The spreadsheet comprises a number of worksheets. It can be seen on the FDIC web site. It is going to also tell you how much tax you will pay on the property depending on the budget tax changes, particularly Section 24 mortgage interest relief. There are several sorts of blank spreadsheet available online. Possessing a blank spreadsheet is currently easy with the assistance of template. The next downloadable dictionary gets the template used to perform non-linear regression utilizing Microsoft Excel.

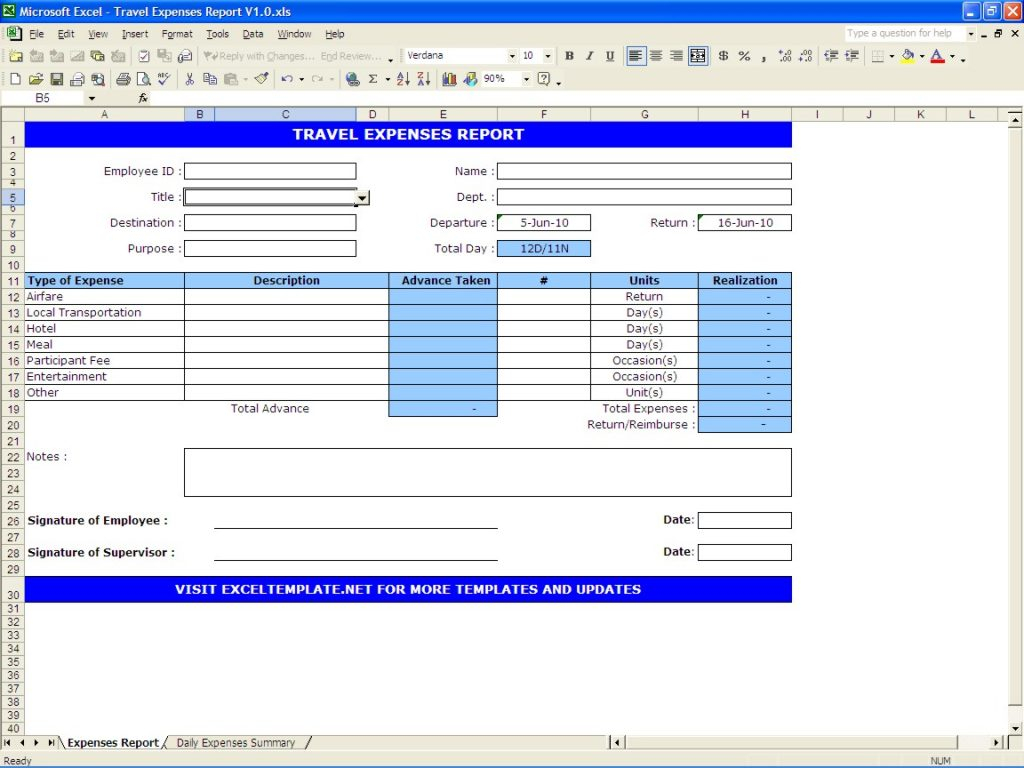

Trip Expenses Spreadsheet For Travel Expense Spreadsheet Aljererlotgd Uploaded by Adam A. Kline on Wednesday, January 23rd, 2019 in category Download.

See also Trip Expenses Spreadsheet Throughout Expense Sheet Template Free As Well Spreadsheet With Household Plus from Download Topic.

Here we have another image Trip Expenses Spreadsheet With Regard To Travel Expenses Spreadsheet Template Heritage Spreadsheet featured under Trip Expenses Spreadsheet For Travel Expense Spreadsheet Aljererlotgd. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading Trip Expenses Spreadsheet For Travel Expense Spreadsheet Aljererlotgd.