may also use our Savings Calculator for a template and customize it to suit your very own personal circumstance.

What You Should Do to Find Out About Savings Account Spreadsheet Before You’re Left Behind

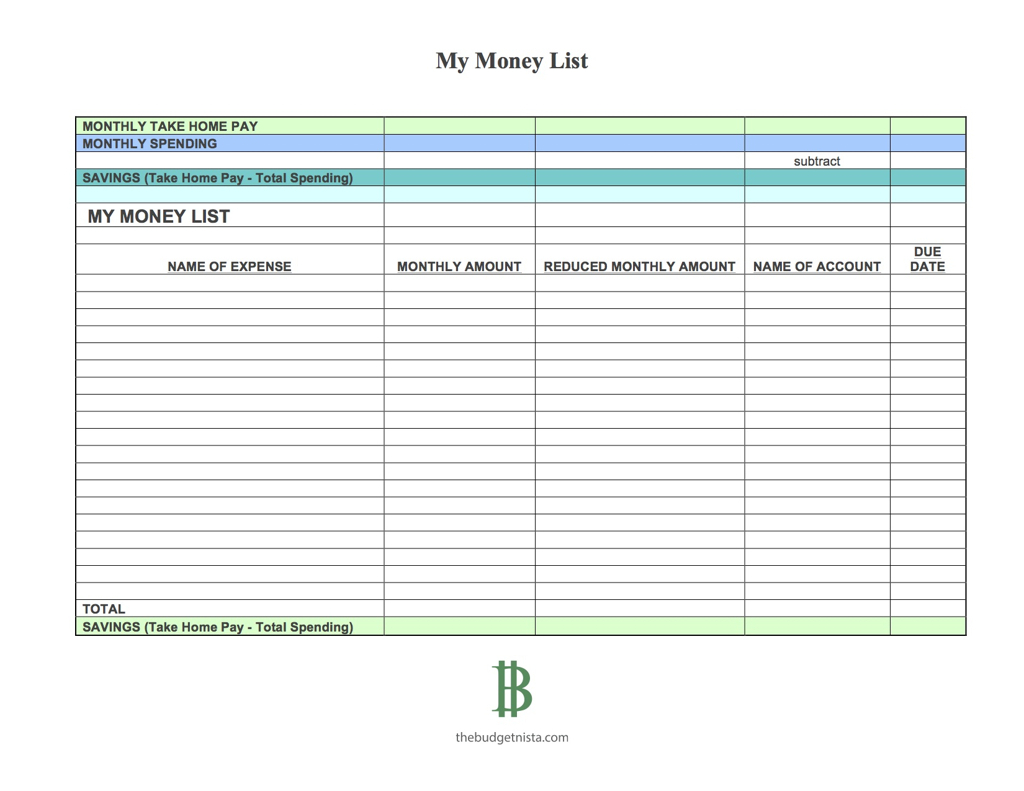

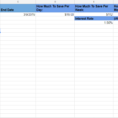

Just make sure you update your plan after you’ve reached an objective. If you decide on a wish to save a huge amount in a particular time period, there’s an opportunity you’ll fall short. Put in specific goals you need to save for. You’re all ready to achieve your savings goals. Financial goals that are many months away can be more difficult to achieve, and when you have a month or two with unexpected costs, you might have to pause your savings effort. Try to remember, retirement plans often provide tax advantages. Three unique options are show for mortgages too, permitting you to compare mortgage choices.

You want to earn saving as simple as possible. Don’t neglect to automate your savings and you will never look back. To find out more about how your savings plan fits together as part of a larger payday program, take a look at the Plan Save Thrive eCourse. Or you may use these suggestions to boost your savings in order to achieve your savings goals sooner. Would you like to keep track of your earnings and expenses incurred regularly. Try out the Annuity Calculator if you’re attempting to find out how much you may need at retirement.

What you will need is a savings program. Developing a savings program is a stress-free approach to handle your money. Before you may make a savings plan, you need to understand what you would like to save for and how much you should save.