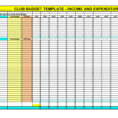

Expense and Income – Tax – Audit Template For Business

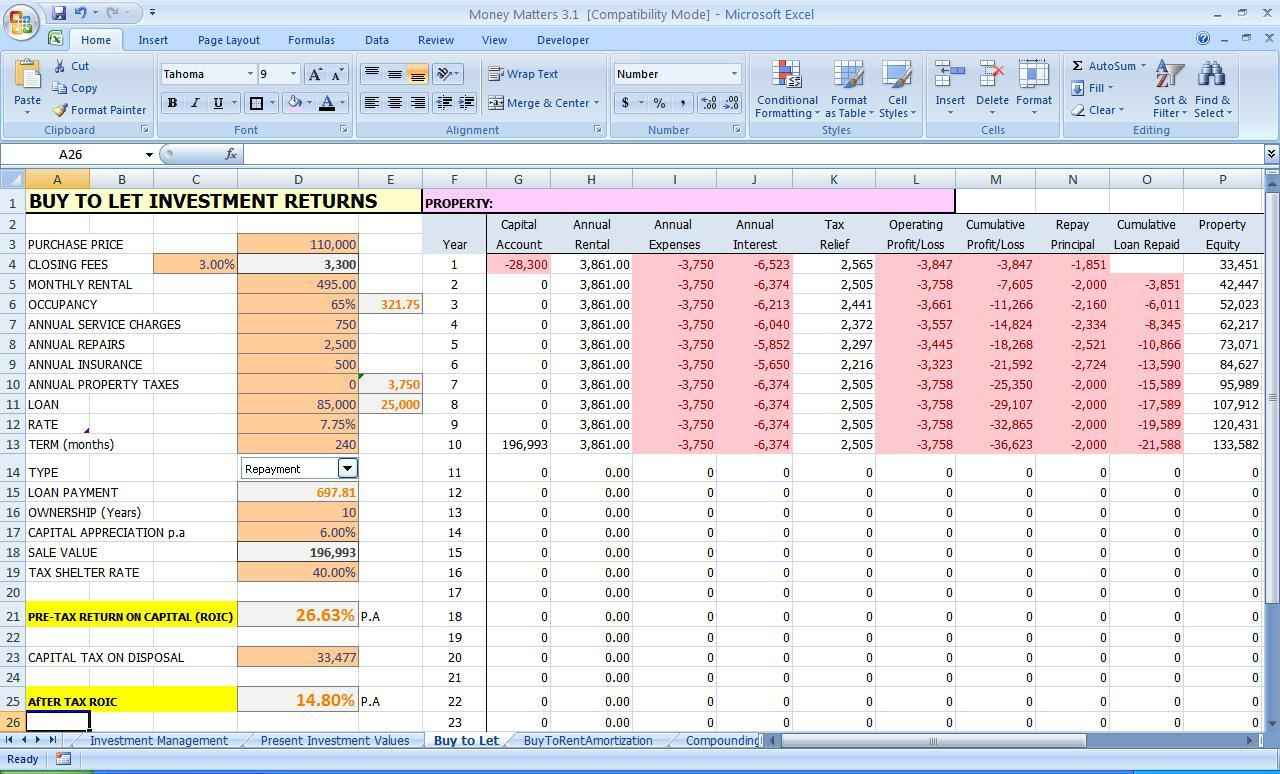

Business template for expenses and income can be used for a wide range of companies. This method of reporting can be used to determine your accounts receivable, vendor cost and vendor discount. You can also use this method for your cash flow statement and balance sheet.

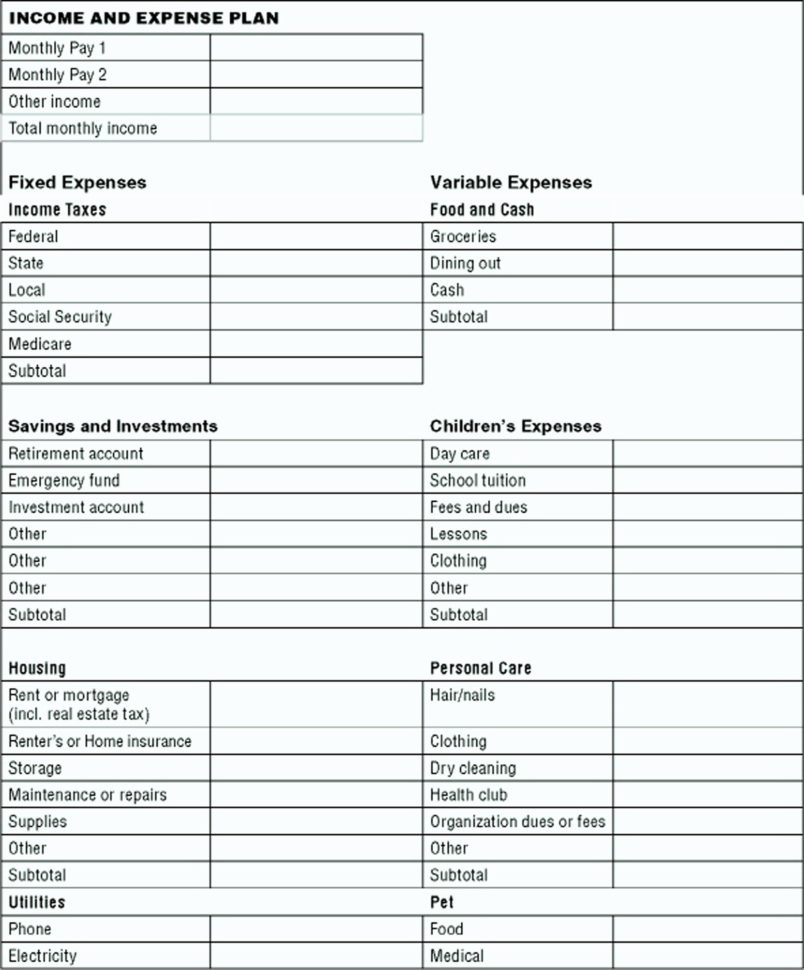

Expense includes the purchase price, purchase order, personal services expense, leasehold improvements, assets sold and inventory. Income includes income, dividends, income from investments, stock dividends, interest income. Both should include all receipts and payables.

The expense statement can be a detailed accounting system that you create on your own using the templates for expenses and income. It can be customized to fit your specific needs. If you are interested in this method of organization, you may want to look into making a profit by utilizing the income and expense templates.

Every taxpayer has a different tax year and so the accounting system needs to take this into account. It needs to account for the tax that is owed for a specific tax year. When you have a particular year to track, it would be best to go with the profit and loss method. Then you will have less trouble in figuring out the taxes that have been paid.

If you are an employer, you can create a template for expenses and income. Then you may use the reports from this system to help your employees. They can use it to make sure that they have the proper record keeping. They will also know how much they have owed their taxes on the pay stubs and bank statements. This way they will not find out late that they are having trouble paying off the taxes that are owed.

Some employers will use a single expense template for all their employees. It would be best to use these templates as a starting point to customize them for individual needs. You may want to find out if the wages are going to cover all of the expenses. This will help you make a decision if you want to have one tax rate or if you want to use the standard deduction rate.

Expenses and income can also be used to control the salary structure of your employees. If they do not feel comfortable with the way the payroll is handled, they may choose to work for another company that uses this method. You may need to have the employee take a step back and look at their entire business picture. How many employees are in each area?

You may decide to get together with the paymasters to negotiate over how much and how often the salary should be adjusted. There are times when this might not be possible. If you only have one employee, then there may not be a reason to add a second employee. Then the tax code may not allow you to deduct all of the salary from the employee’s gross income.

Expense and income are not the only options for managing your employees. You can also set up a system that allows each employee to take a simple computerized test that will help them figure out how much they need to earn. Then they can determine whether or not they will stay in your company. If they stay, they will be able to receive a certain amount of money each month.

As a business owner, you must determine how much you want to keep for yourself. If you do not keep it, it will get taxed again. You may think that all of the money that you will earn is going to be yours for your own use, but when the time comes for you to pay it off, you will still need to pay the IRS.

Expense and income can be used as a starting point for your own setup. As an employer, you may want to use the expense and income for the employees that you have. as, well. The templates for expenses and income will help you organize your own income and expense statements. YOU MUST READ : start up business expense spreadsheet

Sample for Template For Business Expenses And Income