The spreadsheet has several worksheets. Simple spreadsheets are the most often used type, and you’ve got to make most changes manually. The completely free spreadsheet is easily available for downloading here. Though many spreadsheets have the exact same arrangement, when you think about functionality, many different kinds of spreadsheets are…

Tag: small business tax preparation spreadsheet

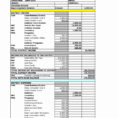

Small Business Tax Spreadsheet

Making a small business tax spreadsheet is something that every small business owner should do. Every owner wants to have as much cash as possible in the bank, and a tax-efficient accounting system is one of the keys to this goal. The information in this article will help you make…