If you commence using Google docs a fantastic deal, you might want to arrange your documents into various folders. Google provides a nifty trick in case you don’t understand the source language. Google specifies that the graphics are offered for personal or business use just in Google Drive and has…

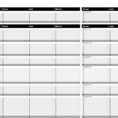

Tag: Simple Budget Spreadsheet

Financial Planning Spreadsheet Free

Financial Planning Solution Free – Make a Plan to Help Yourself From Pockets Financial planning has always been one of the key skills to have. With this skill, you can plan your money in order to achieve your dream home, your children’s education and health care, and even ensure that…