A reimbursement sheet template is a detailed list of different types of business expense codes, and an overview of what they include. Once you get your accounting information down on paper, you can start compiling your own reimbursement sheets for each of your expenses. These are used to identify expenses…

Category: 1 Update

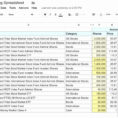

Uber Mileage Spreadsheet

How to Choose Uber Mileage Spreadsheet Tracking your mileage is a bit more straightforward. You should figure out the mileage that you drive from your house, to your very first passenger of the day. Make certain you track the mileage also. You will have to record the mileage for business…

Cybersecurity Assessment Tool Spreadsheet

While there are several cybersecurity assessment tools to choose from, it is worth your time to choose a specific software for the job. It can be a daunting task, but you will feel much more comfortable and accomplished if you stick with the right tool. Here are some guidelines that…

Business Expense Tracking Software

The Low Down on Business Expense Tracking Software Exposed The Basics of Business Expense Tracking Software A time management system enables you to keep a tab on all the tasks which need to be completed immediately that lets you deliver on time which then enhances customer satisfaction level. It is…

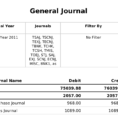

Accounting Journal Template

The Little-Known Secrets to Accounting Journal Template 3 The New Fuss About Accounting Journal Template 3 If you’re a professional and knowledgeable account, it is simple to create an overall journal in MS excel program but an unfamiliar person might fail to do so due to insufficient understanding of the…

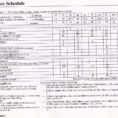

Car Shopping Spreadsheet

Ideas, Formulas and Shortcuts for Car Shopping Spreadsheet The spreadsheet is quite basic and may probably be made better by another Lifehacker readers, but I believe it may help some men and women who only don’t know the best places to start. On purchase you’ll be in a position to…

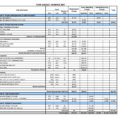

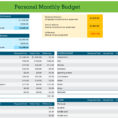

Daily Budget Excel Spreadsheet

Creating a daily budget is an important decision for any family, but it can be much more difficult if you’re not sure how to get started. It’s not as difficult as it looks! So, to help you out, I’m going to show you how to create a daily budget in…