The Tried and True Method for Uber Driver Profit Spreadsheet in Step by Step Detail

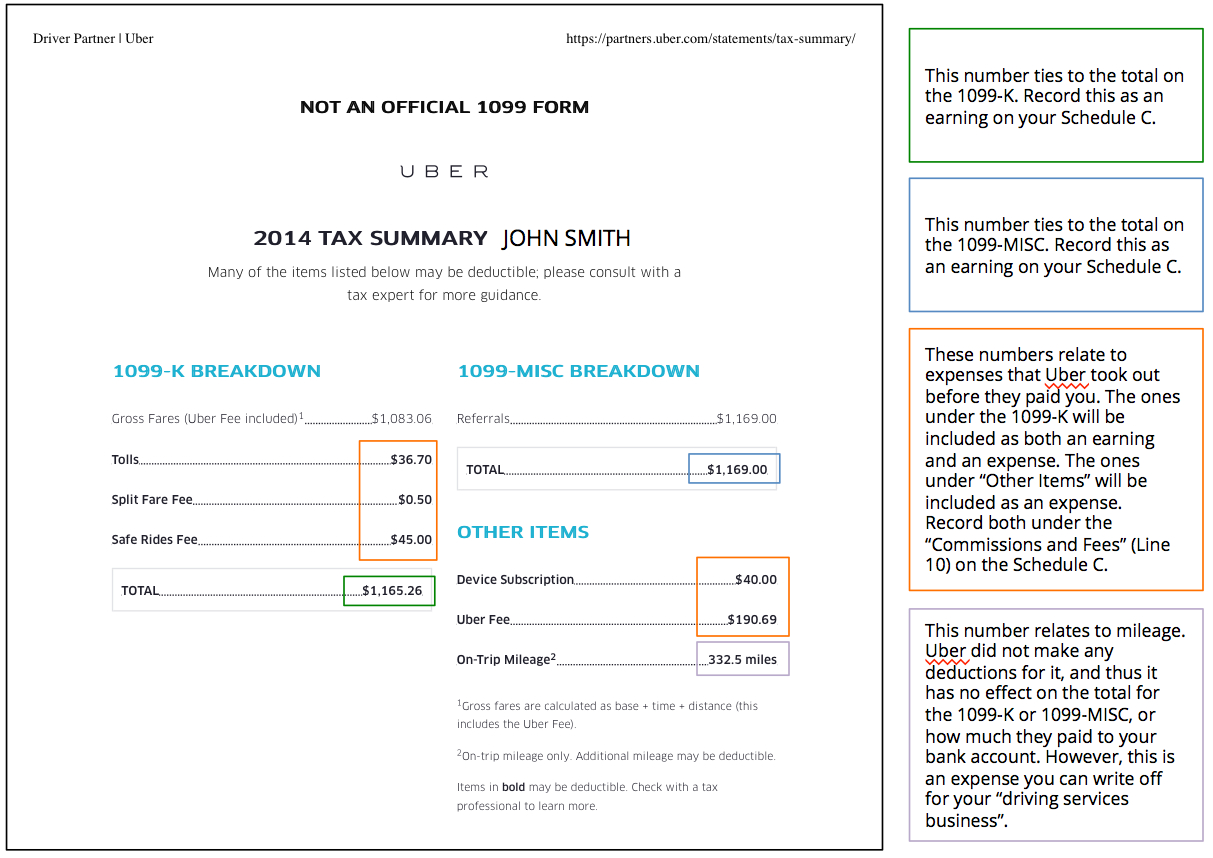

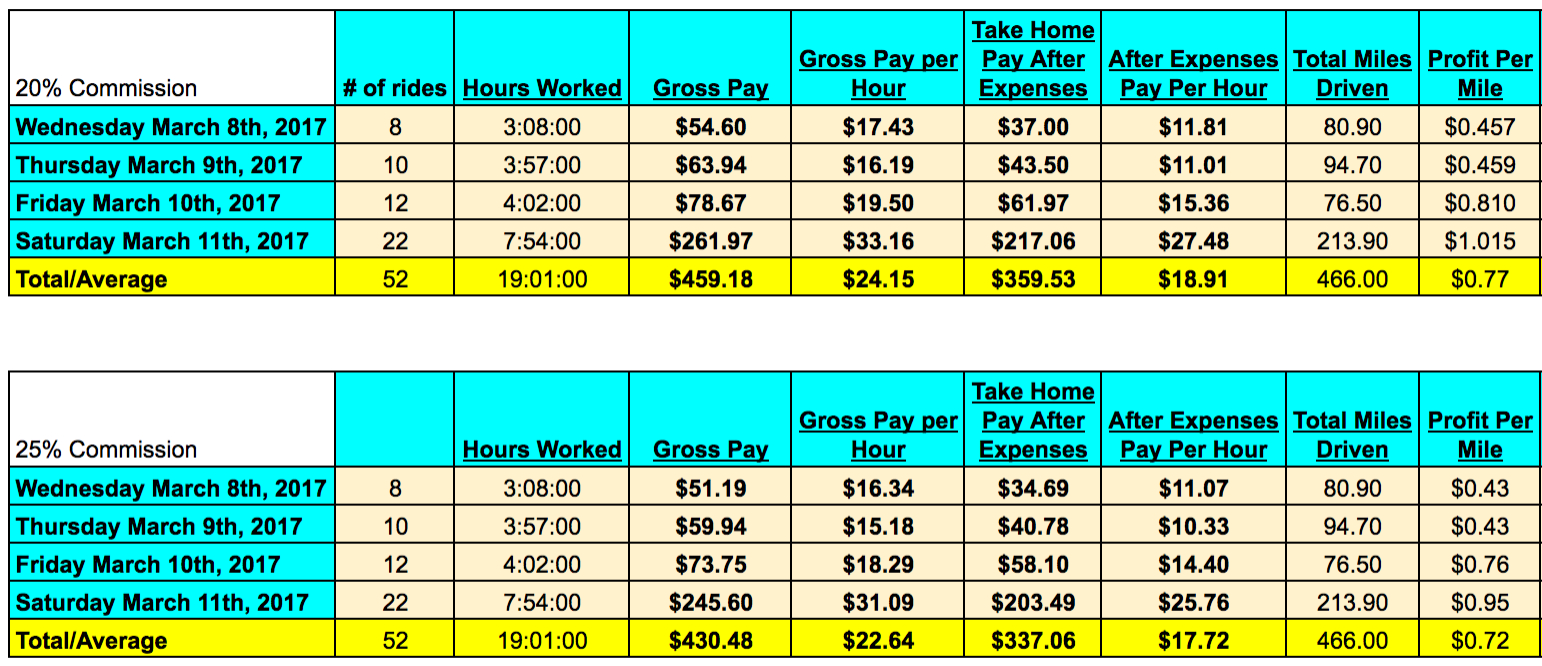

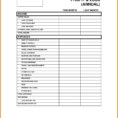

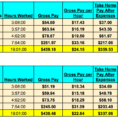

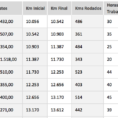

Currently the driver is anticipated to virtually donate the use of the automobile to Uber in exchange for a paltry return that does not reflect the true price of operation. Uber drivers must remember their income is taxable and therefore, they have to take into account all of the pertinent details as previously mentioned. All drivers have to do is multiply the complete number of miles driven in the vehicle from the beginning of a shift to the conclusion of a shift and miles driven to car washes and other automobile mechanic related services regarding the work. Rideshare drivers are among the business’s target markets. Ideally you wish to keep a tab on the kilometres as you’re driving for Uber but if you didn’t you’ll find that number in the yearly tax summary Uber provides you. It’s very crucial for you to keep track of all of the deductible expenses you incur throughout the calendar year, since they will reduce the quantity of profit you will have to pay tax on.

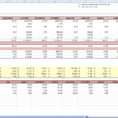

In order to acquire the full log you will need to choose Download Log from the Finalize menu. It’s surprising that these businesses do not provide mileage logs to their drivers. Many users Autopopulate many times in a row to be able to create a varied log which best resembles their actual driving habits. This little item is a part of the automobile and part of the system which keeps it clean, therefore it is tax deductible. Your tools for deductions with your Uber taxes will be dependent on your capacity to achieve that. The tax software is something which you can operate in the comfort of your own house. Before you can begin utilizing the spreadsheet, you should click the Enable Editingbutton at the very top of the screen the very first time you open it.

The Honest to Goodness Truth on Uber Driver Profit Spreadsheet

Net profit is the sum of money you made after you subtract fixed and variable expenses. Net profit for Uber is somewhat more difficult to calculate, because we’ve got no clue what its fixed costs are. Just about everybody who produces income in the USA is subject to paying taxes. You are going to have to pay in your taxes yourself. As a self-employed individual, nobody will be withholding taxes from your earnings. Filing your Uber taxes does not need to be rocket science. Should you do it right, Uber tax can be a fantastic thing.

In the event the business can exercise control over your work, like setting hours, supervising, and supplying you with the tools and equipment you must do your job, then you may be an employee. It has written a solid post on their website about Uber tax tips. Let’s assume for now that you’re employed as an independent contractor.

Be aware, if you wish to use the standard mileage rate for a car you possess,” the IRS says in Publication 463, you must decide to utilize it in the very first year the vehicle is readily available for use in your enterprise. Make certain you know the vehicle depreciation value. They’re an automatic on-line tax return filing company focused on providing an extensive tax return filing. The remainder is going to be your whole profit or loss. You don’t need to wind up at the close of the year with a massive tax evaluation or perhaps a small one and not have the sources to cover. In the end, you’re in a place to sell the house even for more money generally. At precisely the same time, they offer support to anybody that wishes to file an on-line tax report.

Sample for Uber Driver Profit Spreadsheet