Using a Bill Tracker spreadsheet is one of the best ways to stay in contact with your bills. However, you will want to make sure that you do it properly and have the right budget set up. Also, check out all of the different ways to keep track of your payments owed so that you don’t end up getting confused.

Each billing cycle there are different types of bills that you will have to pay. Your bills include: electric, gas, water, telephone, cable television, Internet, and phone. You may have some recurring bills as well. The billing cycle includes: the last month’s payment, the current month’s payment, and the next month’s payment.

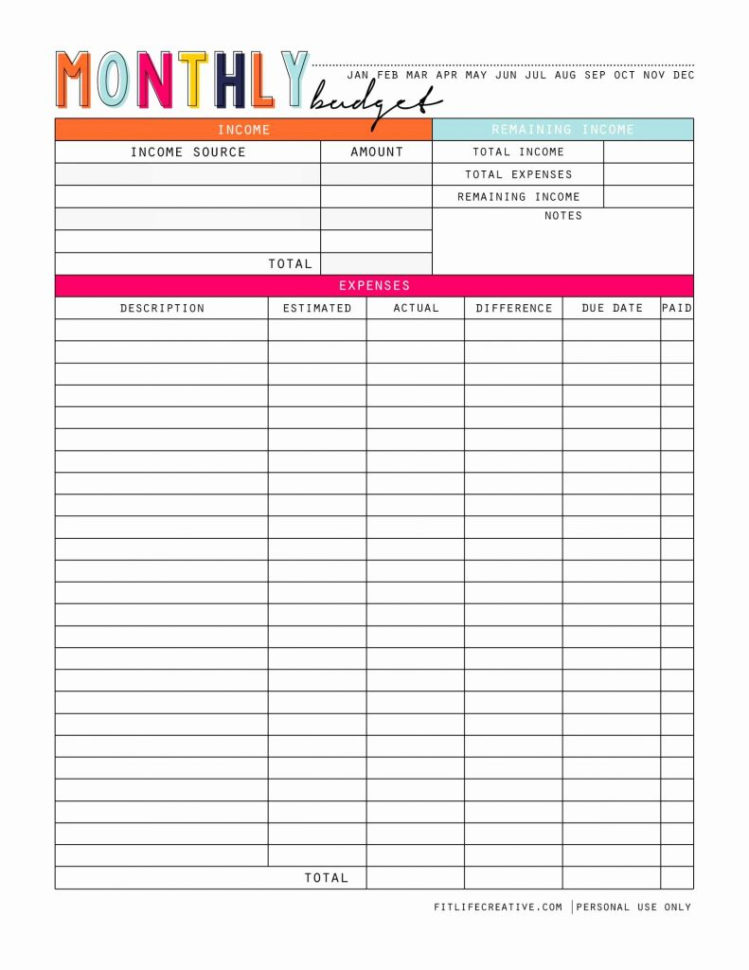

Your bill will usually start with the last month’s payment. Then, it will go on to the current month’s payment, and then the next month’s payment. So, in reality, your bill will show how much you owe. If you make changes to your plan, your new budget will reflect these changes. You must also add all of your recurring bills to your original budget so that you know how much you owe each month.

How to Use a Bill Tracker Spreadsheet

Keeping a Bill Tracker spreadsheet can be done through several different ways. These include:

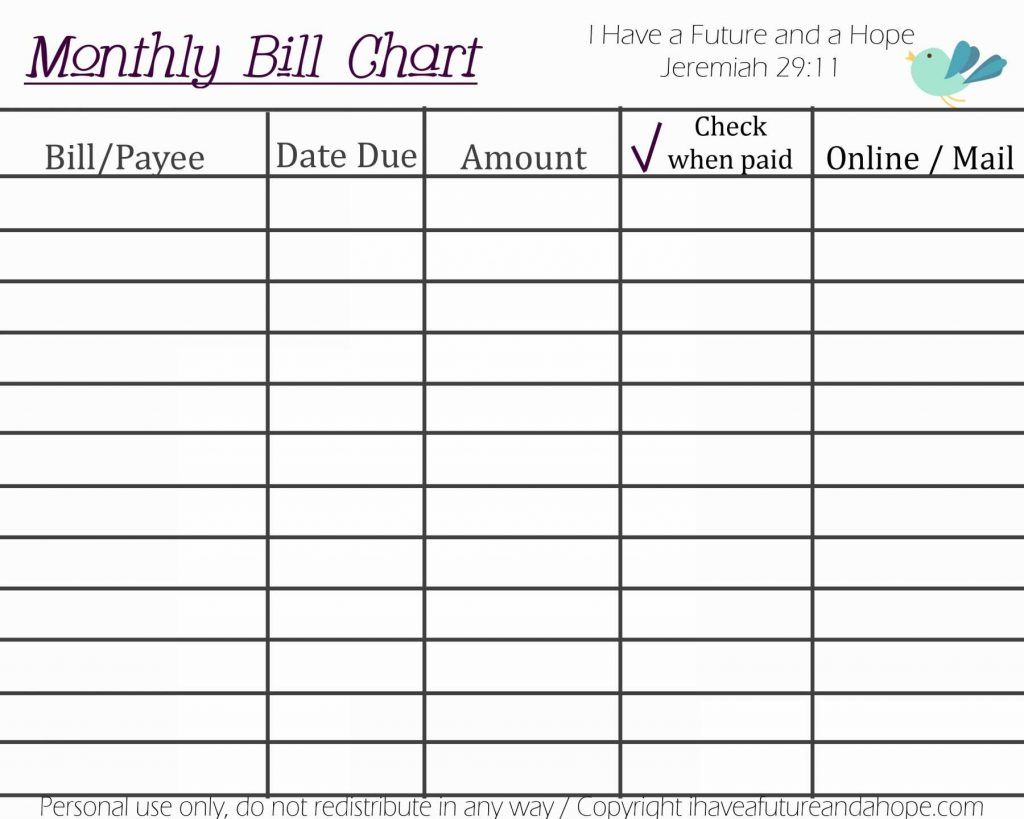

Using the Internet – Darlene Scott uses her computer to keep track of her bills. She checks off all the bills she receives, including bills that have been paid. This allows her to spend more time with her family.

Using a separate form of mail – some people send out a postcard or notice from their insurance company to everyone in their household. These letters will include a bill tracker form that has the total amount due. They will also explain how they can pay.

Collecting the bills – Darlene Scott tries to find all of the bills she has to pay. She even checks each box to see what the bill was. She keeps all of the bills she collects in one spreadsheet so that she can keep track of her debts.

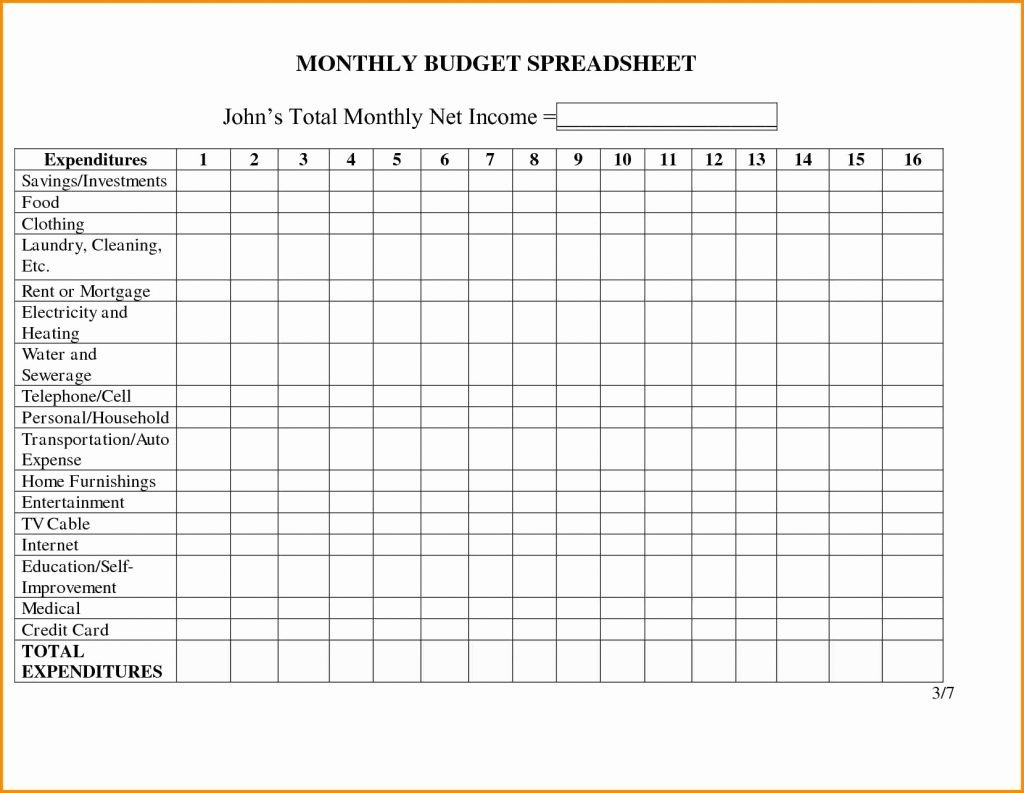

Tracking the bills yourself – some people decide to do it themselves, but they often get a headache when trying to track their money. Instead, they put together a chart, make a list of the monthly payments, and write down the bills they owe each month. This allows them to track their money at home and keeps them from spending.

Using an automatic bill tracker software program – some people find it difficult to make changes on their own. To make this easier, they use an automatic bill tracker program. These programs automatically track your expenses and debts, so that you don’t have to worry about making changes.

Workbooks – you can also use worksheets to keep track of your finances. These programs can help you track all of your bills by using images to show how much money you have each month. This helps you determine whether or not you need to change your budget or make a big purchase to save money.

Remember, however, that you will always want to take the best route for you. Each person will have to keep track of their financial situation differently, so be sure to take care of your finances in the best way possible! YOU MUST READ : bill spreadsheet example

Sample for Bill Tracker Spreadsheet