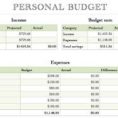

Tag: Simple Budget Template Excel

Personal Financial Planning Template Free

The Secret to Personal Financial Planning Template Free Personal Financial Planning Template Free Options All you need to do is to download a template, and use it in order to complete your data. You need a suitable financial plan template to ensure you’re on the ideal direction. Our 10 year…

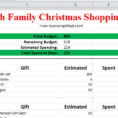

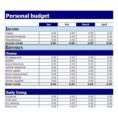

Budgeting Tool Excel

Budget Template Excel

There are a number of Excel budget templates that can help you in your tasks related to business and finance. You can use these templates to prepare a budget for your company. These templates are easily available and they are designed to make you have a well-thought-out blueprint for your…

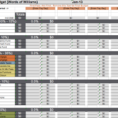

Budgeting Tool Excel

What You Should Do to Find Out About Budgeting Tool Excel 2 Before You’re Left Behind Empty and incomplete applications won’t be considered. The procedure takes me about five to ten minutes every month. Categorize expenses in groups to make it simpler. Another strategy is to replicate the budgeting procedure….