How to Choose Uber Mileage Spreadsheet

Tracking your mileage is a bit more straightforward. You should figure out the mileage that you drive from your house, to your very first passenger of the day. Make certain you track the mileage also. You will have to record the mileage for business trips from your small business location to your organization destination and back to your company.

Using Uber Mileage Spreadsheet

If you would rather use an app, take a look at an app such as QuickBooks Self-Employed. You should search for an app that leads to significant savings, and is effectively able to cover itself over a sensible time. Both apps make a mileage log you could use if you’re audited by the IRS. As stated earlier, some apps utilize GPS tracking even though others connect to the Bluetooth in your vehicle. The apps use the international positioning system (GPS) to track the distance you’ve traveled, together with other parameters, and supply you with a report for the trip. The app encompasses mileage tracking together with expense deductions so that it adds up all your possible deductions. All you have to do is turn on the app and begin the tracking mechanism.

The Debate Over Uber Mileage Spreadsheet

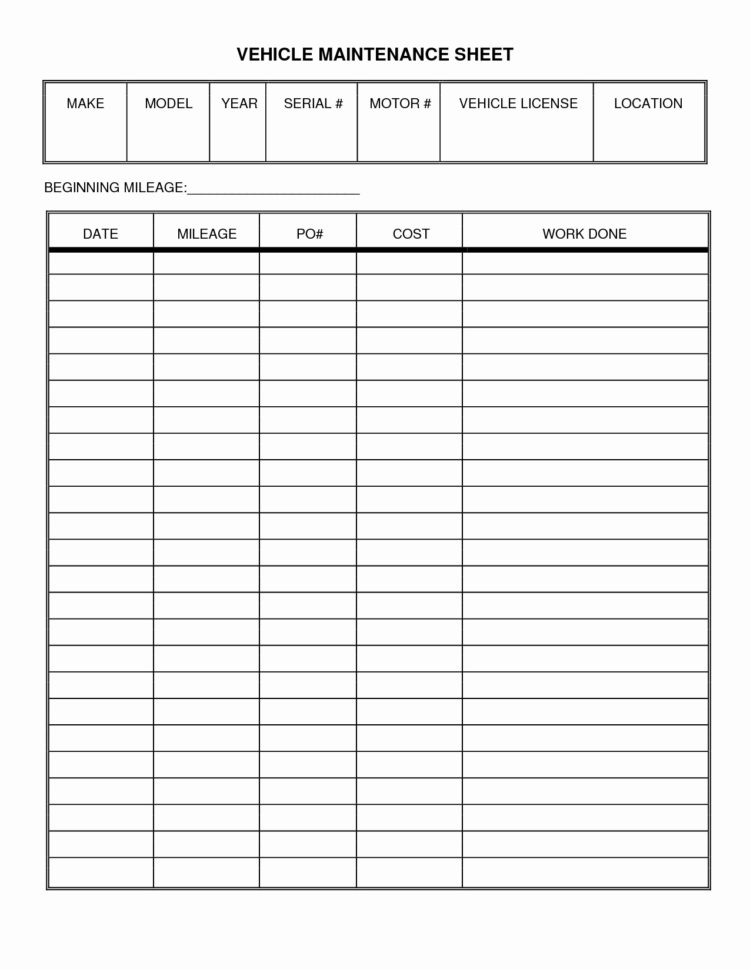

Just don’t forget to include amazing notes on each and every drive that you enhance your mileage log, and keep track of all your supporting documents like Uber trip logs. If you need a mileage log or are watching out for how to earn a Mileage log, the ideal place to find one is online. A You will be lucky to earn a mileage log by next calendar year! Producing your own Mileage log can be quite time-consuming and tiring.

Facts, Fiction and Uber Mileage Spreadsheet

Generally, you can just claim the deduction if you use your own personal vehicle for your organization, medical, or charitable purposes. Along with the items listed previously may be able to take different deductions, for items like car mats and air fresheners, provided that you’re using them for business. You wish to have a deduction for it. Some individuals think that they can choose the deduction should they use their commuting time to earn business calls or listen to business-related recordings. You’ll receive the tax deduction you have earned with almost no effort. You might be able to claim a bigger tax deduction with actual vehicle and truck expenditures, particularly if you drive a costly vehicle (by claiming vehicle depreciation), or in case you paid a lot for auto upkeep.

The other method to deduct mileage is by way of a proportion of actual expenses from business use of the motor vehicle. Your on-trip mileage functions as the minimum mileage you could deduct. If you would like to keep it simple, standard mileage might be best. If you locate your complete deductible mileage for a single month, and can show that you drove about precisely the same amount monthly, then you are able to apply your typical monthly mileage to the remainder of the year.

Uber Mileage Spreadsheet

Spreadsheets might even be utilized to earn tournament brackets. A spreadsheet can improve your accuracy. You will notice adownloadable spreadsheet reportusing an internet browser. You may observe adownloadable spreadsheet reportusing a web-based browser.

The Tried and True Method for Uber Mileage Spreadsheet in Step by Step Detail

Templates are made to make your life simpler. Available Templates pane Thumbnail pictures of the templates it’s possible to choose from appear in the middle. The template will also aid you to figure the volume you’re owed. Excel templates may also help you to produce and permit you to look your finest. Microsoft Excel templates are a part of Excel experience and a great means to conserve time.

Sample for Uber Mileage Spreadsheet