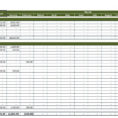

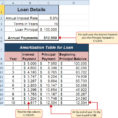

Rental Income and Expense Spreadsheet are a great asset to know if you are interested in buying rental properties. It is very helpful to keep track of expenses. It helps you determine the financial capability of a property before you buy it. In today’s real estate market, luxury homes and…

Tag: vacation rental income expense spreadsheet

Vacation Rental Spreadsheet

The Appeal of Vacation Rental Spreadsheet Vacation Rental Spreadsheet Fundamentals Explained For a spreadsheet it’s fairly elementary. The spreadsheet is intended to do lots of the simple work for you, while being customizable. Upon purchase you are going to be in a position to immediately download the spreadsheet to your…