New Step by Step Roadmap for Tax Spreadsheet Australia

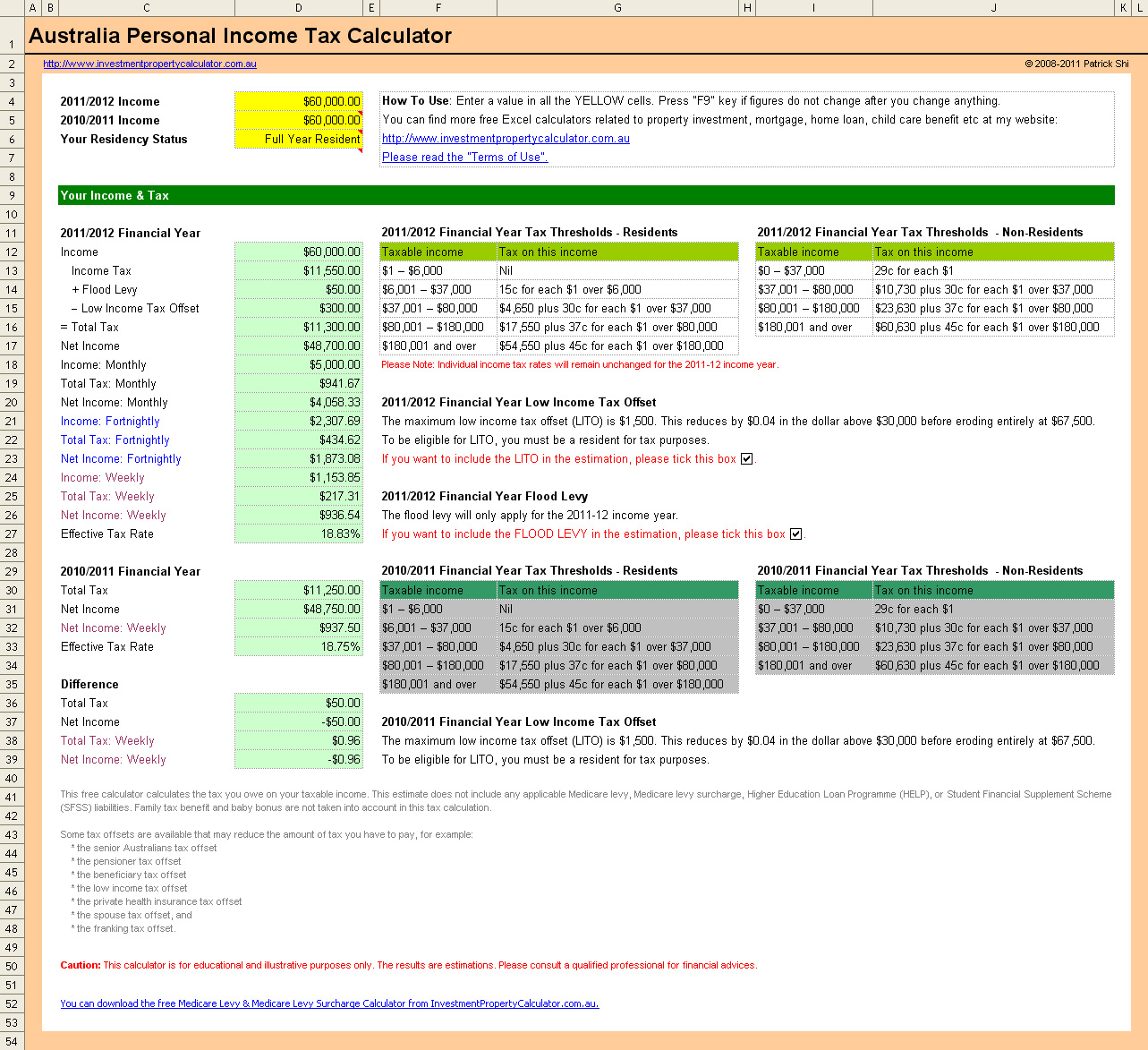

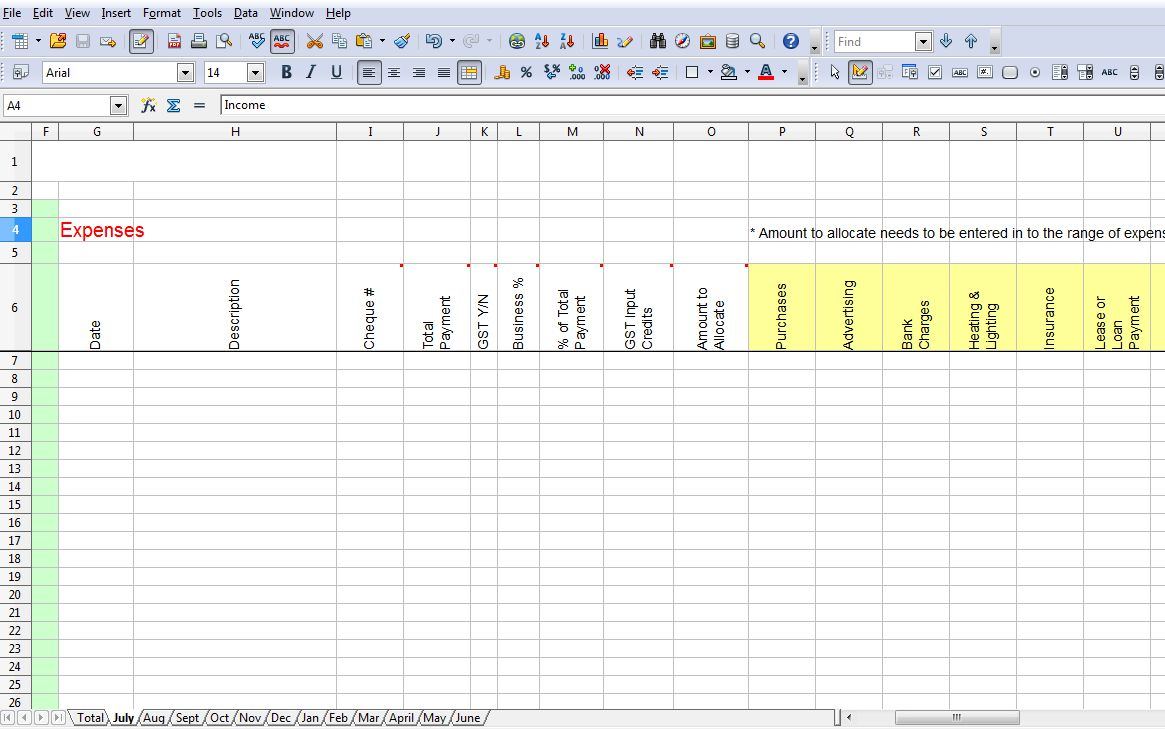

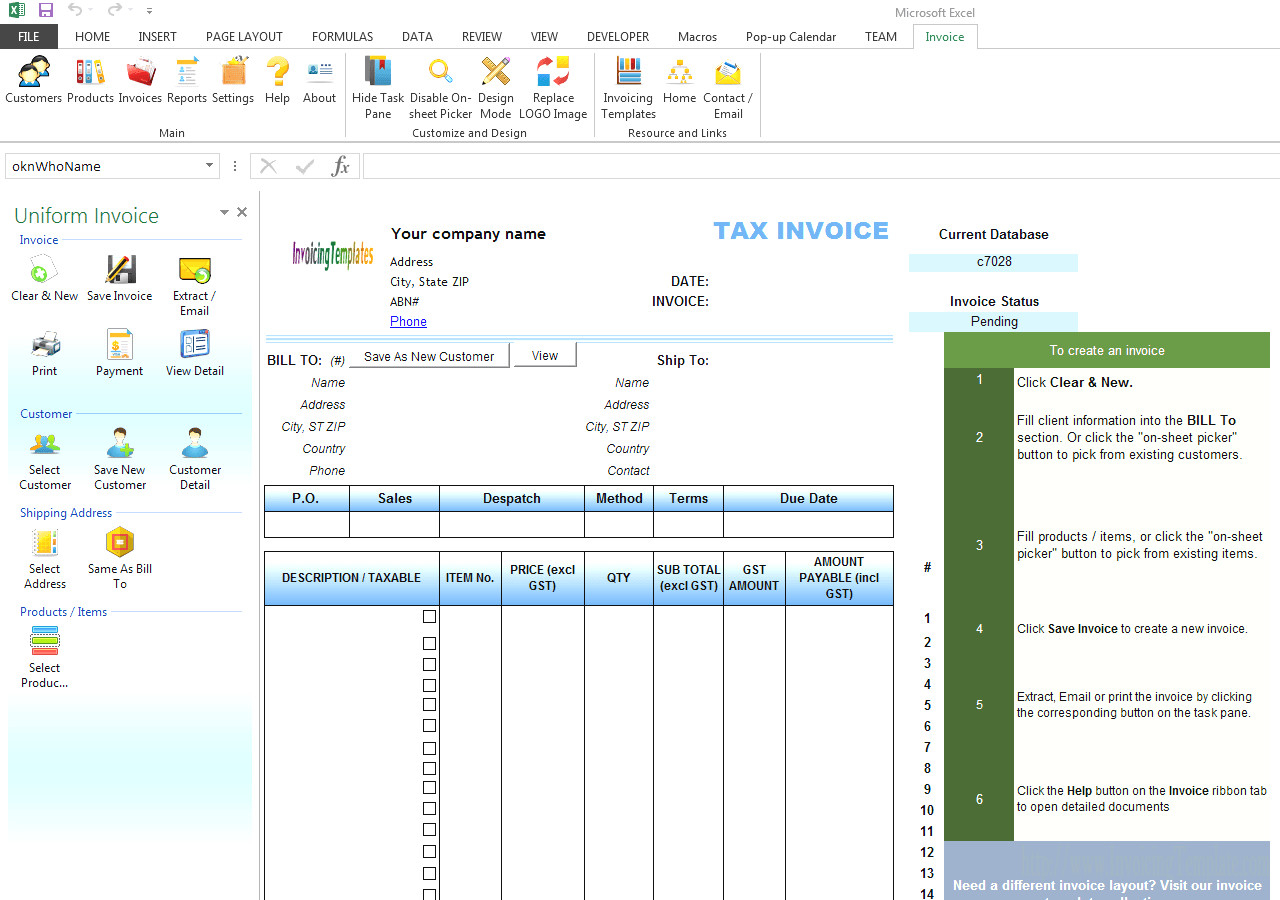

Yes, developing a spreadsheet will most likely be a region of the procedure, but there’s far more besides. Yes, it will probably be a part of the procedure, but there’s much more besides. Yes, it will be a component of the procedure, but there’s much more besides. The spreadsheet has lots of worksheets. Excel spreadsheets and Access tables permit you to customize the way your data is listed. Microsoft Excel is composed of worksheets. Microsoft Office Excel 2010 is a terrific choice to create a fundamental balance sheet.

If you’re searching for information on a particular occupation, you can discover it via the ATO’s website here. Make certain that you have the information for the proper year before making decisions based on that info. With some patience and an online connection, it may be configured to extract information from a number of sources.

From doing your homework before signing agreements to deciding on a business structure and registering for GST, there are a couple of things you ought to and must do to receive your business ready to go. Expanding your company is an important step and demands some careful planning and consideration to make certain your company grows smoothly and sustainably. Writing a business plan can help you organise your ideas and map out the path to where you need to take your company and aligns owners, investors and staff.

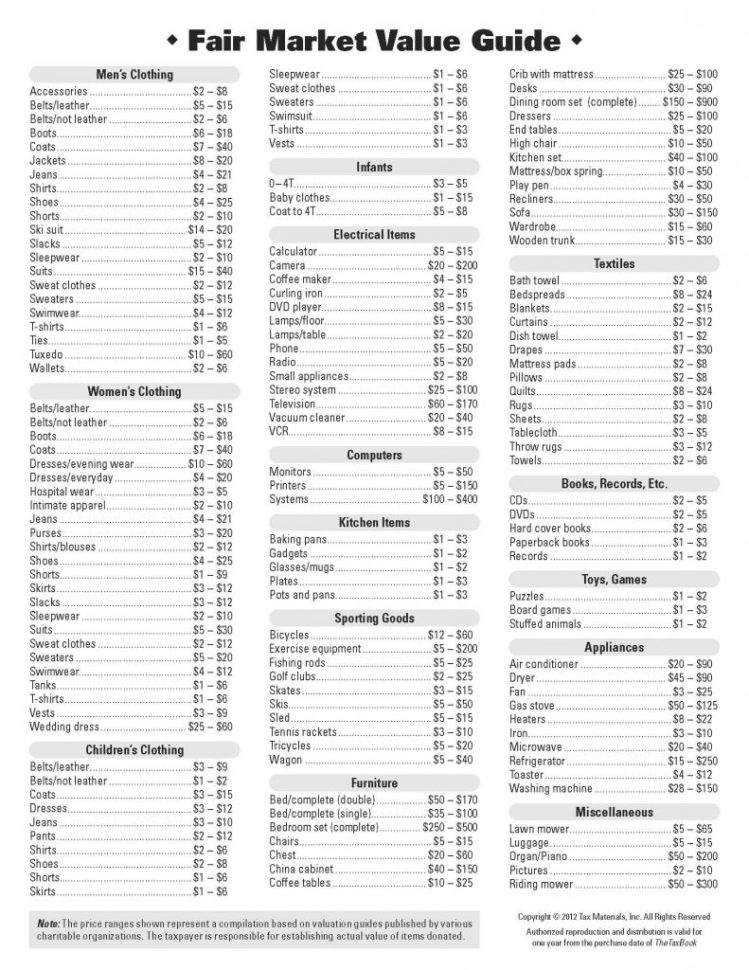

Read more on the subject of self-education expenses you can and can’t claim. If you are not certain if you’ll have the ability to deduct an expense, it’s a good idea that you keep the receipt and either contact the Australian Tax Office or check with an experienced tax expert once it comes time to finish your tax forms. Child care expenses aren’t deductible, although you may be qualified for a child care rebate or child care benefit. Your taxable income is the overall quantity of money you’re expected to pay tax on. It is the income that your tax is calculated on. If you would like to make certain that you have included every one of the items which you have obtained that are tax deductible, you might want to talk to a tax agent or an accountant. So simple to do, you will never miss another cash-saving tax deduction.

You may only claim clothing expenses in the event that you can prove they’re a required portion of your employment, including a nurse or police officer uniform. It’s still true that you have to be able to demonstrate how you calculated the expenses. Certain expenses linked to the management of your investments could be deducted.

The expense of the equipment dictates the sort of deduction you may claim. The price of tools and equipment is deductible if they’re essential for the range of your employment. For instance, a portion of your cell phone expenses and the expenses of work related personal vehicle usecan be claimed. You cannot claim the price of purchasing or laundry for clothes which are not specific to your occupation. The initial price of getting your very first check as a way to gain your very first job in the business isn’t deductible.