Who Else Is Misleading Us About Vat Spreadsheet?

To start with, you must ready the spreadsheet in Google Apps. The spreadsheet has a lot of worksheets. Making your initial standard spreadsheet isn’t an intricate undertaking whatsoever. Microsoft Excel spreadsheets and Access tables both provide a structure to store data in one set or in a number of sets.

Characteristics of Vat Spreadsheet

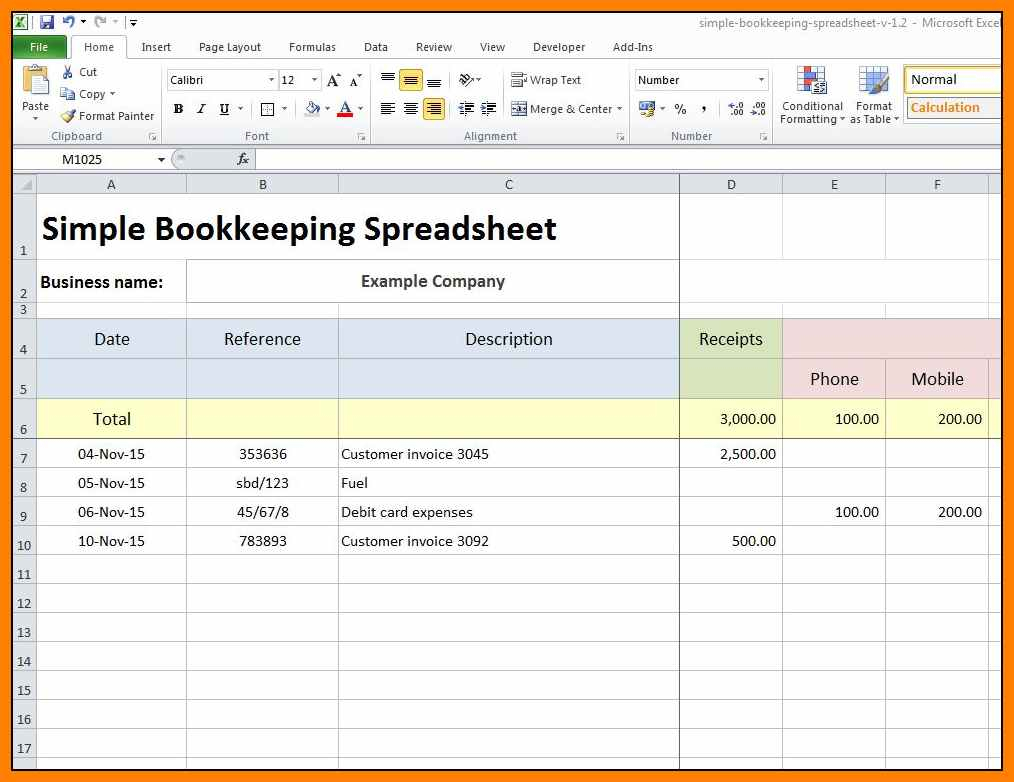

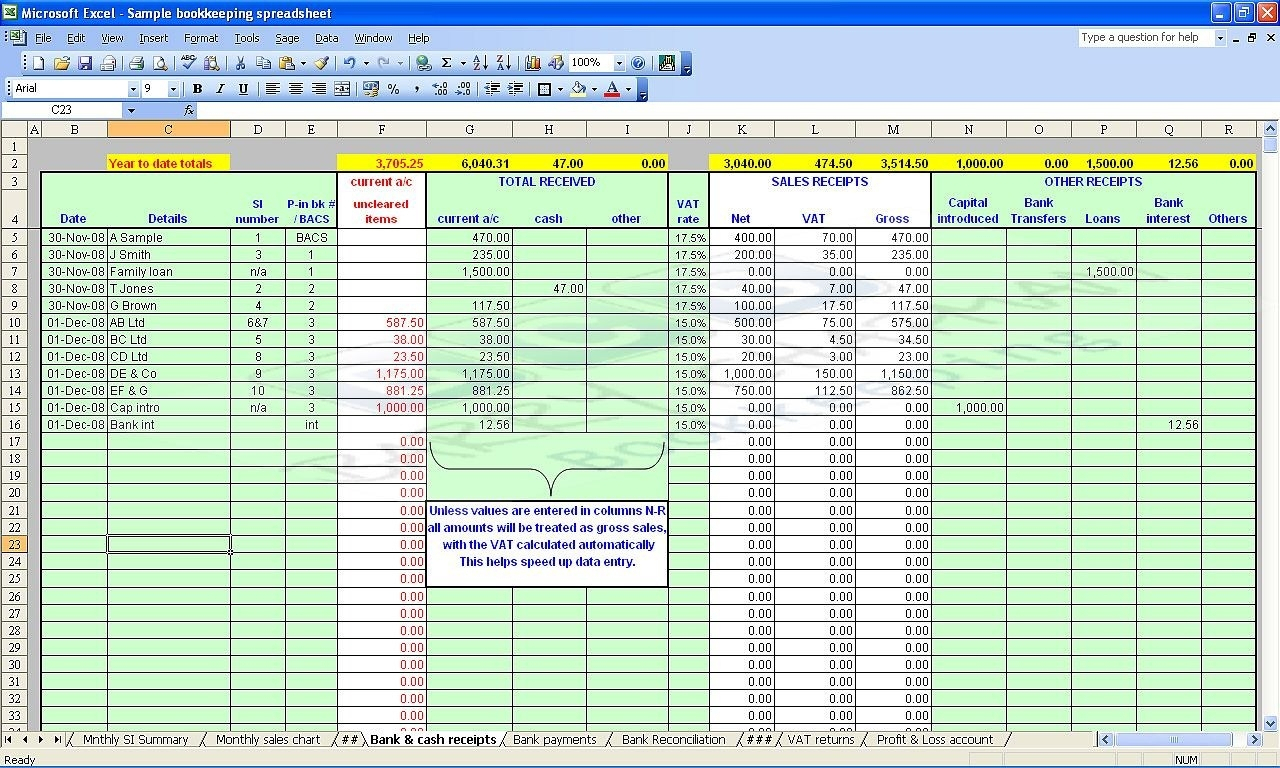

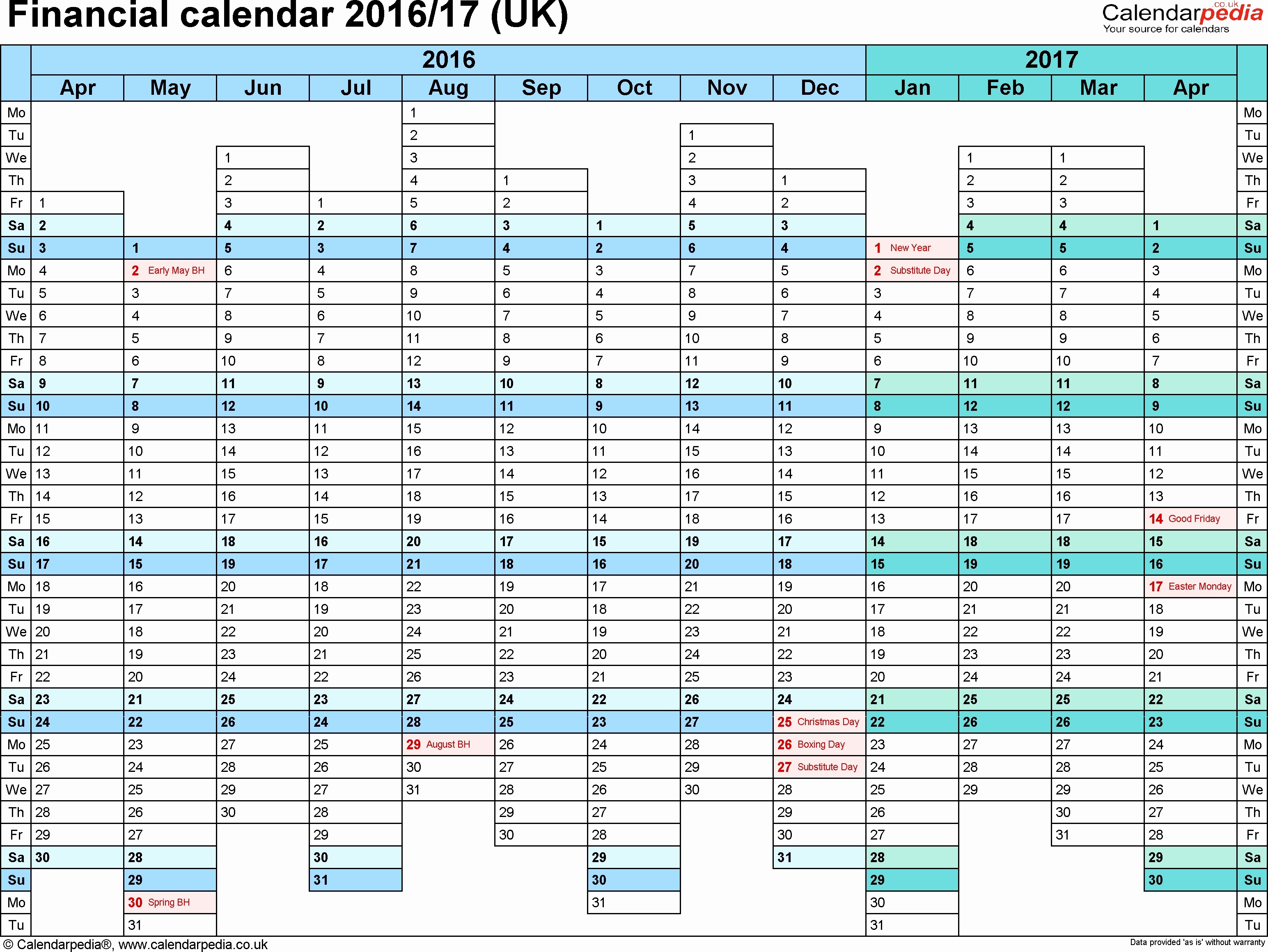

Microsoft Excel is composed of worksheets. Microsoft Office Excel 2010 is an excellent choice to create a fundamental balance sheet. So you’ve got what it requires to build spreadsheets that others would discover useful. Links to any present spreadsheets you might already be using or spreadsheets exported from accounting packages that aren’t MTD compatible. The totally free spreadsheet is readily readily available for download here. In addition, a new spreadsheet ought to be started each VAT quarter, so the column totals (pink figures at the peak of each column) end up showing the correct totals for each VAT return. Simple spreadsheets you may set up using applications like Microsoft Excel can help you keep on top of it all.

Making the jump from traditional small business methods to digital has come in smallish steps through the years. Ordinary small business records may be the foundation for your VAT records. Or in the start, you find it possible to create easy spreadsheet record to keep a watch out for your expenditures and income. You have to keep complete, up-to-date VAT records that let you work out the suitable quantity of VAT to contain in your VAT returns.

Lets you know whenever you have successfully submitted to HMRC, or if it’s been rejected. Without a mileage log of this kind, HMRC could challenge the company motoring expenses claimed. Furthermore, HMRC believes that if businesses see what tax they must pay every quarter, even in case they don’t pay it, they are more inclined to keep aside money for this tax, not spend that, so businesses which have a history of paying late, don’t do so in future. Do not neglect to register for Making Tax Digital with the HMRC otherwise you won’t be in a position to file.

The crucial portion of running a business is to make sure your company is profitable. Businesses which are not registered for VAT do not have to keep VAT records. If you want to find more information regarding bookkeeping services or the way to use our spreadsheet don’t hesitate to get in touch with us. It is vital that you check to your existing software provider to understand if they’re likely to be providing MTD compatible software.

Our software has a lot of different choices and can run on a great deal of unique computers. The program provides an array of reports that may be printed for your records. It’s possible additionally to select custom-made software that may be used with your little small business practice. that you’ve got compatible software. The computer software will request that you reconcile the info by matching payments to invoices, and categorising expenses so that it’s simple to get VAT-exempt expenses right. Our software makes it possible to take advantage of that. It’s spreadsheet software that might help you enter, track and analyze an enormous amount of information.

The Vat Spreadsheet Cover Up

You have to choose the Buy Now option and cannot get a 30-day trial. In order to get the discount you want to pick the Buy Now option and won’t obtain the free 30 days trial offer. Offer may not be combined with any other QuickBooks Online offers. Bulk-pricing discount offer is valid only if you’re registering for over one QuickBooks Online subscription with each purchase. It cannot be combined with any other QuickBooks Online offers, such as the MoveMyBooks service. If you are searching for Vat Spreadsheet Template Uk you’ve come to the correct location. If you don’t have a PayPal account you will get a choice to pay by debit or credit card.

How an organisation approaches the choice of MTD compatible software will ride on their present level of technology maturity and their enterprise model. As a consequence, all organisations will want to contemplate how they are going to stay competitive later on. Organisations which are already making extensive use of information technology will want to make certain that their software supplier will give MTD compatible versions of the applications they may use. There’s also recognition that the comprehensive set of digital records needed to meet MTD for VAT do not need to be kept all in one area or all in 1 format. HMRC state that the debut of MTD for VAT is meant to lower the possibility of errors in VAT returns and to offer a modern-day digital experience. The intricacy of calculating a number of the adjustments required under VAT law was recognised. Data analytics will end up the most effective and powerful way of future tax auditing.