The Good, the Bad and Whole Life Insurance Spreadsheet

A great deal of life can occur in 20 decades. For all of us, there are lots of explanations for why whole life ought to be avoided. So if you’re thinking of a complete life, now’s the opportunity to take action. In truth, it looks like the only folks who say whole life is a very good idea are… Insurance Agents. From a pure insurance policy standpoint, whole life isn’t beneficial for the great majority of young men and women. Whole life has become the most well-known and simplest type of permanent life insurance. Whole life, he stated, was the exact same way.

What is Truly Going on with Whole Life Insurance Spreadsheet

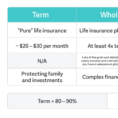

If you own a term policy and die within the period, your beneficiaries get the payout. Term life policies are great once you want a huge quantity of insurance but don’t have enough money to pay the bigger premium of whole life (permanent) insurance. They expire after a certain number of years, but can be renewed for another term. Though a term life insurance plan is totally free to cancel, a whole life insurance policy contract may have surrender charges during the early decades, and you might not get all your cash value back in the event you choose to cancel.

Have a look at life insurance quotes to locate a policy that meets your needs. Some whole life policies may also earn annual dividends, a part of the insurer’s fiscal surplus. They are typically very expensive and easily cost 10X or more than what you would pay for a comparable term life insurance policy. If you are in possession of a whole life policy, you should definitely produce the switch to a term life insurance policy program. Whole life policies are extremely inflexible as it relates to your premium payments, and compared to conventional investments, you could also think that it’s inflexible, as you don’t have any choice in the way in which the money is invested. Whole life insurance policies are slightly flexible in how payments can be created into them, and with the way the policy can be managed.

Whole Life Insurance Spreadsheet: No Longer a Mystery

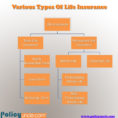

Press CALCULATE, and you’ll receive a dollar amount for your life insurance requirements. Whole life insurance can actually guard your finances even though you remain alive. There are many kinds of whole life insurance on the marketplace. It provides coverage for the life of the insured.

Life insurance was made to care for your family’s immediate and future needs. When you purchase life insurance, you essentially provide your family members with a security net. In an ideal world, you will be young and healthy when buying life insurance. Whole life insurance is an investment as well as the death benefit it offers. It does not have a term. Because it has so many features and options in addition to the death benefit, it is extremely important to understand the illustration fully before entering into a whole life insurance contract.

Term life insurance is extremely easy. It provides life insurance coverage for a specific amount of time. It provides coverage for a certain time period. It is the easiest to understand and has the lowest prices. It is clearly the most affordable and the most suitable form of life insurance for the majority of Americans. It is the most basic form of life insurance because it pays death benefits only.

What You Need to Know About Whole Life Insurance Spreadsheet

There are particular benefits and disadvantages to tapping the money from your life insurance, but in a few situations, it might be the best option under the conditions. In addition, it gives the advantage of accumulating cash values. The death benefit of a complete life insurance policy policy is typically a set quantity of the policy contract. There are advantages and drawbacks to creating a life insurance policy ladder.

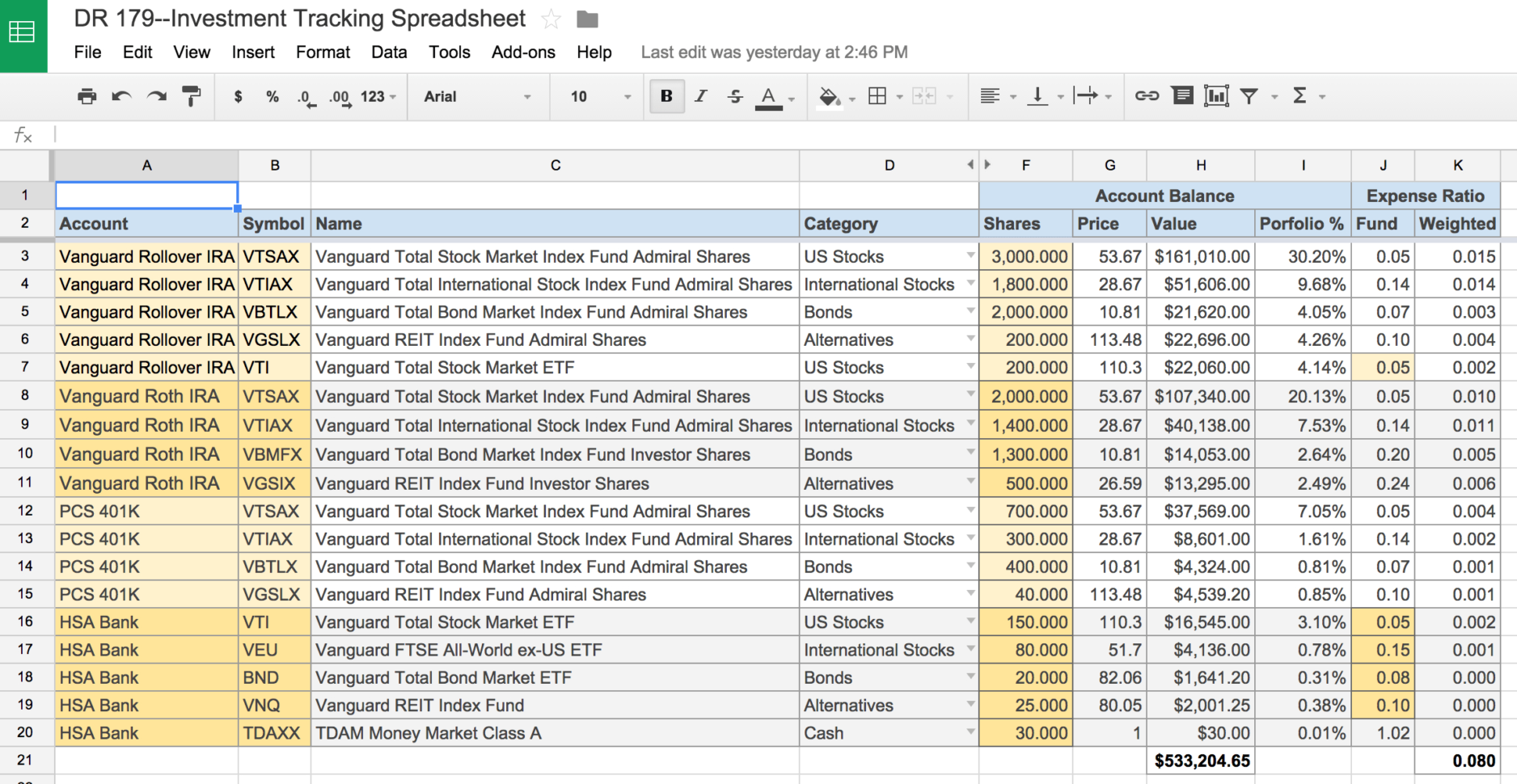

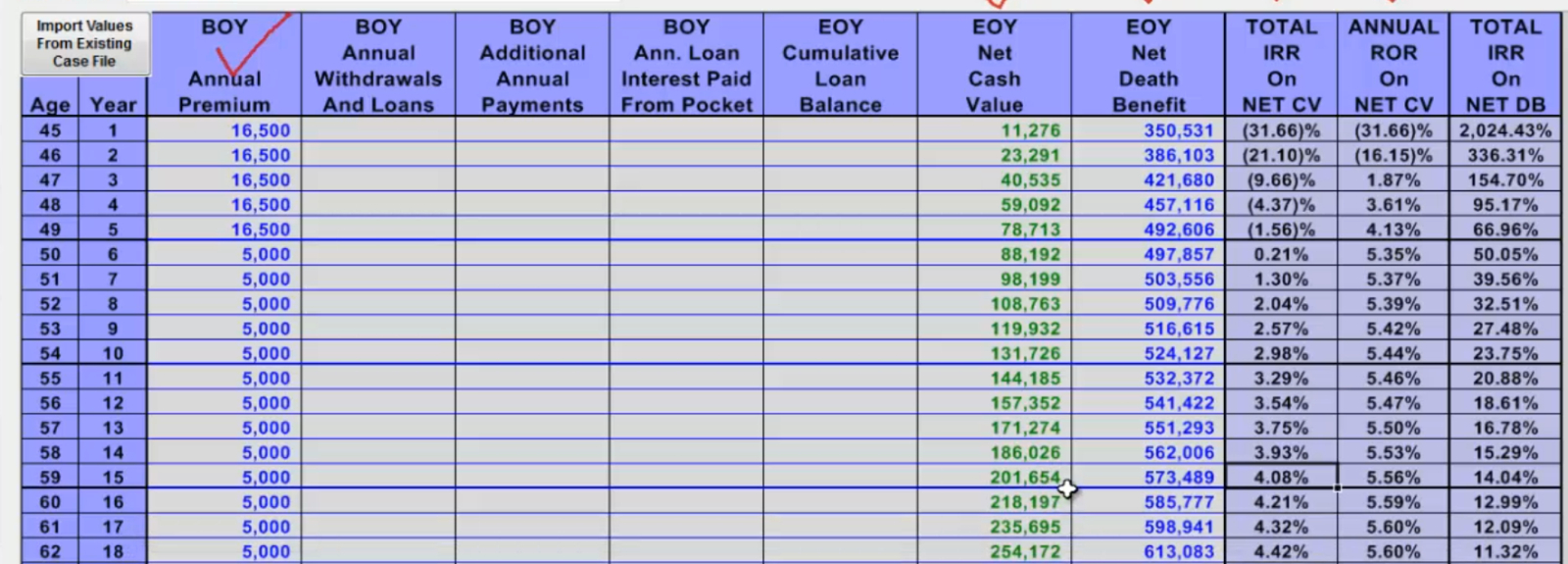

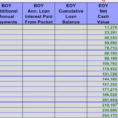

There are much more productive and profitable strategies to commit your money than using your life insurance policy program. In some instances, it is possible to even borrow money against the policy as well based on the circumstances. There are just two ways to find money out of an entire life insurance plan. If you get a great deal of money, have already maxed out all your tax-deferred savings, and you may afford to front-load your policy with large payments in the very first several decades, it can provide much better returns than was discussed above. Possessing the right amount of life insurance policy coverage is among the most important facets of financial planning. There’s the price of the insurance. Not only does this show the yearly price tag of your insurance, but the illustration includes a whole lot of projections regarding your upcoming cash value and death benefit.

Sample for Whole Life Insurance Spreadsheet

![Whole Life Insurance Spreadsheet Inside Term Vs. Whole Life Insurance Cost Cash Value [Calculator] Whole Life Insurance Spreadsheet Inside Term Vs. Whole Life Insurance Cost Cash Value [Calculator]]( https://db-excel.com/wp-content/uploads/2019/01/whole-life-insurance-spreadsheet-inside-term-vs-whole-life-insurance-cost-cash-value-calculator-118x118.png)