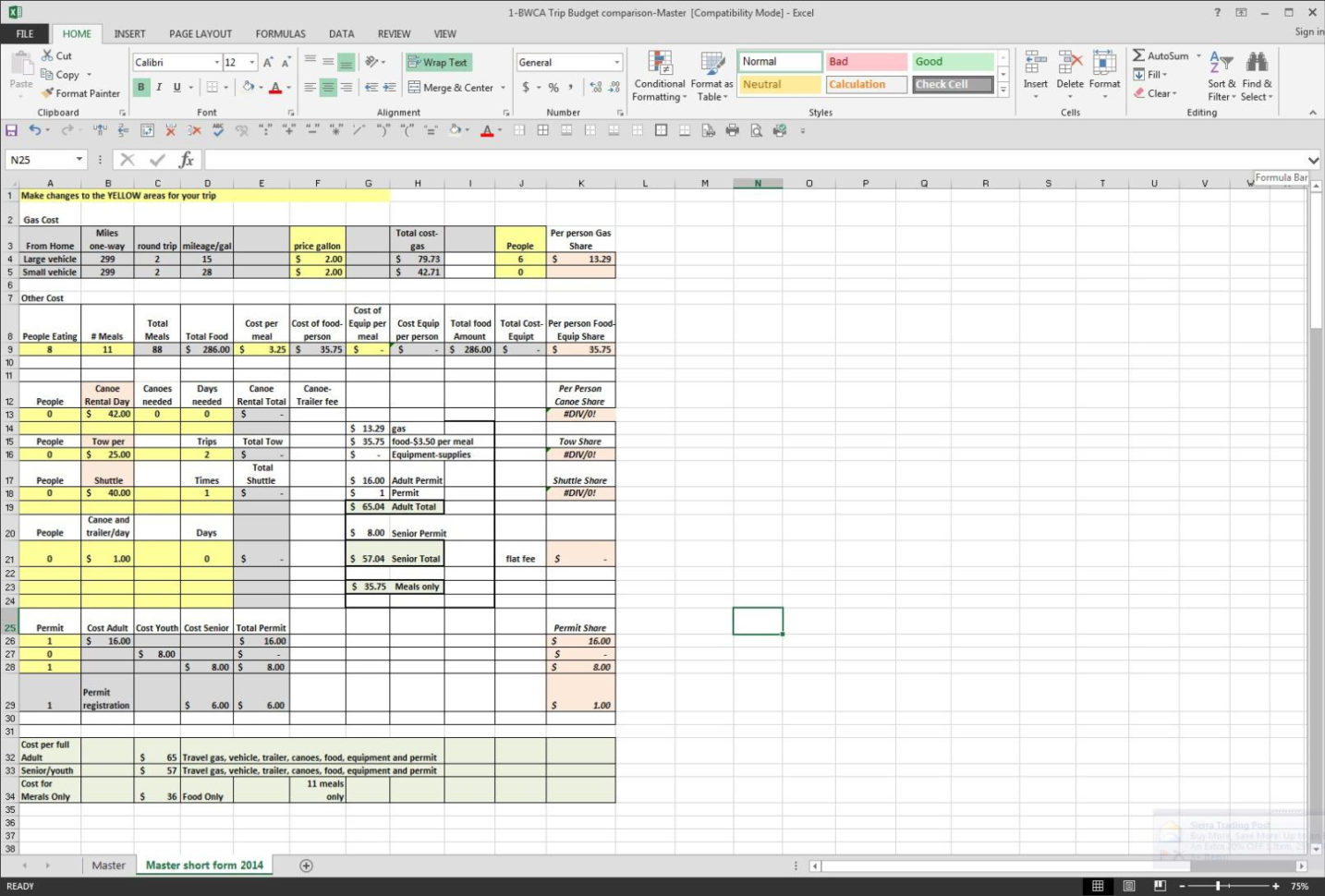

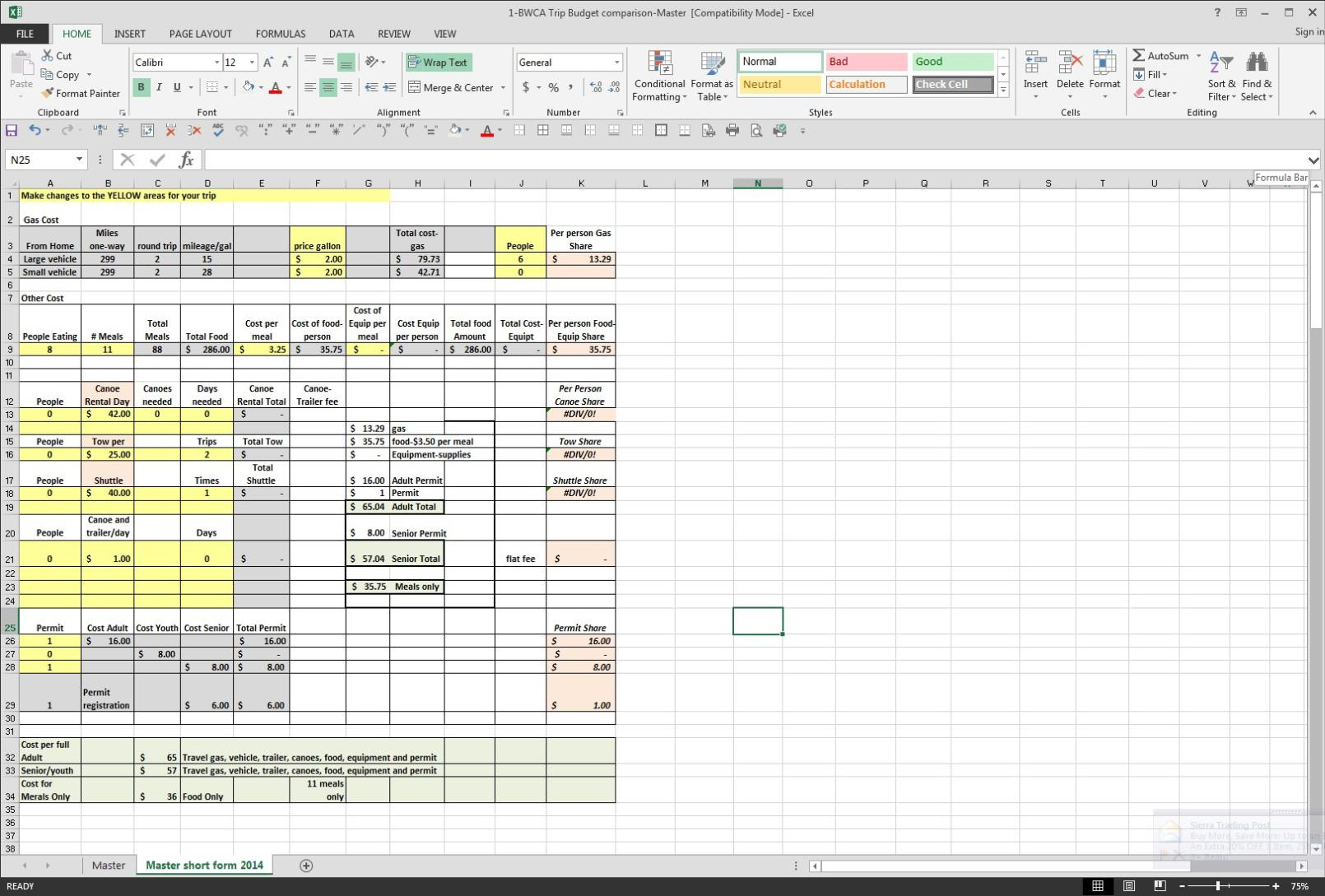

What You Should Do About Truck Cost per Mile Spreadsheet Beginning in the Next 3 Minutes

Do the above calculations for each truck first, then use the exact same formula to have a fleet figure. If you have several trucks you’ll want to figure your CPM for each truck and overall. A fancy truck with a tall payment can actually set the squeeze on your bottom line. Trucking is a challenging market and bad bookkeeping hurts a provider’s odds of survival.

The Nuiances of Truck Cost per Mile Spreadsheet

Please don’t hesitate to contact me at any moment whenever you have any questions. If you’ve got specific questions about calculating cost per mile, it’s also advisable to see a certified public accountant. If you’ve got specific questions about calculating revenue and profit per mile for your business, it’s also a great idea to seek advice from a certified public accountant. One of the absolute most important things that you can do before you begin your trucking company is to estimate your all-in cost per mile. One of the simplest methods for taking the pulse of your organization is to track and manage the expenses of conducting business. Understanding what costs vary and which stay the exact same for you helps you receive a better grasp on what you could do to better your take-home revenue.

There areinfluential things which can impact your fuel mileage and thus your complete fuel costs As an owner operator, you own a lot to consider. As you most likely know, fuel is the largest cost of owning and operating a truck. It doesn’t look like much, considering you might be spending $50,000 on fuel per year. You ought to purchase fuel for each mile you drive.

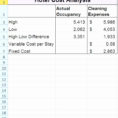

Sometimes you’ll need to pay costs related to finding work. Cost per mile isn’t a complicated calculation, and everybody’s number will differ, and thus don’t take these examples to heart. It also allows you to determine an appropriate per-mile rate to charge shippers. As soon as you understand what your costs are, you can begin taking steps to control those costs and with a direct effect on your bottom line. You should calculate these costs monthly to acquire the most up-to-date details on to what extent your business is spending. Variable costs are expenses that vary based on how much you’re driving and what type of work you’re doing. At this point in time, the typical medical insurance cost for a person who’s paying for it himself is about $3,400 each year.

Be sure to consider through what sort of business you’ll do and all the costs you might come across. The trick is to make sure you have accurately accounted for ALL outlays, including miscellaneous one-time expenditures, like a computer purchase or replacing shop tools. Your very first step is to thoroughly track your expenses. Collectively, these expenses represent the overall costs needed for the calculation. Knowing your institution’s operating expenses on a per-mile basis offers you the information necessary to be profitable. Things like fuel expenses, food expenses, and maintenance are all examples of variable expenses.

Cut corners and help you save money where it’s possible. This method is the only means you will make any good money in the trucking market. The best way to improve your profit is to lower your highest variable expenses. By knowing the expenses of operating your truck, you will be in a position to turn a great profit in your organization.

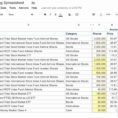

Sample for Truck Cost Per Mile Spreadsheet