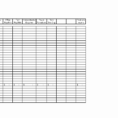

Tag: Small Business Tax Spreadsheet Template

Small Business Worksheet Template

Audit Worksheet Templates – Make Small Business Audits Look More Professional When you get a quote for an audit for your small business, the worksheet that is filled out with the figures is considered. In most cases, this is simply filled out in pen and graph paper. There are lots…

Small Business Spreadsheet Template

Business Spreadsheet Templates

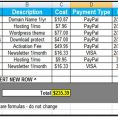

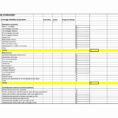

Business Tax Spreadsheet Templates

Using Business Tax Sheets to Help You Plan Your Next Year’s Income There are many different ways to put together a spreadsheet for your business, but it’s not enough just to get a bunch of business tax sheets. It helps to take out some time to do things properly, and…

Small Business Tax Spreadsheet Template

Using a Small Business Tax Sheetsheet Template to Save Time and Money A tax spreadsheet template can be a powerful tool in saving time, reducing costs and promoting tax efficiency for small businesses. So, what is the best way to go about it? How can a tax sheet be manipulated…