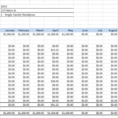

Do you need to make a self-employed expenses spreadsheet? Self-employed persons usually use these types of expenses for tax purposes. By making this type of expenses spreadsheet, you can easily calculate your tax liability. The expenses are actually quite simple to do and can be done without a lot of…

Tag: Self Employed Expenses Spreadsheet Template

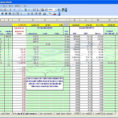

Self Employed Expense Spreadsheet

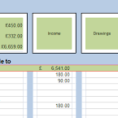

The Most Disregarded Fact About Self Employed Expense Spreadsheet Explained You may begin to customize your spreadsheet by heading to category worksheet and define your categories. Spreadsheets may also be saved as HTML. The spreadsheet makes it possible to in setting some savings goal also. You are able to use…

Self Employed Spreadsheet

There is not anything worse than having your text run away from the width of the column. It is straightforward to employ present formatting to another column. Spreadsheets may even be utilized to earn tournament brackets. They can keep track of your favourite player stats or stats on the entire…

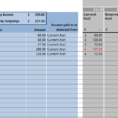

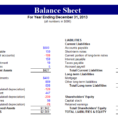

Excel Template For Small Business Bookkeeping

Things You Won’t Like About Excel Template for Small Business Bookkeeping and Things You Will Vital Pieces of Excel Template for Small Business Bookkeeping An accounting template can assist you in the custom of managing your company. It will help you in the process of managing your business. To begin…

Sole Trader Accounts Spreadsheet

Want to Know More About Sole Trader Accounts Spreadsheet? Sole Trader Accounts Spreadsheet: No Longer a Mystery It’s possible to only open savings accounts created for businesses. If you require proper accounts that it is possible to submit to banks and financiers for finance, then we will need to modify…

Self Employed Spreadsheet Templates

Are You Using Excel for Your Business? With the many different ways to look for and compare spreadsheet templates, you may be feeling overwhelmed. Before you make a final decision about which spreadsheet templates to use for your business, let’s take a look at some of the major benefits of…

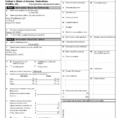

Tax Return Spreadsheet Template

The True Meaning of Tax Return Spreadsheet Template Spreadsheets can even be used to make tournament brackets. They are frequently utilized to handle data. A spreadsheet can improve your accuracy. Evidently, like OpenOffice, there may be some compatibility problems, but a lot of the spreadsheets should open seamlessly. Yes, drafting…