It is quite common that a person starts with a tax return, only to later end up with more than what the original sum is. In the business world, this is called ‘taxing uncooperative’ and could be avoided by understanding tax spreadsheets. Basically, tax spreadsheets are used to calculate taxes from different income sources and credit tax liabilities in such a way that there is an amount that can be refunded.

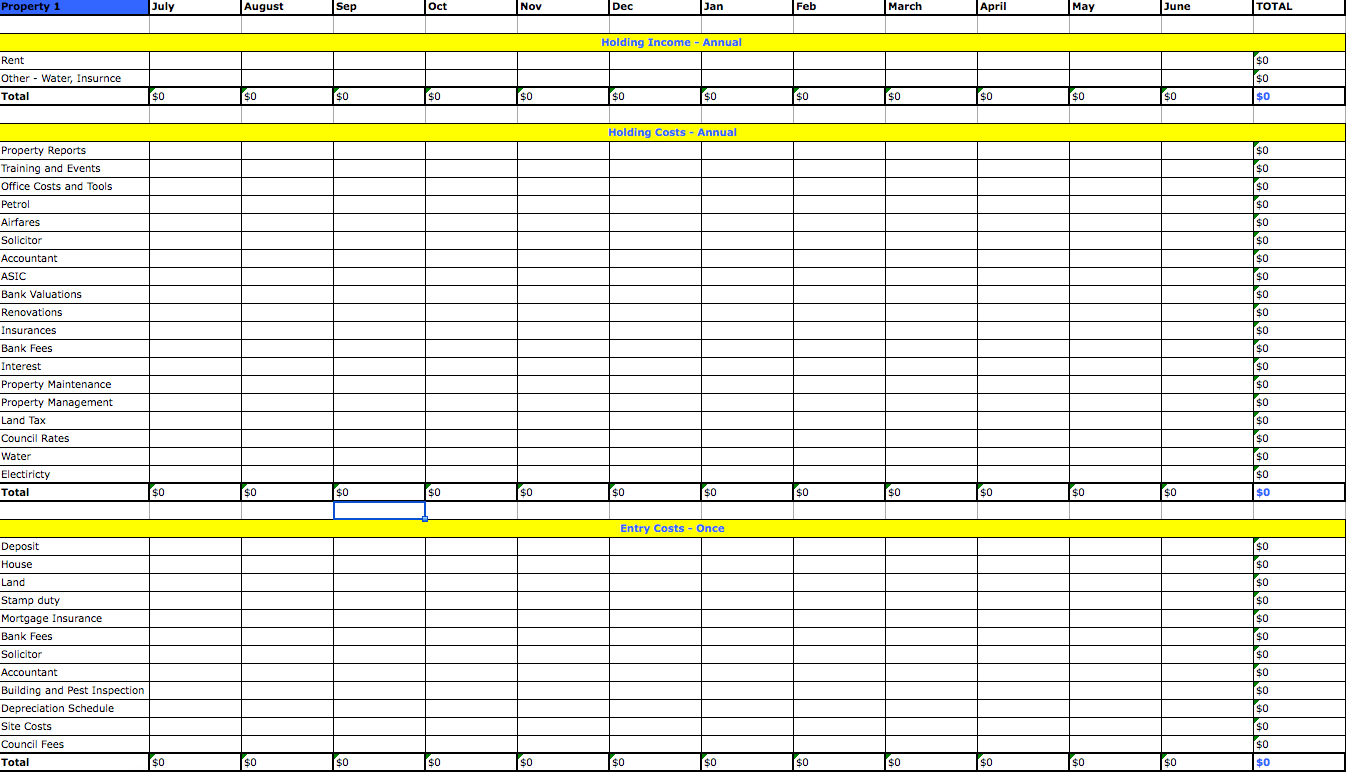

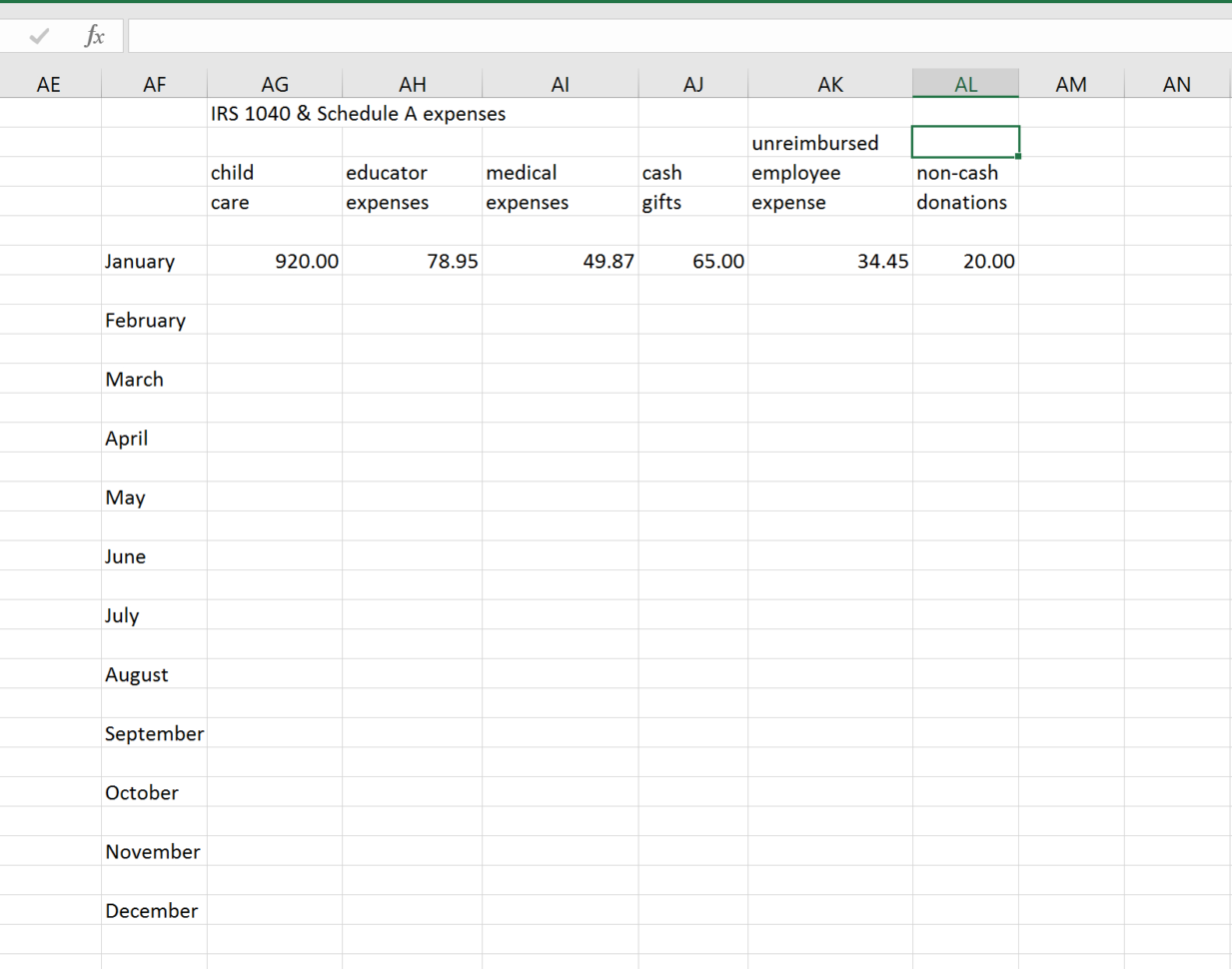

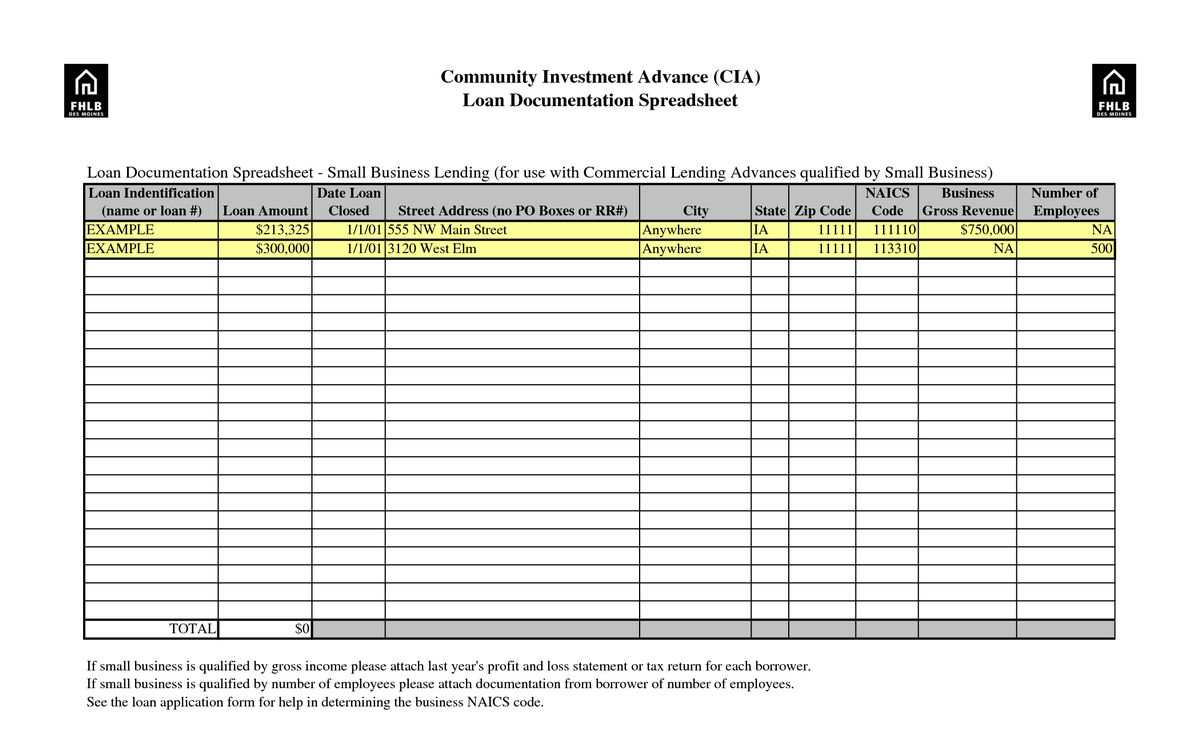

Tax spreadsheets can be defined as financial documents that deal with tax calculations. Tax spreadsheets usually display information such as income, expenditure, tax rate, refundable income etc.

Tax spreadsheets are usually prepared by professional accountants or by using tax software that is provided by the IRS. Since, tax calculations are based on different parameters, these spreadsheets contain different graphs that show the calculations of taxes.

Tax Spreadsheets – How to Compute Your Taxes Quickly and Effectively

These spreadsheets show how to obtain the money back from the government in case a taxpayer fails to pay his or her taxes or fails to file the tax returns according to the law. This makes it easy for people to pay their taxes without any problem or fear.

If you are a businessperson, you will definitely have a need for a tax calculator or a tax spreadsheets. The purpose of the tax calculator is to help you prepare your taxes without having to know a lot of details about the taxation laws.

Calculating taxes with the help of a tax calculator is not as complicated as the people think. All you need to do is to understand the general concept behind tax calculator and then plug in different income streams into the calculator.

After entering some data, you get a number to compute the tax computation. However, you have to ensure that all the important data is entered accurately, otherwise, you will not get the right answer to the question.

In fact, you can use other things to gather information that would be useful for your tax estimator. For example, if you know how much income you have, you can use that information to see what your tax liability is.

In fact, you can make use of any available resource, apart from the calculator to make the tax calculation. However, you must remember that it is much easier to be aggressive and calculate your taxes using a tax calculator.

There is a special calculation called ‘adjustment factor’ that you can use. This adjustment factor gives you the exact amount of tax that you have to pay to the government.

You may also use additional resources such as real estate, property, rental income, charitable donations, etc. in order to compute the income rate. PLEASE SEE : task tracking spreadsheet