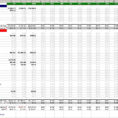

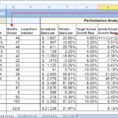

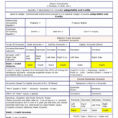

Creating Your Own Accounting Template Using a simple accounting template to create your business’s accounts is an essential part of the process. One of the best things about Excel is the ease with which you can input data. You will be amazed at how easy it is to open new…

Tag: simple bookkeeping spreadsheet template excel

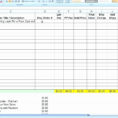

Simple Bookkeeping Spreadsheet

Learn Simple Bookkeeping Spreadsheet You may have heard about “simple bookkeeping spreadsheet” before. It’s just one of those new accounting tools that seems to pop up every now and then. But, it is nothing new. In fact, there are many old-fashioned bookkeeping tools that you can learn from. First of…

- « Previous

- 1

- 2