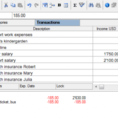

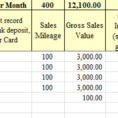

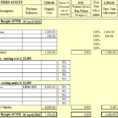

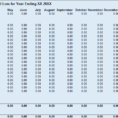

Things You Won’t Like About Excel Template for Small Business Bookkeeping and Things You Will Vital Pieces of Excel Template for Small Business Bookkeeping An accounting template can assist you in the custom of managing your company. It will help you in the process of managing your business. To begin…

Tag: Sole Trader Bookkeeping

Sole Trader Accounts Spreadsheet

Want to Know More About Sole Trader Accounts Spreadsheet? Sole Trader Accounts Spreadsheet: No Longer a Mystery It’s possible to only open savings accounts created for businesses. If you require proper accounts that it is possible to submit to banks and financiers for finance, then we will need to modify…