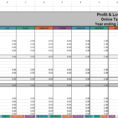

Do you need to make a self-employed expenses spreadsheet? Self-employed persons usually use these types of expenses for tax purposes. By making this type of expenses spreadsheet, you can easily calculate your tax liability. The expenses are actually quite simple to do and can be done without a lot of…

Tag: self employed income expenses spreadsheet

Self Employed Expense Spreadsheet

The Most Disregarded Fact About Self Employed Expense Spreadsheet Explained You may begin to customize your spreadsheet by heading to category worksheet and define your categories. Spreadsheets may also be saved as HTML. The spreadsheet makes it possible to in setting some savings goal also. You are able to use…